- David told NFL Network’s Rich Eisen he can’t follow March Madness

- Seinfeld co-creator admits he only pays attention to the NBA and NHL

- DailyMail.com provides all the latest international sports news

<!–

<!–

<!–

<!–

<!–

<!–

Vice President Kamala Harris was among the few to correctly pick Oakland’s upset of third-seeded Kentucky in the first round of the NCAA men’s basketball tournament. Meanwhile, boxing legend Evander Holyfield believes UConn will repeat as national champion by beating Duke in the final. And as for actor Ryan Reynolds, he envisions North Carolina edging Purdue for the Tar Heels’ seventh title.

But there’s at least one celebrity refusing to indulge the fascinated public by revealing his March Madness films to the general public: Seinfeld co-creator and Curb Your Enthusiasm star Larry David.

“You know what, can I make a confession here,” said David, a longtime New York sports fan. NFL Network’s Rich Eisen. “This tournament – what can I follow in sports? Am I supposed to know who Drake is on? I mean, it’s crazy – crazy.

David is right. There are 68 teams in the tournament, many from mid-major conferences like the Horizon League or Missouri Valley with little-known teams populated by largely anonymous players.

Sometimes a small school has a star, like Division II transfer Jack Gohlke, who scored 32 points on 10 3-pointers for Oakland in Thursday’s stunning upset of Kentucky. But before the tournament, Gohlke was an unknown nationally.

There’s at least one celebrity who refuses to get caught up in the spirit of March Madness: Larry David.

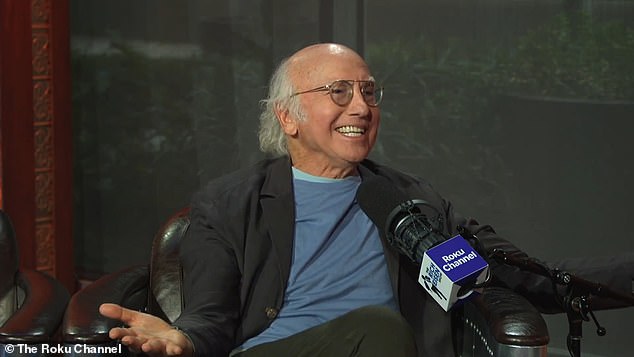

Seinfeld co-creator Larry David discusses March Madness on the Rich Eisen Show

David went on to drop the name of a small Catholic school in northern Indiana – even though it didn’t actually qualify for the tournament.

“Valparaiso?” » David added. “I know any names in Valparaiso? This is insane. I know nothing. Maybe I’ll watch the semi-final, but that’s it. What can I do?’

David is quick to talk about his love for his favorite pro teams in New York, but without his alma mater, Maryland, in the men’s NCAA tournament, he really doesn’t have much of an interest.

Larry David during a Knicks-Suns game in 2014

“I have the Rangers, I have the Knicks; I can’t keep up with all these teams,” he said. ‘How do people do it? How do they do it?’

Eisen then made a comparison to Long Beach State coach Dan Monson, who has continued to coach the team since his firing at the end of the regular season, miraculously guiding them to a Big West Conference title and a place for a tournament.

Monson’s story is similar to David’s experience at Saturday Night Live, where he quit his job as a writer and returned to the studio the next day as if nothing had happened.

“I stopped,” David said. “And then I came back Monday morning and acted like nothing happened.” It was (the idea) of my neighbor Kramer, the real Kramer.

The Kramer mentioned by David was the real-life basis of the famous Seinfeld character.

‘You know what? I thought it might work,” he continued. “I thought it was a great idea. I thought I had nothing to lose.

Washington State beat Drake in the first round on Thursday, even though Larry David didn’t care.

But even though he doesn’t follow the tournament closely, David took some joy in Monson’s story while questioning the University of Southern California’s mere existence.

“Good for him,” said David. “Where is he, Long Beach State?” It is a university ?

” There are so many. How can there be so many athletes? How can so many people play these games? Look at all these middle and high schools; they all have teams.

“Let’s go to the colleges, there are some really good people playing on those teams. How can there be so many great players?

The first round of the NCAA women’s and men’s basketball tournaments is currently underway, with the championship games scheduled for April 7 and 8, respectively.