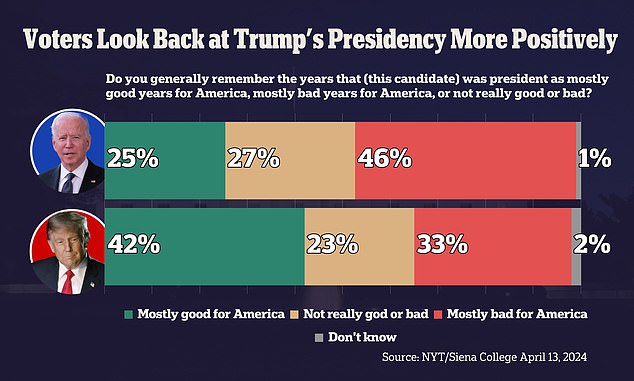

Only a quarter of Americans think Joe Biden’s presidency has been good for the country, according to a new poll, a sign that could be detrimental to his upcoming re-election hopes.

Donald Trump’s presidency, by contrast, is viewed in a much more favorable light since he left office, even by those who voted against him.

The left poll New York Times of 1,059 registered voters found that perceptions of Trump’s effect on the country became more positive over time.

His handling of the economy in particular is remembered positively, especially since the runaway inflation of 2022-23 occurred under the Biden administration.

Former President Donald Trump speaks during a rally in Schnecksville, Pennsylvania

The economic forces that affected each presidency were largely outside the control of both leaders, but voters associate them with them anyway.

Trump earned a 10 percent increase in voters’ perception of his handling of the economy compared to 2020, according to the New York Times-Sienna poll.

Its management of law and order also increased by eight percent, even though that is almost entirely the purview of state and local governments.

‘When I was running for the first time, I was like, what is this guy talking about? What is he saying? “He’s saying all the wrong things,” Maya Garcia, a former “Trump hater,” told the Times.

‘But to be honest, if you look deeply into his personality, he actually cares about the country. You know I didn’t like it at first. But sometimes we need that kind of person in our lives.’

Trump also saw a nine percent increase in perceptions of whether he left the country better off, a metric in which he has a considerable lead over Biden.

‘We all had a little more money in our pockets when he was in office. I think he gave more money than any other president he’s ever had in my life,” Marecus Maupin, 31, told the Times.

“Now I feel like even though I’m earning more, I don’t see it.”

Only 25 percent of voters in the survey consider Biden’s presidency so far “good for America,” compared to 46 percent who said it was mostly bad.

Trump has 42 percent of voters on his side on that issue, and 33 percent say it was mostly bad.

The two men will face off in the presidential election in November, as Biden continues to trail in many polls and Trump seeks to return to the White House after being defeated in 2020.

Trump took credit (pictured) for the Supreme Court overturning Roe v. Wade, which had established a constitutional right to abortion since 1973.

A Trump voter attends a rally in Pennsylvania over the weekend

Other views on Trump, including his handling of Covid, the Supreme Court and “unifying America,” remained virtually unchanged with only very small increases, according to a Times poll.

The percentage of voters who believed he “respects women” also dropped by four after countless statements degrading women and their issues.

Trump also took credit for the Supreme Court overturning Roe v. Wade, which since 1973 had established a constitutional right to abortion.

Fear of a second Trump term has also diminished, the Times concluded. In 2016, about 40 percent said they were afraid of what Trump would do if he were elected. That figure currently stands at 31 percent.

That presidents are remembered more fondly in retrospect is normal and happened with both Barack Obama and George W. Bush.

But the difference is that only one president has served two non-consecutive terms: Grover Cleveland in 1885-89 and 1893-97.

This makes changing opinions about Trump more relevant and could help propel him to the presidency even if voters who support him after wistfully remembering that the economy was better in his day realize why they voted against him in 2020.

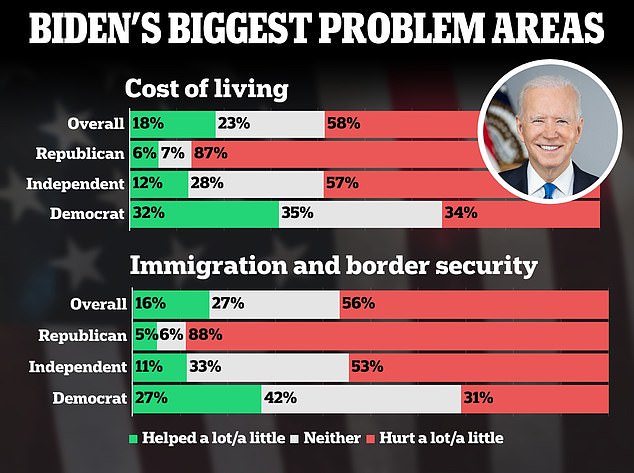

President Joe Biden got the worst marks on “cost of living” and “immigration and border security,” with more than half of respondents saying he had hurt the country on those issues.

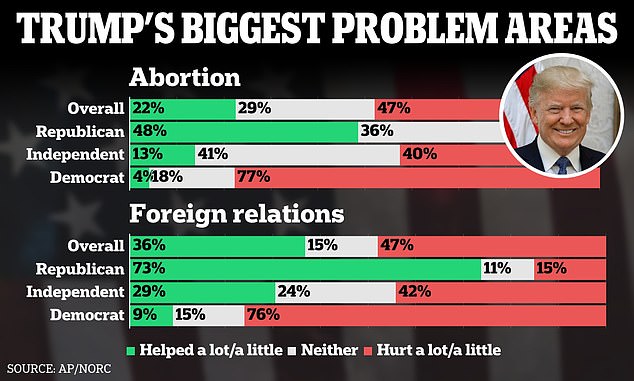

Nearly half of Americans surveyed said former President Donald Trump hurt the country on abortion and foreign relations issues.

The latest Times poll comes after recent results from the AP-NORC Center for Public Affairs Research which found that more than half of American adults think Biden’s presidency has hurt the country about the cost of living and immigration.

Nearly half believe Trump’s presidency hurt the country on voting rights and election security. relations with foreign countries, abortion laws and climate change.

When asked which president did the most to help people like them, about a third said Trump and a quarter said Biden. While 30 percent said neither had helped much.

Americans rated Biden particularly negatively on several key issues. Only two in ten think that his presidency has helped them “a lot” or “a little” to improve their cost of living. Even fewer, 16 percent, say it has been helpful on immigration and border security.

About 60 percent said the Biden administration hurt them on those issues.

Nearly half, 46 percent, of Americans said Trump’s presidency helped “a lot” or “a little” on immigration or border security and 40 percent believed it helped the cost of living.