Heidi Klum’s daughter Leni Klum made waves when she attended David Yurman’s event in New York on Thursday.

The model, 19, flaunted her incredible physique in a simple long black dress while showing off her ample cleavage with a plunging neckline.

The rising star accessorized the look with a chunky gold necklace and black heels, while her brunette locks were styled in loose curls.

Leni was joined by her fellow nepo-baby Iris Law, who was also surprised by the event.

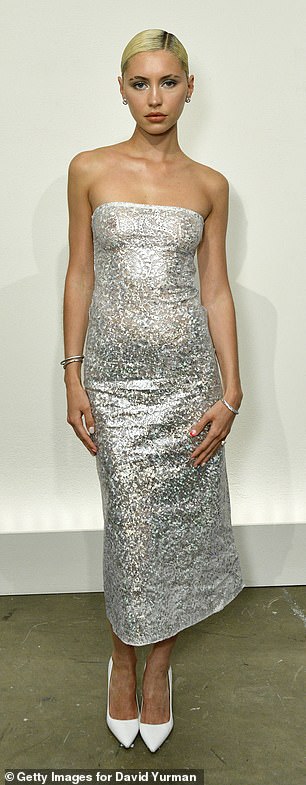

The daughter of Jude Law and Sadie Foster cut a glamorous figure in a strapless sparkly silver dress.

Heidi Klum’s daughter Leni Klum, 19, put on a VERY busty display when she was joined by the glamorous Iris Law at the David Yurman event in New York on Thursday.

The model flaunted her incredible physique in a simple long black dress while showing off her ample cleavage with a plunging neckline.

The model, 23, added a pair of white heels to the ensemble and an array of silver jewellery, while her short blonde locks were swept away from her face in a slick bun.

Enjoying the evening, Iris was seen posing for an artist while he drew her portrait and she made sure to show off her best angles.

It comes after Iris was seen putting on a leggy display while stepping out in shorts to meet friends for a relaxing afternoon in West Hollywood last week.

She cut a relaxed figure for the outing, wearing a coral T-shirt under an oversized black Alaska-branded sweater.

The star began her fashion career with a photo shoot with Illustrated People.

From there she was chosen to be the face of Burberry’s beauty campaign in 2015. She has also appeared in advertisements for Marc Jacobs, Stella McCatney and Lacoste.

Iris made her runway debut in 2020 at the Miu Miu show.

Meanwhile, Leni recently attended Coachella as she wowed in a black lace bra and low-rise acid-wash blue jeans.

The daughter of Jude Law and Sadie Foster cut a glamorous figure in a strapless sparkly silver dress.

The rising star accessorized the look with a chunky gold necklace and black heels, while her brunette locks were styled in loose curls.

Leni posed for photos with Gabbriette without a bra

Enjoying the evening, Iris was seen posing for an artist while he drew her portrait and she made sure to show off her best angles.

The model added a pair of white heels to the ensemble and an assortment of silver jewelry, while her short blonde locks were pulled back from her face in a sleek bun.

Guests enjoyed dinner and drinks during the evening.

The cover girl also posted a photo of herself sharing a kiss with her boyfriend Aris Rachevsky under the neon lights.

The rising star wore a black bra with spaghetti straps and carried a pair of retro sunglasses in her hands as she hugged her boyfriend.

Heidi, 50, was also partying at the festival when the German supermodel shared a close-up selfie of herself showing off her fun eye makeup.

Embracing the Coachella vibe, her makeup featured bright sunset colors, sharp eyeliner, and iridescent glitter.

This comes after she rocked a sheer bright green crochet dress with matching sparkly eyeshadow for her first day look.

She was seen in a video she posted enjoying a treat by the pool to cool off from the heat in the desert and before heading to the festival grounds.

She was seen hanging out with fashion designer and Making the Cut winner Yannik Zamboni.

In the clip, Klum showed off her equally eye-catching ensemble in a black crochet dress with a bright pink print across the torso, which matched her makeup look.

Underneath the sheer garment, the blonde bombshell wore a cheetah-print bikini top and also sported a wide-brimmed printed hat.

Leni was seen sharing a kiss with her boyfriend Aris Rachevsky under the neon lights during one of the second day’s shows at Coachella.

Heidi, 50, was also partying at the festival when the German supermodel shared a close-up selfie of herself showing off her fun eye makeup.