Families will be hit by the highest-ever tax rates on flights under Labour’s multibillion-pound raid on tourists.

Analysis shows levies on airfares for a family of four to popular destinations such as Walt Disney World in Florida will rise above £400 for the first time after the increase.

The discovery comes ahead of Sunshine Saturday next weekend, when millions will buy overseas holidays on what is traditionally the busiest booking day of the year.

Critics said the Government’s claim that it has not raised taxes on “workers” and is prioritizing economic growth is a mockery, given the move will hit the travel industry.

Sector bosses are already considering cutting jobs and investment because of Rachel Reeves’ National Insurance raid on businesses.

In the October Budget, the Chancellor increased Air Passenger Duty (APD), a stealth tax on fares also known as “holiday tax”, by 15 per cent on most flights, which is more than five times the current rate of 2.6 percent. inflation.

A study by the Taxpayers’ Alliance shows that by April 2026, when Reeves’ APD increases come into effect, inflation will have risen by about 111 per cent since 1994, when the tax was first introduced.

But over the same period, APD for short-haul European destinations like Spain will have increased by 200 percent.

The Chancellor increased air passenger charges (APD) by 15 per cent on most flights, which is more than five times the current inflation rate of 2.6 per cent.

According to Rachel Reeves’ increases, a family of four in economy class will have to pay a tax of £408 to fly to Disneyland Florida.

For long-distance trips it will have shot up 920 percent and 960 percent for ultra-long distance trips. The measures mean the Chancellor will raise an extra £2.5bn from the APD between 2026 and 2030.

This belies Ms Reeves’ claim that the APD has not increased with inflation, which she cited as one of the reasons for increasing it during her budget speech.

Darwin Friend, of the Taxpayers’ Alliance, said: “While the Prime Minister can travel around the world without needing to pay APD out of his own pocket, taxpayers who fund his travel have to work even harder to afford a annual leave.

“Ministers should immediately freeze this tax for an extended period to bring it more in line with inflation.”

Conservative transport spokesman Gareth Bacon said: “Farmers, pensioners, small businesses and now tourists – Keir Starmer wants everyone to pay to fund pay rises aimed at curbing inflation for his union paymasters.

Former British Airways boss Willie Walsh, now head of industry body the International Air Transport Association, said: ‘British passengers are rightly fed up with paying ever-higher APD fees.

‘But the APD is not just a tax on holidays: it drags down the entire UK. Sir Keir Starmer has said growth is his Government’s “number one priority”.

“If that is the case, why is he allowing his Chancellor to strangle aviation, which supports 1.6 million jobs, generates £127 billion in GDP and is the only way for the UK to quickly move its goods and services abroad?

Conservative transport spokesman Gareth Bacon (pictured) was one of several critics of the plan to increase airfares.

The cost for a family of four at popular destinations such as Walt Disney World in Florida (pictured) will top £400 for the first time after the increase.

And Tim Alderslade, boss of Airlines UK, which represents major airlines including BA, Virgin, easyJet and Tui, said: “APD is already making the UK less competitive and the increases will hit workers in the UK. pockets and will make it more difficult for airlines to build and maintain new routes.’

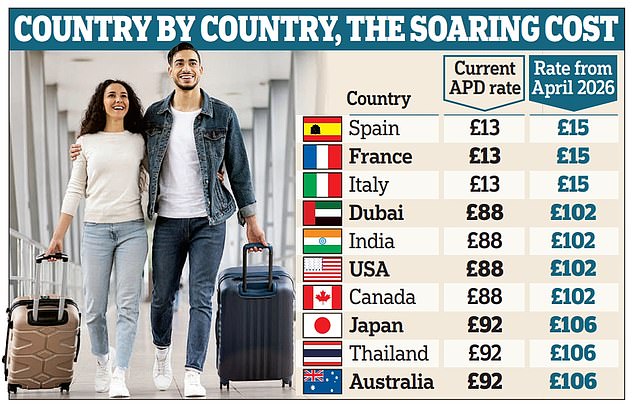

The study shows that, with Ms Reeves’ increases, a family of four in economy class will pay a tax of £408 (or £102 per person) to fly to Disneyland Florida, a 16 per cent increase on the rate current.

The amount for ultra-long-haul destinations, such as Australia, will be £424 (or £106 per person), while for short-haul destinations, a family of four will have to pay £60 (or £15 per person), a 15 percent. raise.

When it was introduced in 1994, APD cost £5 for destinations in the European Economic Area and other closely related destinations, and £10 for the rest of the world.

If it had risen in line with inflation, it would be £10.31 and £20.62 respectively in October this year, much lower than the current APD categories.

The tax is charged on flights departing from the UK, so it is not charged on return journeys and airlines usually always pass the cost on to customers.

The APD regime was reviewed in April last year, replacing the old two-band system with a three-tier scheme based on distance traveled and the amount of carbon emitted.

Those flying internationally up to 2,000 miles currently pay £13 in economy class.

For journeys up to 5,500 miles the charge is £88 and for ultra-long journeys it is £92. Fares for business class seats are even higher.

A Treasury spokesman said: ‘Unlike other sectors, there is no VAT on airline tickets and no tax on jet fuel.

‘It is only right that the aviation sector plays its part in helping to address the £22bn hole and restore the economic stability needed for businesses to thrive.

“Changes in the APD rate have significantly lagged inflation in recent years.”