A 23-year-old man has come under fire after admitting he emptied his savings over the holidays and has since racked up more than $9,000 in credit card debt, all while refusing to work more than 15 hours a week.

Myles is a field auditor based in Austin, Texas, after moving from Pennsylvania, where he worked in construction earning between $10,000 and $12,000 per month.

Following his move, he depleted his entire savings account, which contained a whopping $30,000.

Today, Myles struggles to make ends meet since he only earns $3,500 a month and has filled out several credit cards while refusing to dedicate more than 15 hours a week to his job.

Myles is a field auditor based in Austin, Texas, after moving from Pennsylvania, where he worked in construction earning between $10,000 and $12,000 per month.

He spoke to Caleb Hammer on the YouTube Financial Audit podcast and revealed he spent $30,000 partying.

The 23-year-old detailed his finances in an episode of Financial Audit with Caleb Hammer shared on YouTube.

The 23-year-old blew his finances in an episode of Financial audit with Caleb Hammer which was shared on YouTube.

Myles explained that when he lived in Pennsylvania, he worked in construction and made between $10,000 and $12,000.

He decided to move to Austin when his company offered him a new project. However, once he arrived, the offer collapsed.

Myles then got a job as a field auditor and was making much less money than usual.

So he dipped into his savings account to fund his partying lifestyle and ended up emptying it all.

When talking to Caleb, he noted that he worked 15 hours a week, did jiu-jitsu six hours a day, and spent the majority of his money eating out with his buddies.

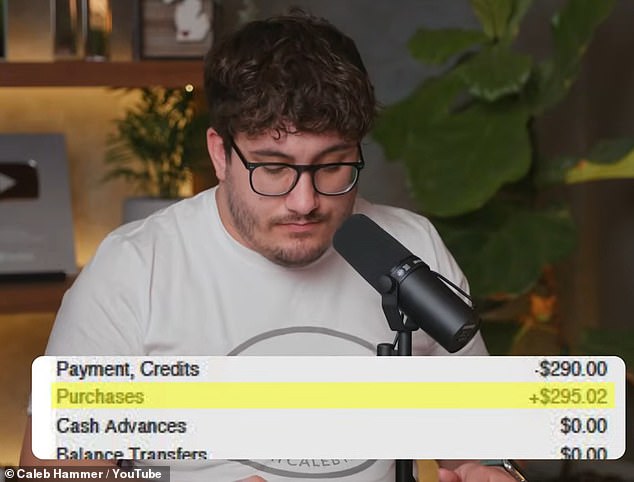

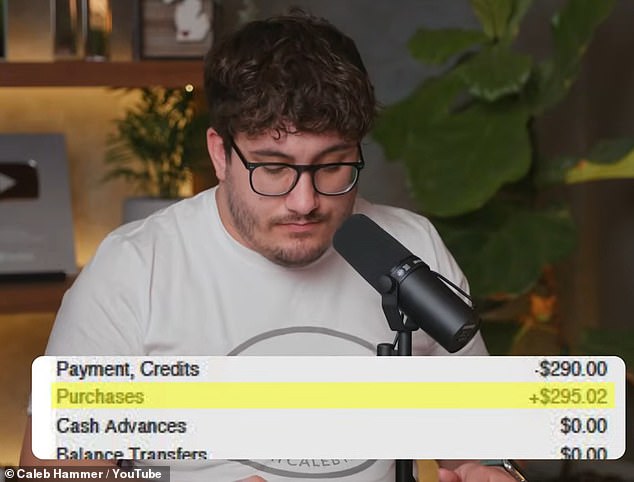

His fun-loving lifestyle led Myles to rack up over $9,000 in credit card debt on multiple cards with 30% interest rates.

He also needs to raise $4,000 to pay his taxes. Caleb estimates that Myles could better budget around 30 to 35 percent of his salary.

When talking to Caleb, he noted that he worked 15 hours a week, did jiu-jitsu six hours a day, and spent the majority of his money eating out with his buddies.

His fun-loving lifestyle led Myles to rack up over $9,000 in credit card debt on multiple cards with 30% interest rates.

And to make matters worse, Myles revealed that he wasn’t willing to work more than 15 hours a week to survive because it would interfere with his education.

Caleb said: “I don’t care, your training doesn’t give you anything, fitness does, but longevity financially doesn’t. Like you’re going to die under a broken bridge but you’ll be fine.

The financial expert was shocked to learn that the 23-year-old was not willing to work to get rid of his debt.

He added: “What are you? You’re not a baby! What are you doing?! You accumulate debt. It does not work!’

