Table of Contents

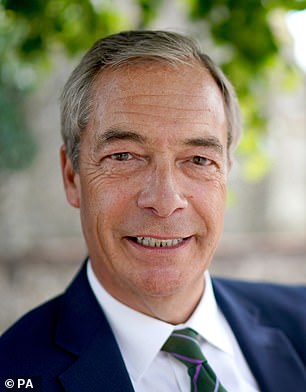

A terrier that keeps digging: Nigel Farage

NatWest is embroiled in another potentially volcanic row with Nigel Farage. The former UKIP leader is threatening to sue if he does not pay her compensation and legal costs after Coutts, his private banking arm, closed his accounts.

NatWest has a couple of days to deal.

And if he doesn’t, Farage is threatening legal action which, he hopes, will thwart the Treasury’s plans to sell off the taxpayer’s stake in a ‘Tell Sid’ campaign.

In his words, the bank is not suitable for a public sale until its house is in order. Oh, and he wants me to promise to stop closing accounts of clients whose opinions I disagree with. He also asks what reforms have been put in place so that others like him, but without as much voice, are not treated the same way.

Farage is right. Who would want to invest in NatWest if it has a high-profile legal dispute with such a tenacious adversary hanging over it?

Remember, its shares fell 35 percent immediately after Farage made public the closure of his account. Frankly, the appetite for NatWest shares is pretty dismal anyway, as it is for all banking stocks.

Having a public dispute over the bank will be discouraging, especially for private investors who would have liked to dabble.

What is most incredulous about this latest row is that NatWest’s new top team (confirmed yesterday) must have thought they could get away with not resolving the mess left by former boss Dame Alison Rose, who was forced to resign by Farage’s decision. debanking.

It was Rose who brought the matter to a climax after admitting to a BBC journalist that it was NatWest that closed Farage’s account, breaking client confidentiality, the most basic of banking principles. They have obviously learned nothing from the scandal, which also led to the sacking of Coutts’ director after it became public that the private bank had compiled a huge Stasi-style dossier on Farage and his politics.

After such a damaging affair, NatWest should know better. The new team should invite Farage for a fireside chat, apologize for the past and reach an agreement. It is necessary to show that they have cleaned the house.

It is also incredible that Jeremy Hunt could plan such a massive stock sale with Farage at large. If the Chancellor has not fully grasped the damage Farage has already done to NatWest’s reputation, he must now appreciate how powerful he remains politically.

As the results of the two by-elections show, having Farage on the sidelines is dangerous. He is a terrier, one who keeps digging until he gets his bone even though he is buried on the other side of the world.

Imagine if after the Brexit vote Farage had been given a noble title and some kind of role in the negotiations, how different the last few years might have been. It is better to have your enemies inside the store. NatWest should learn from that mistake.

been and gone

Well, that was a short recession. If January’s buoyant retail sales figures are an accurate guide, the UK has been in and out of recession and is recovering.

But growth will be slow as higher interest rates bite deeply. Those with young families facing massive mortgage payments and other high costs are suffering the most pressure.

That is precisely what the Bank of England wanted to achieve with its rate hikes: dampen demand. Enough is enough. Now is not the time for cowardly caution: lower rates soon.

The Chancellor must be equally bold. Plans for a 2p cut in income tax in next month’s Budget are understood to have been put on hold.

That is wrong. Now is precisely the time to move forward with tax cuts and reforms to help households and small businesses. It should do the unthinkable with merchant fees: abolish them entirely instead of continuing to tinker with opt-outs. There are alternatives. Just ask James Timpson, of Timpsons, who is full of big ideas for rescuing the High Street.

Light on

April may be the cruelest month but it is also getting cheaper. Ofgem is likely to confirm next week that energy bills will fall in April by almost £300 a year for a typical household, the lowest level in two years.