Table of Contents

John Ions, CEO of Liontrust Asset Management

The chief executive of one of Britain’s biggest fund managers has said a new government with a sizeable majority could help spark a revival in the country’s lackluster stock market.

Liontrust Asset Management boss John Ions told shareholders on Wednesday that Labour’s victory in last week’s general election “should herald a period of stability which will be positive for financial markets”, and also praised the party’s “pro-growth agenda”.

Earlier this year, Ions cited the “out-of-favour” status of UK stocks, particularly small- and mid-caps, as contributing to the exodus of investors from Liontrust funds.

Of the £6.1bn withdrawn from Liontrust funds last year, around £4bn came from UK equity vehicles.

The fund manager, which was forced to abandon a takeover bid for Swiss rival GAM last year, saw outflows from new investors slow to £923m in the three months to June 30, from £1.6bn in the same period last year.

Total assets under management fell 2.8 percent to £27 billion.

However, the bulk of these outflows (around £770m) came from UK retail funds and managed portfolio solutions, suggesting that domestic investors have yet to rekindle their interest in the market.

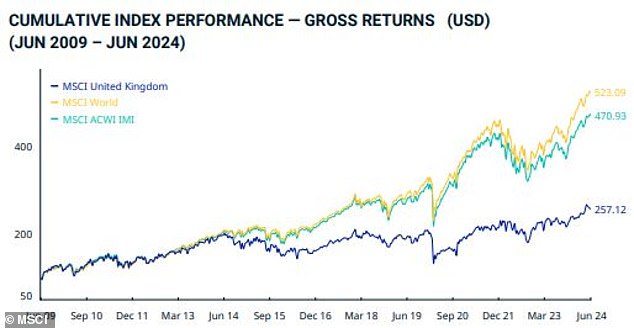

The performance of the UK stock market has lagged behind its international peers for some time

Ions said: ‘Labour’s large majority in last week’s election should herald a period of stability which will be positive for financial markets.

“It is encouraging that the new government has a pro-growth agenda and is committed to simplifying pensions.”

The MSCI UK Index, which measures the performance of the large- and mid-cap segments of the UK market, has risen by 6.94, 5.74 and 2.7 percent over three, five and ten years respectively.

Meanwhile, the MSCI World has gained 7.38, 12.32 and 9.73 percent respectively over the same periods.

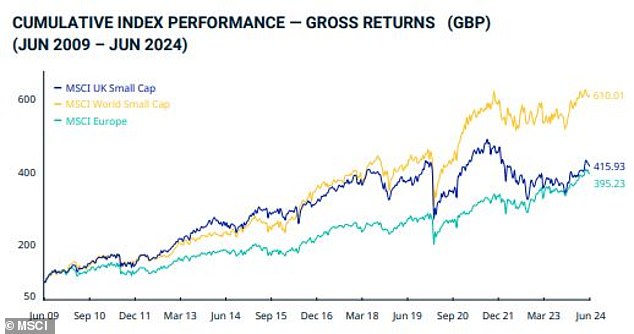

And the data shows the gap between the performance of smaller UK companies and their international peers is even wider.

The MSCI UK Small Cap Index is down 2.67 percent over three years, while up just 1.97 and 5.03 percent over three and ten years respectively.

International small-cap pairs have gained 2.15, 7.5 and 10.04 percent respectively over three, five and ten years.

But Ions said greater political stability “coupled with falling inflation and expectations of lower interest rates” should “encourage” international investors to return and “boost capital flows into the stock market.”

He added: “Given the growing need for people to save more for their retirement as well, this will significantly improve the outlook for asset managers.

‘Liontrust is well positioned for this improving environment as we have a strong brand, distribution, robust investment processes and a leading reputation in UK equity management.

‘Liontrust will also benefit from the progress we have been making in positioning the Group for the future, including further expanding our investment and distribution capabilities, increasing client engagement and improving operations.’

Liontrust shares were up 2.3 per cent at 617.6 pence as of midday on Wednesday, having lost almost 75 per cent from their September 2021 peak of 2,455 pence.

UK small caps have struggled, but European peers also lack global indices

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

eToro

eToro

Stock Investing: Community of Over 30 Million

Trade 212

Trade 212

Free and commission-free stock trading per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Compare the best investment account for you