115

Table of Contents

The FTSE 100 will open at 8am Companies with trading reports and updates today include Marks & Spencer, SSE, Mitchells & Butlers, BT and Severn Trent. Read the Business Live blog from Wednesday 22 May below.

> If you are using our app or a third-party site, click here to read Business Live

Services inflation remains unstable

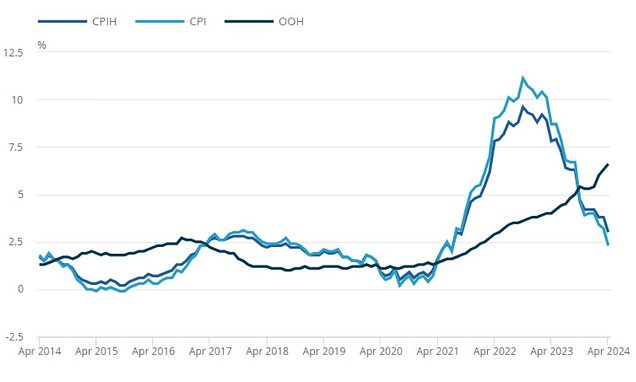

Inflation remains above forecasts, but the trend towards deceleration in prices “is intact”

Inflation falls to 2.3% as Rishi Sunak says Britain’s woes are ‘in the rearview mirror’… but questions arise over Bank of England interest rate cuts and fall not as steep as expected

The CPI plummets to 2.3%