Table of Contents

13 Share

1

View

comments

Advertisement

Follow Mail Sport’s live blog for all the latest Premier League news and updates.

Captain Son returns to Spurs after Asian Cup humiliation

Is Mo Salah getting closer to fitness?

More about Ten Hag in our podcast ‘It’s All Beginning!’

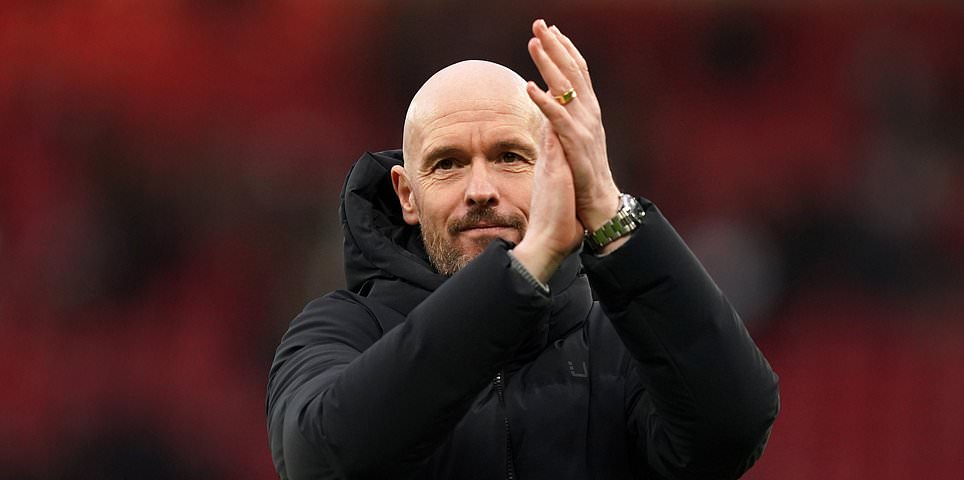

Summary of Erik ten Hag’s press conference

Villa too soon for Mount and Malacia

Mason (Mount) and Ty (Malacia) are not ready.

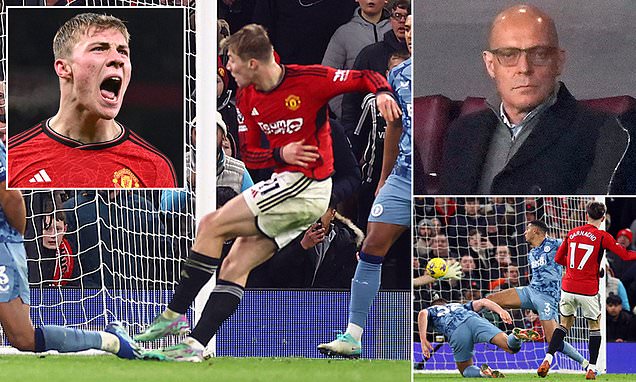

The future is bright for the young Red Devils

I think they like playing together, the adventure, they want to do it together. They also want to pass the ball between themselves so that everyone can take advantage of their qualities and score goals. It’s great that they want to do it together and that’s the key. Young players, Manchester United’s future is quite bright, with talent on board, we have to develop it.

This club wants to achieve a lot, this club wants to win such ambitious trophies that they have to step forward and reach high levels. Also against the best opposition they have to express the same threat and it’s about the final product.

‘Every match is a final from now on’

I told the team since the beginning of January that now every game is a final. That was also our approach against West Ham, this is a final, we have to accept this challenge and see it as a final. That will be every day from now on.

Who will replace Martínez on the side?

We have options. How to face that position. We have good center halves in our team so the others are available, Luke (Shaw) can play there too. I’m pretty confident we can keep the process going so others can fill the role and also contribute by playing at high levels. Those players have experience.

The rise of Garnacho and Hojlund

Players need time, especially young players like Rasmus (Hojlund) and Alejandro (Garnacho), they need time but they also need a team, so those effects were not there in the first half of the season.

From the beginning I had confidence that they had the potential to do what they are doing and now it’s about moving forward, being hungry.

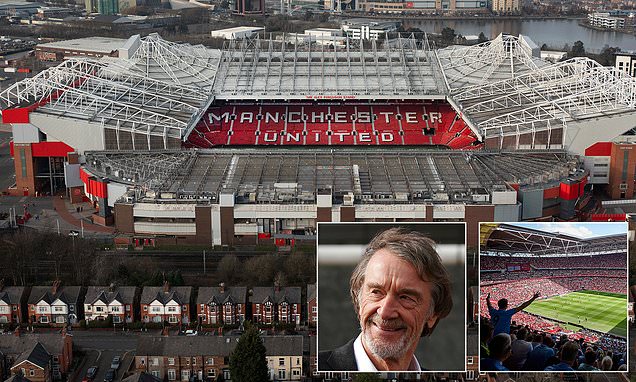

“The ambition of North Wembley is good, but it is not my task”

If that is your opinion (Jim Ratcliffe), then I would say that it expresses the ambition of this club, which is good, but it is not my job at this club to deal with stadium issues, the facilities, my job is to manage the team. and rebuild the team.

‘Licha is a fighter’: Martínez prepares for time on the sidelines

It is a clear setback, Licha (Martínez) was returning, you can see his contribution to the team when he is playing, in addition to technique, also mentality.

It’s a big setback for Licha, he’s very disappointed but he’s a fighter. He will come back, be stronger and play at the end of the season. As a team we have to replace him and we have players who can play there and will play there.

What’s going through Erik ten Hag’s mind?

Will Thiago Alcántara play for Liverpool again?

Can Rasmus Hojlund continue his scoring streak?

What is the strangest transfer of a Premier League star in football history?

Hello and welcome!