Table of Contents

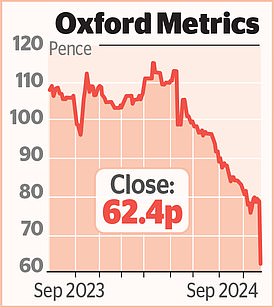

Shares in a British-Canadian semiconductor company have plunged after it warned that the merger of two major artificial intelligence (AI) clients in South Korea would hurt business.

Alphawave IP Group said the Korean alliance along with delays in final chip designs have hurt its outlook.

As a result, the London-listed company expects to report

revenues of £233m to £248m and profits of £38m by 2024.

This figure will fall short of the £259 million to £274 million in revenue and £53 million in profit previously forecast.

Shares fall: Alphawave IP Group said the merger of two major AI clients in South Korea along with delays in final chip design have hurt its outlook

The shares, which fell 13.8 per cent, or 17.2 pence, to 107.8 pence, were a far cry from the listing price of 410 pence in May 2021, which valued the company at £3.1 billion.

Alphawave’s sales more than halved to £68m in the six months to the end of June as it earned revenue from 12 fewer clients compared with a year earlier.

A fifth of sales came from Chinese customers (up from 66 percent the previous year) as the company moved away from the country.

Alphawave swung from a profit of £24.3m to a loss of £9m during the period.

The company, founded in 2017, makes chips it hopes will power the next generation of AI and cloud infrastructure.

The FTSE 100 rose 0.4 per cent, or 29.72 points, to 8,259.71 and the FTSE 250 rose 0.1 per cent, or 13.28 points, to 20,845.12.

WH Smith said it would buy up to £25m worth of shares from investors between now and April next year. Shares in the retailer rose 2.1 per cent, or 29p, to 1,429p.

Currys shares soared after analysts at Berenberg raised the electronics retailer’s target price from 92p to 125p.

The broker said the company’s turnaround plan had succeeded in cutting costs and it expected cash to be freed up as its pension deficit was due to be cleared within three years. Shares gained 8 percent, or 6.3 pence, to 84.7 pence.

But the luxury consumer is “exhausted” from shopping, according to Bank of America, which warned that the industry’s slowdown is likely to continue next year.

Burberry was one of the victims of the gloomy outlook, with analysts cutting their target price on the British fashion brand from 700 pence to 475 pence. The shares fell 0.9 per cent, or 5.4 pence, to 599 pence.

Private equity firm Bridgepoint also fell after analysts at Stifel raised their target price for the French software provider they expect to buy to 285 euros. The broker said the firm’s offer of 262 euros per share is fair, but warned it might not be high enough to avoid a potential bidding war.

Bridgepoint shares fell 2.9 percent, or 9.8 pence, to 329.8 pence. Recruitment firm Hays sank after a stockbroker downgraded its rating.

Analysts at Exane BNP Paribas cut their rating due to concerns about industry activity and weakness in the company’s key German market. Both factors could affect its ability to pay special dividends in the future, the broker added. The shares fell 3.1 percent, or 2.9 pence, to 90.9 pence.

Capita has extended its agreement to support the roll-out of smart meters in the UK for a further two years. Shares in the BBC, which collects licence fees, rose 3.9%, or 0.76p, to 20.3p.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.