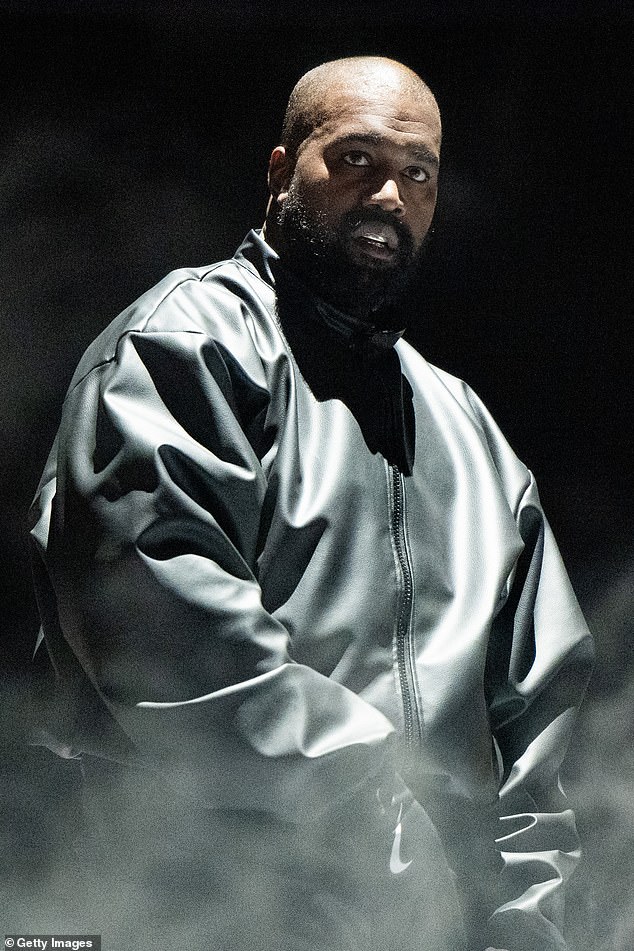

Kanye West looted his pension fund and used subprime mortgage lenders to finance a $35 million mansion in Beverly Hills, a property he has no intention of living in with his wife Bianca Censori, DailyMail can exclusively reveal. com.

The rapper, 47, and his wife, 29, borrowed a total of $15.5 million, DailyMail.com can reveal, including a $2.7 million loan from a fitness entrepreneur.

The couple closed on the 11-bedroom, 18-bath home in the exclusive Beverly Park gated community last month. Neighbors include Adele and Justin Bieber.

But the property, co-owned with his wife Bianca Censori through their firm Shore Drive Holdings LLC, was purchased solely for investment purposes and will likely be rented out.

Kanye had to turn to several lenders to finance the purchase, including a private lender whose motto is “when the banks say no, private money is the only way to go.”

Kanye West, 47, allegedly raided his pension fund and used subprime mortgage lenders to finance the recent purchase of his $35 million Beverly Hills mansion.

Kanye has borrowed a total of $15.5 million, DailyMail.com can reveal, including a $2.7 million loan from a fitness entrepreneur for the mansion he and his wife Bianca jointly own.

The deal also involved a company that offers risky mortgages to people who would not qualify for one based on their credit history and score.

The largest loan amount was $12.5 million with Lone Oak Fund and its investment arm Lone Oak Industries.

Lone Oak offers bridging loans for investment properties – a loan that provides immediate cash flow using short-term financing until an individual or business obtains permanent funding.

Kanye signed an “assignment of rents and leases” deed of trust, meaning that if he defaults on the mortgage, the lender can profit from any future rent.

It also took out an additional $3 million mortgage from two sources: RGGL LLC and pension firm Provident Trust Group.

RGGL is owned by Richard and Lucy Glassman, fitness entrepreneurs living in Albuquerque, New Mexico. They handed over $2,693,000 using their broker Private Money Solutions (PMS).

PMS is a “hard money lender,” meaning it has people willing to invest large sums quickly in short-term loans secured by real estate.

