An estate agent has criticised first-home buyers for being too demanding and urged them to better manage their expectations.

Amir Jahan, 25, owner of A-Class Agents, said he has seen an increase in buyers who “want everything” and miss out on opportunities because of a need for “perfectionism”.

“They’re expecting a palace because they’re so excited about buying for the first time and they want everything to be perfect,” she told Daily Mail Australia.

“You can’t find something that’s 100% perfect because everyone’s tastes are different.”

Sydney housing availability is at an all-time low, with soaring buyer and rental demand pushing up prices, which are set to rise further.

The New South Wales capital has a median house price of $1,473,038 with units priced at $852,766, according to the latest data from CoreLogic.

Mr Jahan advised first-time homebuyers to focus on the structure of the property and what they can afford, rather than superficial things that can be changed later.

‘A man once refused to buy a property because he said he needed a new extractor hood above the oven,’ he said.

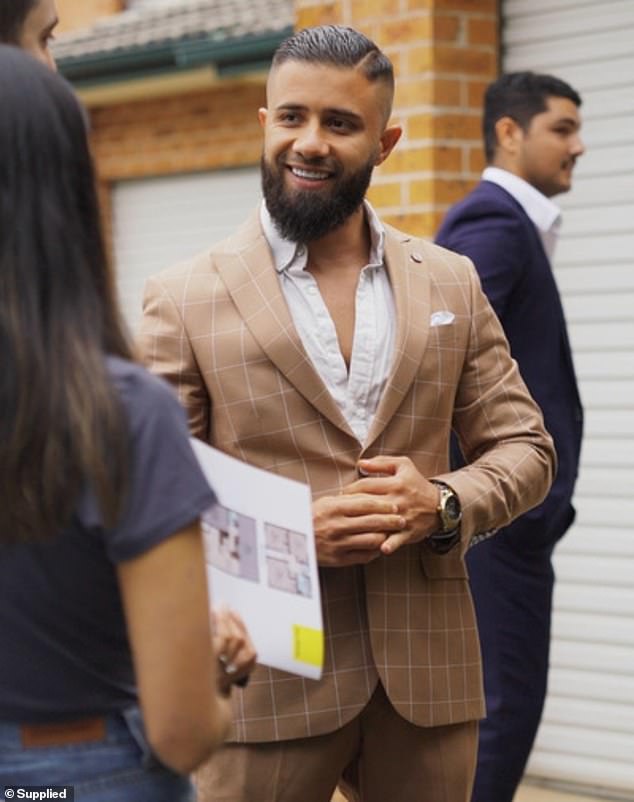

Amir Jahan, 25 (pictured), has noticed some growing trends among first-time home buyers, such as being overly picky and wanting to show off to their friends.

The Sydney real estate agent said first-home buyers need to do their research to make sure their expectations are realistic, otherwise they could miss out on big investments.

‘You can pay $400 for a new range hood. Why lose something that’s good for a repair that costs $400?

‘The man, after months of searching for the perfect place, of course came back to me and said what everyone always ends up saying: “I wish I had bought it.”‘

Mr Jahan said he has also noticed an increase in first-home buyers who want a mansion with a small outlay.

“They’re expecting a castle,” he said.

“They don’t realize what they can get with their money, but their standards are very high.”

He said the main problem is that buyers “buy for the wrong reason.”

“Sometimes a first-time homebuyer doesn’t think of their purchase as a place to live or their first asset – they want to show it off to friends and family,” he said.

One buyer I knew, Mr Jahan, paid more for a one-bedroom apartment than a three-bedroom because it had a good view and “nice tiles”.

“When I told him I could get a three-bedroom apartment for the same price, he replied: ‘I want a nice place so that when my friends come over they’ll say ‘wow,'” she said.

‘One-bedroom apartments in the area have since lost value, but you could have made money on a three-bedroom because they are like gold – there aren’t many on the market right now in your area.’

Mr Jahan has also observed a worrying trend of buyers wanting to purchase a property without doing any research.

The successful estate agent (pictured) said there are an increasing number of first-home buyers hoping for a “castle” or “mansion”, making research even more vital.

“They are not doing adequate research to know exactly what they want,” he said.

‘Don’t look at 200 two-bedroom apartments in six months.

‘Define exactly what you want.’

Mr Jahan said it was even more important for buyers to avoid “delaying the process” once they get financial approval because pre-approvals typically only last three months.

After this time, reapplying may affect the buyer’s credit score.

The agent also said that people need to act because prices continue to rise.

“Do your research and know what you want, otherwise when you decide you won’t be able to afford to get what you wanted six months ago,” he said.

The agent has also seen an increase in loans from the Bank of Mom and Dad and warns that while it is a good option, it can have drawbacks.

“If you accept money from your mom and dad, don’t always take their advice,” he said.

‘It can delay a purchase because what the new generation wants clashes with what the older generation thinks is good for them.

‘Investment advice can be helpful, but make sure you don’t let them impose their tastes on you, which I see all the time.

“Their opinion may be a hindrance, but if you’re going to live there, you have to be happy. If it gives you good vibes, go for gold.”

Mr Jahan warned buyers to hide their enthusiasm from agents.

“Don’t show that you’ve fallen in love with a property. Many agents will take advantage of that,” he said.

“There may not be any other interest in it, but the agent will use it against the buyer (who loves the property) to try to negotiate the highest number they can get.”