Reptile farms in Thailand, which supply leather to Gucci, Yves Saint Laurent and Louis Vuitton, kill snakes by hitting them on the head with hammers.

Video and images from inside Closed-Cycle Breeding International and Si Satchanalai Python Farm show the disturbing ways the reptiles were housed and slaughtered.

Workers placed the python’s head on a table and hit it repeatedly with a hammer, a shocking method that experts said might not even knock them out.

They then ran a metal hook through the head and pumped the hose full of water to make it easier to remove the skin.

Phokkathara Crocodile Farm, which supplies hides to Kering brands such as Gucci and YVS, also killed its reptiles using shocking and painful methods.

Workers placed the python’s head on a table and hit it repeatedly with a hammer, a shocking method that experts said might not even knock them out

They then ran a metal hook through the head and pumped the hose full of water (pictured) to make it easier to remove the skin

The footage was obtained by undercover investigators from the animal rights group PETA, who spoke to farm owners and visited their facilities.

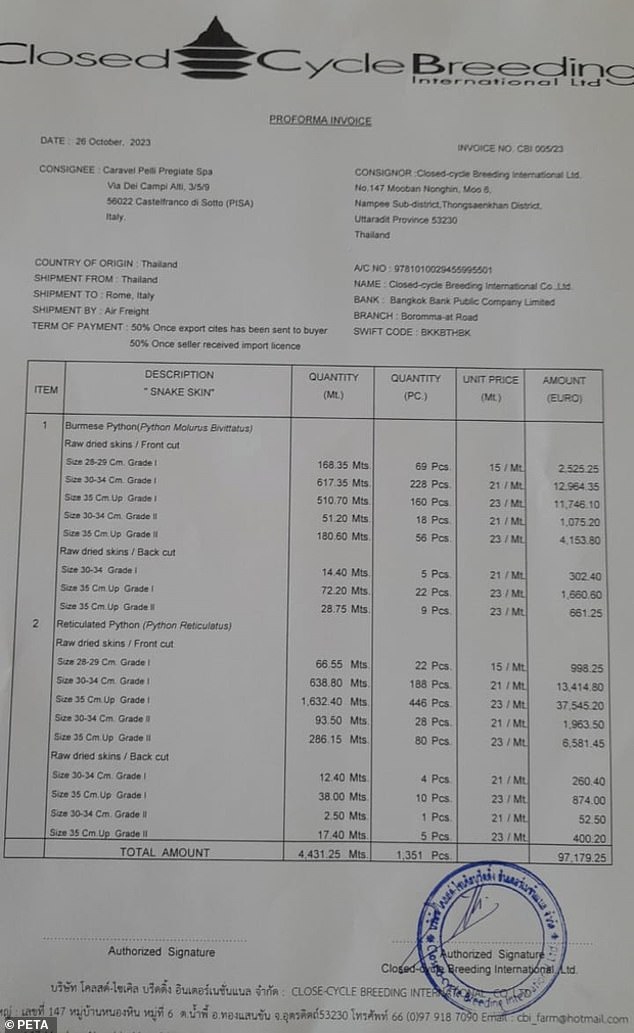

CCBI and Si Satchanalai, owned by a father and son, told investigators they supplied leather to Caravel, a tannery owned by Kering, and to Louis Vuitton.

The massive CCBI farm had 15,000 pythons in captivity and killed 20 to 30 a day during busy seasons to fulfill a contract for 5,000 skins with Caravel this year.

Snake skin is used to make bags, shoes, belts and other accessories sold around the world by the luxury brands.

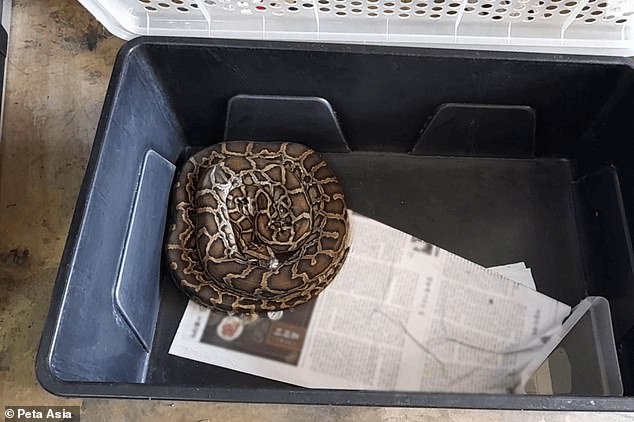

Pythons on the two farms were bred in captivity and placed in completely naked small cages and boxes, sometimes slithering in their own feces.

The owners said the snakes sometimes killed each other during the breeding season, when the females were mated with three or four males.

They pointed to an emaciated snake that ‘didn’t eat for a long time’ and said ‘they should get rid of it… it’s better to kill’.

Another snake had not shed properly and its melting scales got stuck in its eyes, which the owner said was also reason to kill and dispose of it.

Pythons on the two farms were bred in captivity and housed in completely naked small cages and boxes, sometimes slithering in their own feces

Snake skin is used to make bags, shoes, belts and other accessories sold around the world by the luxury brands

A worker pumps a hose with water as skinned hoses are seen in boxes

The massive CCBI farm had 15,000 pythons in captivity, killing 20 to 30 a day during busy seasons to fulfill a contract for 5,000 skins with Caravel this year

The owner said the snakes were chilled for a day before they were killed, but the researchers are not convinced that hypothermia significantly reduces their sensitivity.

Clifford Warwick, a reptile expert to whom PETA showed the footage, said it was likely the snakes were conscious during their painful deaths.

Many of the snakes continued to move during and even after the process that was supposed to kill them.

Investigators also visited the crocodile farm which supplied the Caravel and saw how workers tried to kill the animals with a ‘neck stab’ to sever their spinal cords.

PETA said the method ‘likely caused extreme pain and a slow, agonizing death’.

“This animal’s leg continued to move for at least 23 minutes after the worker forcefully thrust a metal blade into his or her neck,” it said.

“Scientific evaluation suggests that crocodiles can remain alive and conscious for over an hour and a half after sustaining such injuries.”

The owner of the farm claimed to have 4,000 crocodiles on the premises, which were kept in murky pools filled with disease.

Metal hooks drive through the pythons’ heads so they can be skinned – but they may still be alive and conscious

Workers hit pythons on the head with hammers to stun or kill them

Investigators also visited the crocodile farm which supplied the Caravel and saw how workers tried to kill the animals with a ‘neck stab’ to sever their spinal cords

An invoice between Closed-Cycle Breeding International and Caravel

Kering lists Caraveli Pelli Pregiate SpA, the legal name of the Caravel tannery, as a wholly owned entity. It bought a majority stake in the company in 2001 and bought the rest in 2008.

Kering’s animal welfare standards state that animals must have ‘space to move freely’ and be ‘managed to promote good health and treated promptly if disease or injury is detected’.

They also require ‘humane handling at the end of life’.

Kering co-founded the Python Conservation Partnership in 2013, which focuses on ‘improving the sustainability, transparency, animal welfare and local livelihoods of the python skin trade’.

PETA claimed that its investigation showed that these standards were not being followed.

About 500,000 snake skins are legally imported into Europe from Southeast Asia each year, according to a 2017 report.

Kering and Louis Vuitton’s parent company LVMH were contacted for comment.