Shameless conspiracy theorists have flooded the Internet with deranged speculation linking the Kansas City parade shooting to Travis Kelce and Taylor Swift’s support for gun control laws.

Social media users suggest that the shooting was somehow part of a plan to increase support for Joe Biden and the Democrats by the celebrity couple.

Less than 24 hours after one person was killed and dozens more were injured in the horrific Valentine’s Day shooting during what was supposed to be a celebration, several widely shared posts have made the strange connection.

Swift has been the subject of a number of conspiracy theories in recent weeks from far-right conservatives who support Donald Trump, who believe the singer and Kelce will promote Biden’s campaign to be re-elected if the Chiefs win the Super Bowl.

Many claimed that the Super Bowl, in which the Chiefs scored a 25-22 overtime victory against the San Francisco 49ers, was rigged for political reasons.

Shameless conspiracy theorists have flooded the Internet with wild speculation linking the Kansas City parade shooting to Travis Kelce and Taylor Swift’s support for gun control laws. (Pictured: People flee after shots are fired near the Kansas City Chiefs’ Super Bowl LVIII victory parade on February 14, 2024)

Swift has been the subject of a number of conspiracy theories in recent weeks from far-right conservatives who support Donald Trump, who believe the singer and Kelce will promote Biden’s campaign to be re-elected if the Chiefs win the Super Bowl.

Social media users suggest that the shooting was somehow part of a plan to increase support for Joe Biden and the Democrats by the celebrity couple.

‘Who else finds it strange that there was a shooting at the KC Champions parade and suddenly we now have Travis Kelce talking about gun control?’ mused one conspiracy theorist.

“Oh, that’s right, he’s dating anti-gun activist Taylor Swift. I find it funny that when Democrats are in charge we have more shootings in this country.”

‘The vertically integrated messaging apparatus is heating up. That passionate Taylor Swift/Travis Kelce gun control video is coming, and SOON,” another person fumed.

‘This mass shooting at the Kansas City Super Bowl parade seems like a perfect pretext for a passionate plea for gun control from Taylor Swift and Travis Kelce. Just sayin’,” a third person said.

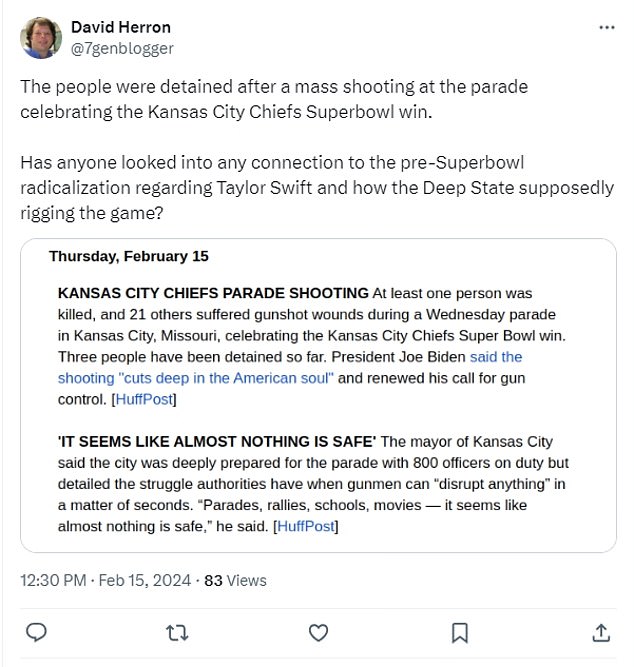

“People were arrested after a mass shooting at the parade celebrating the Kansas City Chiefs’ Superbowl victory,” said another on X.

‘Has anyone looked into any connection to the pre-Superbowl radicalization regarding Taylor Swift and how the Deep State allegedly rigged the game?’

In a strange combination of two strange conspiracies, another user pointed to Kelce’s vaccination status and his position on gun laws to supposedly bring the two together.

‘After Pfizer paid him 20 million to promote the vaccine, now here comes Travis Kelce expressing his opinion on gun laws. What do you have to say about this asshole? They got angry.

Reposting this same tweet after the shooting, they added: ‘Kansas City Chief’s Parade Shooting Predictive Programming 101. Am I being a conspiracy theorist or days before the Chief’s Parade Shooting, Travis Kalce, Taylor Swift’s boyfriend said this?’

Travis Kelce and Taylor Swift celebrate the Kansas City Chiefs reaching the Super Bowl

Less than 24 hours after one person was killed and dozens more were injured in the horrific Valentine’s Day shooting during what was supposed to be a celebration, several widely shared posts have made the strange connection.

Swift has been the subject of other conspiracy theories surrounding her relationship with Kelce, including the unsubstantiated rumor that they are “fake dates” to boost the NFL’s ratings by getting the pop star’s millions of fans to tune in. .

Vivek Ramaswamy was among those pushing the internet conspiracy theory that Swift and quarterback Kelce are in a “fake relationship” and that the Chiefs would win a “rigged” Super Bowl to help Joe Biden win a second. mandate.

“I wonder who will win the Super Bowl next month,” the former Republican presidential candidate wrote on X in late January.

And I wonder if this fall there will be a major presidential endorsement coming from an artificially culturally supported couple. Just some wild speculation here, let’s see how it ages over the next 8 months.’

Television cameras regularly focus on Swift when he attends Chiefs games, but as regular football viewers know, the action on the field regularly slows down and it’s normal for cameras to show the crowd, even when one of the most famous women in the world is in it. .

Vivek Ramaswamy was among those pushing the internet conspiracy theory that Swift and quarterback Kelce are in a “fake relationship” and that the Chiefs would win a “rigged” Super Bowl to help Joe Biden win a second. mandate. He has also endorsed Trump for 2024

Taylor Swift posted on her X account in October 2020: I spoke with @vmagazine about why I’m voting for Joe Biden for president

Conspiracy theories gained such traction that they even asked Kansas City Chiefs head coach Andy Reid for his response before the Super Bowl.

A German journalist asked Reid at one of his pregame press conferences: “What do you say about the conspiracies that have arisen around Travis Kelce and Taylor Swift, some kind of Republican conspiracies, that you guys came to the Super Bowl to come back secretly?” -elect or help re-elect President Biden?’

“That’s out of my league,” Reid joked in response.

The Chiefs coach laughed before attempting to put the theory to rest: ‘Listen, I appreciate the question. She (Swift) has been great and we had a nice visit from President Biden last year. That’s as far as I can go.