A rebound in the large family home market has helped property sales prices rise for the fourth month in a row, according to Rightmove.

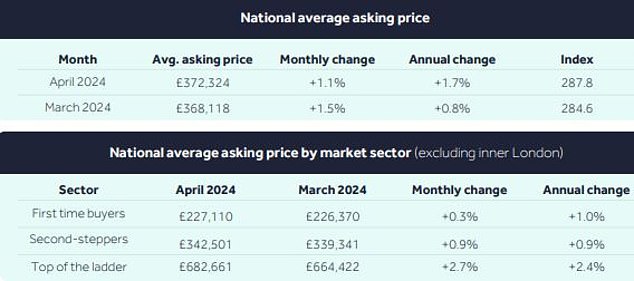

The average newly listed property price increased by 1.1 per cent or £4,207 in April to £372,324.

And the real estate website said a driver of current growth was sales of larger homes at the top of the scale, where sales prices rose 2.7 percent in a month and are rising at the fastest pace. seen since 2014.

The latest rise means the average price of newly listed properties has risen 1.7 per cent since April 2023, and is just £570 below the peak sales prices recorded in May last year.

On the rise: The average selling price has now increased by 1.7% compared to a year ago and is just £570 away from the peak recorded in May 2023.

This means prices are rising more slowly in the more mortgage-reliant first-time and second-step buyer sectors.

Rightmove is also reporting a much busier start to the year than the first four months of 2023.

The number of new sellers coming to the market has increased by 12 percent compared to the same period last year, while the number of agreed sales has increased by 13 percent.

However, once again much of the activity is concentrated in the higher end, which is made up of four and five bedroom properties.

The number of new sellers in this sector has increased by 18 percent compared to the same period last year, and the number of sales agreed has increased by 20 percent.

Real estate agents say the increase in options in the larger home sector is encouraging previously reluctant homeowners to come to the market, creating a cycle of more new listings that lead to more sales activity.

Fourth month in a row: The average sales price of properties coming to market increases by 1.1% (£4,207) this month to £372,324

In the more mortgage-reliant first-time buyer market, the number of new sellers rose 10 percent, and the number of sales agreed increased a more modest 9 percent.

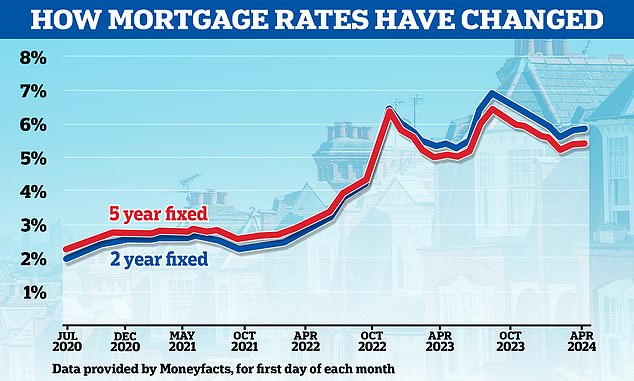

Mortgage rates have not fallen as much as some people expected at the beginning of the year and have been rising recently.

Since the beginning of February, the average two-year fixed-rate mortgage has risen from 5.56 per cent to 5.81 per cent, according to Moneyfacts.

Meanwhile, the five-year average fixation has increased from 5.18 percent to 5.38 percent.

The biggest growth in activity is occurring in larger homes, according to Rightmove

Tim Bannister, property expert at Rightmove, said: “The top end of the scale continues to drive pricing activity earlier in the year, and developers in this sector tend to be less sensitive to higher mortgage rates and are richer in actions. contributing to their ability to move.

‘While some buyers, across all sectors, will feel their affordability has improved compared to last year due to wage growth and house price stability, others will be more affected by cost of ownership challenges. life and higher-than-expected mortgage rates.

North London estate agent and former residential chairman of Rics, Jeremy Leaf, says buyers are negotiating hard

‘Despite these factors, it has been a positive start to the year compared to the quieter start to 2023.

“However, traders report that the market remains very price sensitive and, despite current optimism, these are not the conditions to support substantial price growth.”

Jeremy Leaf, north London estate agent and former chairman of Rics residential, added: “The market continues to catch up as the surge in new inquiries is encouraging sellers to not only make their properties available to the public but also to risk his arm with higher figures. .

‘The prospect of more stable or even falling mortgage rates is certainly helping to improve overall confidence.

“However, increased supply has meant more choice, so the market remains price sensitive and buyers are bargaining hard, especially those reliant on little or no financing.”

What’s next for mortgage rates?

Currently, it doesn’t look like mortgage rates will fall dramatically anytime soon.

This is despite markets anticipating three base rate cuts by the Bank of England before the end of this year.

The price of fixed rate mortgages is reflected in Sonia’s swap rates. Mortgage lenders enter into these agreements to protect themselves against the interest rate risk involved in making fixed-rate mortgage loans.

Put more simply, Sonia swap rates show what lenders believe the future will hold with respect to interest rates and this governs their prices.

This means that current mortgage rates have already anticipated future interest rate declines to some extent.

From a historical perspective, it is also very rare for lower-priced fixed mortgage rates to fall below equivalent swap rates.

On the rise again: Since the beginning of February, the average two-year fixed-rate mortgage has risen from 5.56% to 5.81% according to Moneyfacts.

Currently, the lowest five-year fixes are around 4.2 percent and the lowest two-year fixes are around 4.6 percent.

As of April 17, five-year swaps were at 4.13 percent and two-year swaps were at 4.67 percent, both trending below the current base rate and generally in line with whether bond offers Fixed rate are cheaper at the moment.

Nicholas Mendes, mortgage technical manager at broker John Charcol, said: “The market urgently needs some positive move from the Bank of England, until we see a rate cut we will see a period of rate increases as markets They begin to be uneasy.

‘Mortgage holders coming to the end of their fixed agreements this year and in early 2025 will need to be prepared to see higher rates than in previous predictions.

“Initial forecasts of a 3.5 per cent fixed rate between August and the end of September are highly unlikely, and any sign of such a deal will now be postponed until later in the year.”

What’s next for the real estate market?

Overall, the number of agreed sales is now at the same level as 2019, despite higher mortgage rates, according to Rightmove.

This may be partly because people’s salaries have increased in recent years.

Nicholas Mendes, mortgage technical director at John Charcol, says the mortgage market “badly needs” some positive move from the Bank of England.

While average property prices are 22 per cent higher than in 2019, according to Rightmove, affordability has been helped by average wage growth of 27 per cent over this period, slightly above property price growth. the House.

Andrew Wishart, senior economist at Capital Economics, said: “The slight rise in mortgage rates since the start of the year is likely to mean house prices will stagnate in the short term.”

“While the housing price-to-income ratio has returned to its 2019 level thanks to strong wage growth and a drop in house prices, higher rates mean buying a home with a mortgage remains more expensive in comparison with previous standards.

However, according to Wishart, house prices will soon start to rise again. Capital Economics forecasts that house prices will end the year up 3 percent and then rise another 5 percent in 2025.

“Lower inflation and significant base rate cuts mean mortgage rates should fall substantially in 2025,” Wishart added.

“And as borrowers seem content to borrow for longer periods and spend more on payments, that’s likely to push prices up even more.”

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.