Liberal economist Larry Summers warned that inflation has not yet been fixed and that a Trump administration could make things even worse.

Summers, who was Treasury Secretary under Bill Clinton and also advised Barack Obama after the 2008 financial crisis, was correct in his 2021 prediction that if “Bidenflation” was left unchecked it would bring back Donald Trump.

In a talk at the Economic Club of New York, Summers says the Federal Reserve, led by Jerome Powell, is still not taking it seriously enough.

“My view is that the Fed and the markets continue to underestimate the risk of overheating,” Summers said.

He then predicted potential disaster for a decision Powell has already made: “I wonder: Why is cutting rates a priority in that environment?”

Liberal economist Larry Summers warned that inflation is not yet fixed and that a Trump administration could make things even worse.

Summers worries that President-elect Donald Trump will only make ‘Bidenflation’ worse

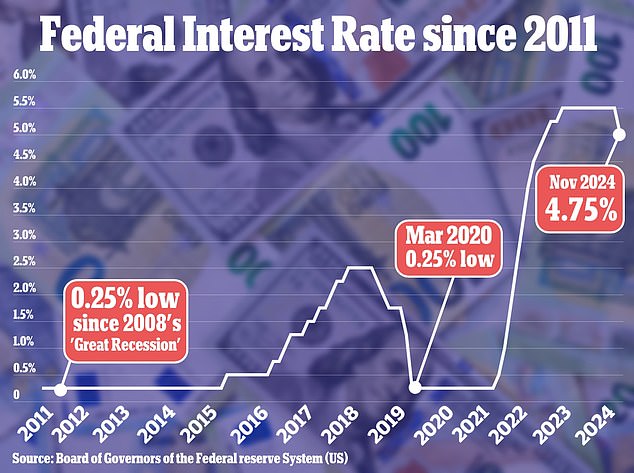

The central bank made a 25 basis point cut on Thursday, lowering rates to between 4.5 percent and 4.75 percent.

Summers called this a “surprising” and “huge” mistake, similar to when the Federal Reserve was slow to raise rates three years ago.

“I fear the Fed will behave more like once burned, twice burned, rather than once burned, twice shy, when it comes to inflation risks,” he said.

Lower rates are good news for consumers, as they make borrowing money less expensive and should mean cheaper loans and credit card rates that will eventually reach Americans.

It is the second time in a row that the Federal Reserve, led by Powell, has cut rates this year, following an aggressive rate-hiking campaign to curb inflation.

However, Summers remains unconvinced: “The work on inflation is not done yet,” Powell said.

He added that he is concerned that Trump, by using tariffs, could take advantage of a Biden problem and make it even worse.

‘There is a very significant risk that the president will try to implement what he spoke about. “If it does, the consequences are likely to be substantially higher inflation than caused by Biden’s excessive stimulus,” Summers said.

He then predicted potential disaster for a decision Jerome Powell has already made: “I wonder: Why is cutting rates a priority in that environment?”

The central bank made a 25 basis point cut on Thursday, lowering rates to between 4.5 percent and 4.75 percent.

Trump is expected to allow Powell to remain in office until the end of his term in May 2026, according to cnn.

It says there could be a “substantial adverse supply shock due to higher prices” and a “substantial risk of labor shortages, which in turn are an inflationary force” from Trump’s plan to deport illegal immigrants.

While Trump could still change his mind, the current thinking among him and his economic team is that Powell will remain at the helm of the central bank as it works to cut interest rates.

Powell, a Republican with a background in private equity, was originally tapped to lead the Federal Reserve by Trump in 2018. He was later reappointed to a second term by President Joe Biden.

Trump has also taken issue with the Federal Reserve’s lack of transparency, criticizing its private policy meetings and delay in releasing discussion notes.

According to CNN, Trump’s advisers have suggested that he would prefer real-time release of the Fed’s minutes and economic reports, with meetings held in front of cameras for greater public understanding.

During Trump’s first term, he and Powell clashed repeatedly. In 2018, Trump openly considered replacing Powell after a rate hike by the central bank, although the president cannot legally remove a Fed chair unless he breaks the law.

Thursday’s decision is the second time the Federal Reserve has cut rates this year, amid a slowing labor market and cooling inflation.

During a press conference Thursday, Powell said “the law does not allow” a president to fire or remove a Federal Reserve chair.

Authorities voted to cut interest rates by 50 basis points in September, lowering benchmark borrowing costs from 23-year highs.

Experts note that while the decision to keep Powell as Federal Reserve chair is important, it may be overshadowed by the potential economic changes that a second Trump administration could bring.

Trump’s recent election victory and the likelihood of a Republican-controlled Congress in January signal possible policy changes – from import tariffs to tax cuts and restricted immigration – that could reshape the economic landscape that U.S. policymakers see. Fed anticipated for next year.

While these changes could take months to pass Congress, even with Republican majorities, they have the potential to significantly alter the country’s growth and inflation prospects.

Economists across the political spectrum have warned that Trump’s policies could reignite inflation and therefore slow or halt the Federal Reserve’s moves to cut interest rates.

Jonathan Moyes, head of investment research at Wealth Club, said: “All eyes will be on Donald Trump and any major changes to tax and spending plans once the new administration has been formed.”

If they go too far too soon with any tax cuts, the Fed could be forced to raise rates to cool any additional inflationary pressure, which could set the stage for a conflict between the new administration and the Fed in 2025. .

“For now, as always, the outlook remains uncertain.”