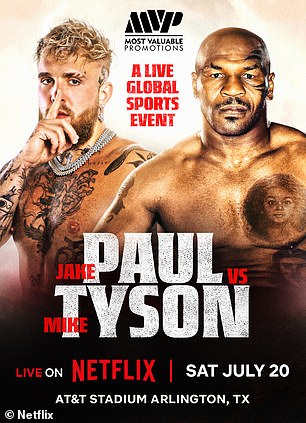

- Paul is scheduled to face Tyson in a live Netflix exhibition fight on July 20.

- Canelo says he has no interest in tuning in for ‘Iron’ Mike’s return to the ring

- DailyMail.com provides the latest international sports news.

<!–

<!–

<!–

<!–

<!–

<!–

Canelo Alvarez insists he has no interest in seeing Jake Paul take on Mike Tyson this summer after calling their display “more show than fight”.

Paul, the YouTuber turned fighter who is forging a career in professional boxing, will take on former heavyweight champion Tyson in a controversial fight that will air live on Netflix on July 20.

It marks a sensational return to the ring for ‘Iron’ Mike, who will be 58 when he climbs the ropes again, although his showdown with the 27-year-old looks like an exhibition given there will be no judges in the ring to score him.

The pair will also wear 16-ounce gloves instead of the traditional 10-ounce ones used in professional fights.

And given the relaxed rules on the matter, Canelo has no plans to tune in to Paul vs. Tyson.

Canelo Álvarez insists he has no plans to see Jake Paul face Mike Tyson this summer

Paul will face heavyweight icon Tyson in a controversial fight live on Netflix on July 20.

But four-weight world champion Canelo believes the fight is “more spectacle than fight”

“Not at all, not at all,” said the four-weight world champion. sports when asked if he will watch the fight. ‘No, nothing.’

“I think it’s more show than fight.”

Two-minute rounds will be implemented when Paul steps into the ring with Tyson in Texas, instead of the usual three-minute rounds. The only way either man can win the fight is by knockout.

Most of the rules, aside from glove weight, are the same as when Tyson faced Roy Jones Jr in a similar exhibition fight in November 2020.

The boxing legend taking on a fighter 30 years his junior has sparked outrage in the boxing and sporting community, with promoter Eddie Hearn recently declaring the fight “sad” in an interview with Mail Sport.

“For me it’s really sad because Mike Tyson was one of my idols growing up, and to see him fight at 57, 58… but I also understand that a lot of people are going to tune in and watch it,” Hearn told Mail Sport.

‘It’s an entertainment event, Netflix, it’s great to see them involved in boxing. I think he will do very well. But it’s not really something for me.