Wednesday is a big day for Americans looking to buy a home or keep an eye on their 401(k) plans, in a rare economic news double-header.

New data on inflation in the consumer price index will be released in the morning at 8:30, and in the afternoon the Federal Reserve will reveal how it plans to react.

The month-on-month CPI rate was unchanged, below the 0.1 percent increase Wall Street had expected.

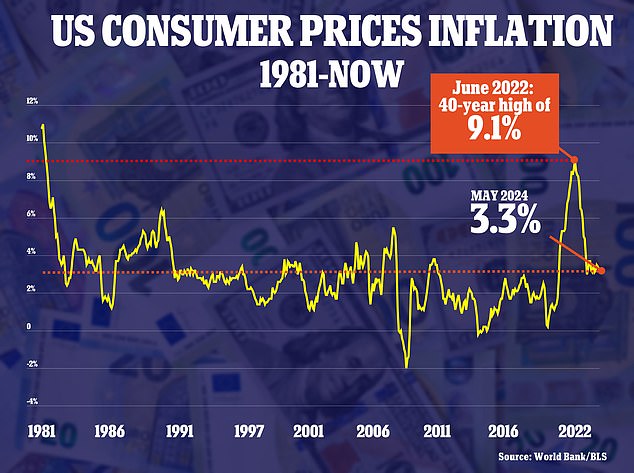

Compared with a year ago, May inflation cooled to 3.3 percent, meaning prices rose by that amount across the board. But that figure was also lower than expected. Most economists thought it would be 3.5 percent. Cheaper gas helped.

These lower readings caused stock futures to soar and also drove down bond yields (an indicator of interest rates).

S&P 500 futures rose 0.8 percent, the tech-heavy Nasdaq 100 rose 1 percent.

For Americans, cooling inflation means more than just falling prices. It gives the green light to Federal Reserve officials to consider lowering interest rates, which reduces borrowing costs for consumers and businesses.

Of course, it would mean a drop in mortgage rates and a cut in credit card rates and the cost of auto loans. That frees up money for Americans to spend, which is good for businesses.

Lower rates are good for businesses in another way, too. They make it cheaper for them to borrow and grow their business.

The CPI, the main measure of inflation in the US, cooled to 3.3% in May from a year earlier. In May it had been 3.4%.

Wall Street has held steady ahead of a busy week of inflation reports and the Federal Reserve’s latest interest rate policy decision.

All of the above means that Wall Street likes lower rates, and that means the prices of stocks and 401(K) plans go up.

The May Consumer Price Index report is expected at 8:30 am ET, while the Federal Reserve’s policy announcement is scheduled for 2:00 pm ET.

The Federal Reserve is expected to keep rates as they are: at a 23-year high of between 5.25 and 5.5 percent.

But the tone of what Jermoe Powell says at 2:30 p.m. will give clues as to when the interest rate will be reduced. Investors are looking for guidance.

It will be the seventh consecutive time that the Federal Reserve has kept rates at that level.

Inflation must cool for the Federal Reserve to reduce interest rates. Higher rates slow consumer spending and lower demand for goods causes prices to fall.

The Federal Reserve wants the annual inflation rate to drop to 2 percent.