Then he called Myles “immature” and noted that most people “bust their ass” for 40+ hours a week and still can’t make it, while Myles refuses to do more ‘efforts.

Myles said he didn’t want to work more than 15 hours a week because his current plan “is working for him” and if he spent more time at one job he wouldn’t be “happy.”

“Do you know how hard people work there, man, and they can’t even make it and you have the ability to work half as hard as them and live a good life? Caleb criticized.

The financial expert was shocked to learn that the 23-year-old was not willing to work to get rid of his debt.

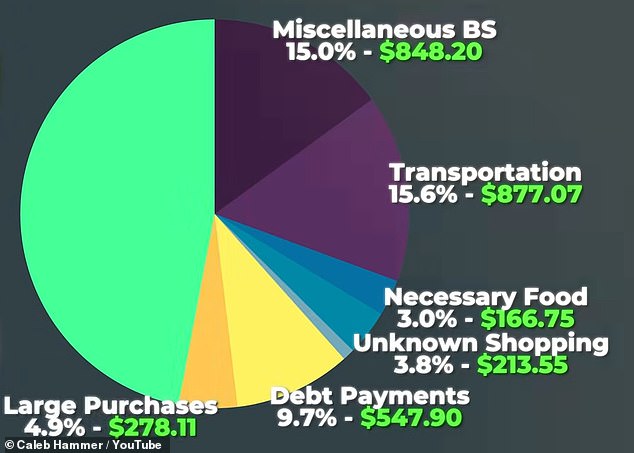

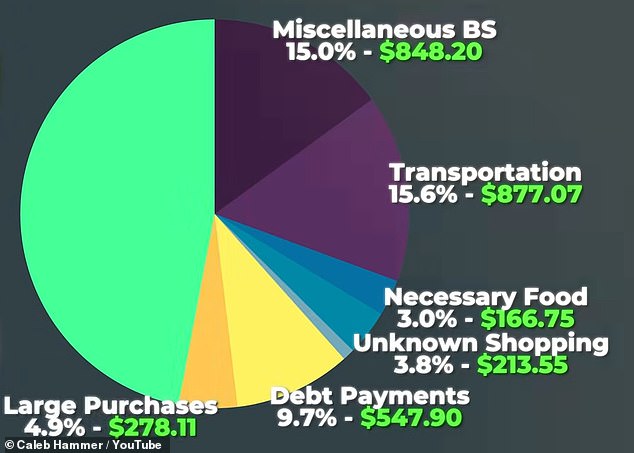

Caleb then reviewed his finances and found that the majority of his salary was spent on food, snacks and tobacco.

“And you’re not even willing to do that, that’s the most immature thing I’ve ever heard in my life.”

Myles replied, “I mean, I’ve been working 120 hours a week, but then I feel like I’m running out of time in my day.”

Caleb said Myles was currently short on time because he was devoting it all to “having fun.”

He then looked into the 23-year-old’s finances and found that the majority of his salary was spent on food, snacks and tobacco.

The YouTube financial guru asked Myles to get a second job, but he refused.

After some back and forth, the duo came up with a plan to get Myles out of debt in five years if the 23-year-old increased his hours.

At the end of the clip, Myles agreed to work at least 30 hours.

And while Myles refused to work more, others who put in hours at work still found themselves in hot water when it came to finances.

Many people have even turned to living in a car or van due to inflation, while others cannot afford to live on even a six-figure salary.

He stressed that he would need more than $2,000 to survive.

After some back and forth, the duo came up with a plan to get Myles out of debt in five years if the 23-year-old increased his hours.

Due to the soaring cost of living, people across the country are trying to cut back on their expenses.

Although inflation has declined in recent months, it still remains high at 7.1 percent.

According to consumer data company Dunnhumby, a third of households skip meals or reduce their portion sizes to save money.

Researchers found that 18 percent of the 2,000 survey participants reported that they weren’t getting enough food to eat.

Additionally, 31 percent of households have reduced their portion sizes due to empty pantries due to rising grocery prices.

Besides the cost of food, millions of people across the country lack a financial safety net.

According to the researchers, 64 percent of participants admitted that they would not be able to raise $400 in an emergency.

Many suffered from inflation, which sent prices of basic goods soaring, including meat and poultry prices up 10.4 percent, cereals up 15.1 percent and fruits and vegetables up 8.1 percent.

Gasoline prices are another pressure point for many people across the country, rising nearly 60 percent over the past year, with the cost of plane tickets increasing by more than 34 percent. cent and the price of used cars by more than 7 percent.

Clothing costs increased 5.2 percent, overall housing costs increased 5.5 percent and delivery services increased 14.4 percent.