The Glassmans have no connection to Kanye personally, but Richard told DailyMail.com why he got involved in the deal in which Kanye still had to front $19.5 million of his cash to finance the purchase, which represents a total of 55 percent of the sale price.

The property is jointly owned by his wife Bianca through their firm Shore Drive Holdings LLC.

The home has 11 bedrooms and 18 bathrooms, located in the exclusive gated community of Beverly Park, where its new neighbors will include Adele and Justin Bieber.

‘When you have a total loan of 40 per cent of value, it is a good investment. “This is the great creativity of the broker, it’s not the creativity of Kanye West, they do all the due diligence, I’m just the little guy,” Richard explained.

‘To be totally honest, sometimes when investors look at celebrities, they don’t want to. Well, it definitely is, because if they don’t pay, we’ll be left with a $35 million property.

“But we would prefer that they just pay, we don’t want to hurt anyone, we are just investors.” We want to get a return on our money.

The couple has purchased numerous properties in California and New Mexico. Richard owned eight gyms in New Mexico as part of the Planet Fitness franchise group before selling them, according to public records.

He is linked to other fitness companies with his wife Lucy.

The investor surmised that Kanye was able to raise the $19.5 million using equity he received when he recently sold his run-down Malibu home in September.

Kanye dismantled it to make an ‘air raid shelter,’ which sold for approximately $21 million, 60 percent less than the $57.3 million purchase price in 2021 following his divorce from Kim Kardashian.

Richard said: “He just sold a $57 million property for $21 million; what happened was he took the $21 million to buy this property.”

‘So we finance the difference. He didn’t want to use his cash, not that he lives on this property.

Kanye recently sold his run-down Malibu home in September after dismantling it to make a ‘bomb shelter.’

“I mean, the guy has tons of property, I guess property to him is like you and I owning a car, a watch, or a pair of pants.”

Kanye also borrowed $307,000 against a ‘cash balance pension plan’ with Provident Trust Group, which one financial expert said could come from the rapper’s retirement fund.

The loans from RGGL and Provident Trust were included in a $3 million mortgage contract and were serviced by PMS.

The mortgage servicer is California TD Specialists, based in Anaheim Hills, who are experts in finalizing complex real estate deals.

They are also a branch of FCI Services, which on their website claims to be a “nationally leading non-QM and private money service.” Non-QM loans are intended for borrowers who do not meet the usual criteria for purchasing a home and do not qualify for conventional financing.

Kanye signed the $12.5 million and $3 million loan agreements under the official name ‘Ye’ on October 16. This was able to happen while the rapper was in Tokyo because he used a notary under Richard Smith, who is registered in Virginia.

Doug Perry is a strategic financial advisor to Real estate bees who provided an analysis of Kanye’s debt.

Kanye signed the $12.5 million and $3 million loan agreements under the official name ‘Ye’ on October 16.

The Malibu home sold for $21 million, 60 percent less than the $57.3 million purchase price following his divorce from Kim Kardashian in 2021.

Perry says that while Kanye made a large down payment of $19.5 million, his mortgage loans are huge and come with risks.

Perry says: “There aren’t many lenders that make loans that large, the risk is simply too great.” Kanye’s first mortgage is from Lone Oak, a well-known commercial lender in the California market.

‘They do not lend on owner-occupied properties and typically provide 12-month bridging loans with rates in the range of 8.5 to 10 per cent, requiring interest payments only over the term of the loan.

“Most likely there was a second mortgage because the lender of the first mortgage did not want to lend the entire amount of the loan, due to the risk of lending so much money to one person or entity.”

Perry explained why he believes some of the funds came from Kanye’s pension, adding, “I think it’s possible that the source of the $3 million is Kanye’s retirement account.

‘The company on the document, Provident Trust, is a company that focuses on self-directed retirement accounts and there is a specific account number on the registered beneficiary document, so it is likely that Kanye borrowed from his own retirement to that part of the loan. .’

Kanye also has a six-bedroom mansion in Calabasas that he purchased for $2.2 million in May 2018.

His property portfolio includes two rental apartments in Calabasas and Thousand Oaks that cost $1.6 million and $575,000.