Average investors may be nervous as U.S. stocks hit record highs and America’s biggest financial gurus stay on the sidelines of the market.

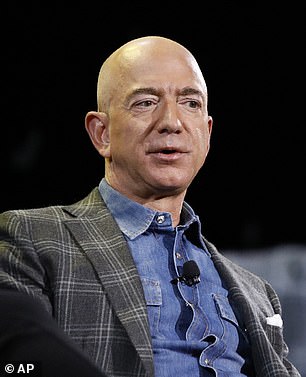

Last week, it was reported that Amazon’s Jeff Bezos and Meta’s Mark Zuckerberg sold billions of dollars in shares of their own company this year, even as the S&P 500 posted its best nine months on record.

Even the Oracle of Omaha Warren Buffett slashed Berkshire Hathaway’s Apple holdings and amassed a massive $277 billion in cash.

And it’s not just the heavyweights who are overlooking this market rally.

Officers and directors of all American companies – the ‘corporate insiders’ – reported the lowest net purchases of shares of their respective companies in a decade (22 percent in September, below the 10-year average of 26 percent ), according to InsiderSentiment. com.

This sparked hysteria in some sections of the mainstream media.

Last week, it was reported that Amazon.com’s Jeff Bezos and Meta’s Mark Zuckerberg sold billions of dollars in shares of their own company this year, even as the S&P 500 posted its best nine months on record.

Officers and directors of all American companies – the ‘corporate insiders’ – reported the lowest net purchases of shares of their respective companies in a decade.

A finance professor told the Wall Street Journal last week that insiders are worried about an impending recession.

“Insider trading is a very strong predictor of future aggregate stock returns,” said Nejat Seyhun, a professor at the University of Michigan’s Ross School of Business. “The fact that they are below average suggests that future stock returns will also be below average.”

So what’s going on? What do these bigwigs know about the business world?

The answer is that they know their own limitations.

Despite their genius and access to ‘inside data’, not even Bezos, Zuckerberg and Buffett can predict what the market is going to do, so they are diversifying their assets, and you should too.

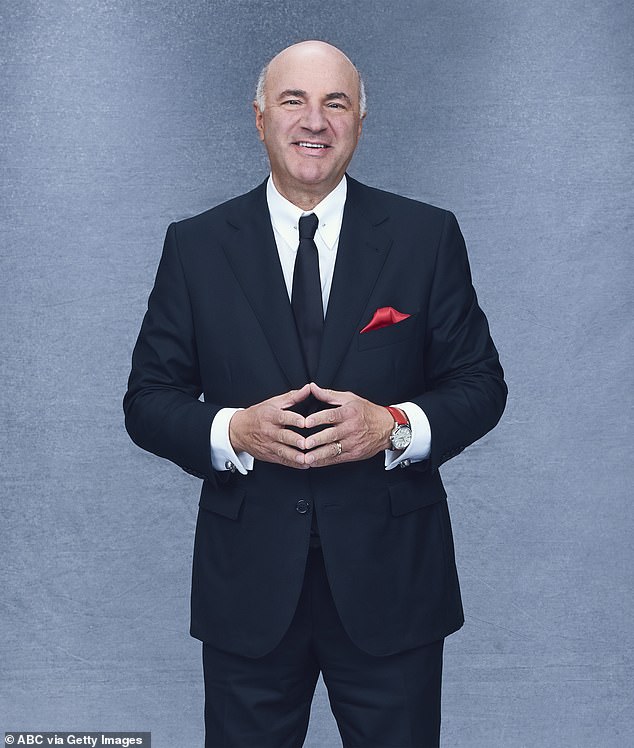

I’m here to tell you that insider trading is almost useless. If someone tells you they can predict how a stock will move, run the other direction.

After all, nearly nine out of ten hedge fund managers can’t beat the annualized returns of the S&P 500. I don’t follow any advice from anyone who claims they can predict what’s going to happen.

In this last financial quarter of 2024, I am selling and buying stocks.

If a group of my investments, such as energy industry stocks, has grown to represent significantly more than 20 percent of my total portfolio, then I will sell it. I will use that cash to strengthen my positions in one of the other ten market sectors, such as healthcare, finance, or real estate.

It’s great when stocks rise in value, but that also means there’s more to lose if that sector turns south.

Even the Oracle of Omaha Warren Buffett slashed Berkshire Hathaway’s Apple holdings and amassed a massive $277 billion in cash.

I’m here to tell you that insider trading is almost useless. If someone tells you they can predict how a stock will move, run the other direction.

And there’s another factor to keep in mind as the year winds down: the U.S. presidential election.

I’m going to avoid making big bets from now until November 5th.

Just like the markets, no one can predict what will happen in the election. And I believe that in January 2025 whoever occupies the White House will shape the future of the American economy.

In recent weeks, Vice President Kamala Harris finally began revealing some of her economic policies after carefully avoiding divulging specific details for months.

It is now clear to me that Harris will pursue a similar agenda to President Joe Biden, meaning she will direct the federal government to favor certain “preferred” industries over others.

I call that “picking winners and losers.”

The CHIPS and Science Act, signed into law by President Biden in August 2022, is a good example of this.

The administration decided it would give trillions of dollars – through various federal investments – only to companies that produced certain types of computer chips.

Under the Biden White House, those companies were the “winners.”

Now, Vice President Harris is proposing that the federal government continue this strategy and pay for it by raising corporate taxes for all other businesses (from 21 percent to 28 percent).

Those companies will be the “losers” under President Harris.

As an investor and voter, if you think the federal government is good at picking “winners and losers,” you may favor Harris’ approach. (Although there is no evidence in over 200 years of economic history of a successful centralized economy.)

On the other hand, former President Donald Trump has made it clear that he will lower corporate taxes, allow companies to compete with each other, and let the markets decide who wins and who loses.

It is now clear to me that Harris will pursue a similar agenda to President Joe Biden, meaning she will direct the federal government to favor certain “preferred” industries over others.

On the other hand, Donald Trump has made it clear that he will lower corporate taxes, allow companies to compete with each other, and let the markets decide who wins and who loses.

I think that’s how an economy works most efficiently. I will be waiting for the outcome of the election to determine my investment strategy going forward.

So here’s my best advice for the investor facing this market rally.

Keep your powder dry and continue investing in a 401k plan that almost guarantees an eight to ten percent return over a long period of time.

If you want to take a little more risk, buy a basket of higher-quality stocks through ETFs like the Russell 2000, which tracks two-thirds of the most profitable companies in the S&P 500.

And remember: If America’s financial gurus can teach the average investor anything, it’s that no one can predict the market.