Table of Contents

Smaller US listed companies were not spared from the blow that most stock markets took in response to fears that the West’s largest economy was heading for recession and the Federal Reserve’s refusal to join the Bank of England in cutting interest rates.

The Russell 2000 index, a barometer of the stock market fortunes of smaller U.S. companies, fell sharply before rebounding toward the end of the week, ending Thursday evening at 2,084, down 8 percent from the end of July.

The drop is in stark contrast to last month, when the index gained 10.2 percent, largely in response to a tougher outlook for some of the so-called Magnificent Seven tech companies (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla).

While Jonathan Brachle, manager of JPMorgan US Smaller Companies Investment Trust, says the Russell 2000 index will remain volatile for the time being, he still believes the case for investing in a somewhat neglected subsector of the US stock market is strong.

“August and September tend to be weaker months for US stocks,” he says, “and we should not forget that the US presidential election is fast approaching.”

“Yes, the economy may not be as strong as it could be, but more jobs are being created than are being lost, and what we’re hearing from the businesses we have is not as pessimistic as some suggest.”

The trust does everything it can to protect shareholders from downside risks. Brachle and his investment team are meticulous about the companies they buy and are quick to exit holdings that fail to meet expectations.

“We like companies that generate strong and durable cash flows,” Brachle explains. “We also like companies that are backed by quality management teams. And of course, we look for signals that suggest the company’s stock market valuation will increase.”

He adds: “On average, we hold stocks for four or five years, and we exit if a company appears overvalued by the market, perhaps sooner if there is a management change we don’t like, or if a new executive team comes in with fresh ideas.”

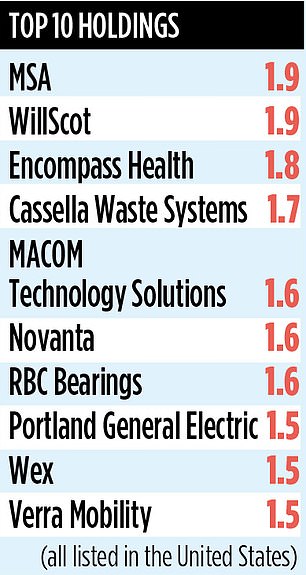

The trust currently has 86 holdings with an average market capitalisation of about $5bn (£4bn). Positions in large stocks are limited to 5 per cent, while biotech stocks tend to be screened out because they often do not have a sufficient track record of earnings to justify inclusion in the trust.

BJ’s Wholesale Club is an example of the type of business the foundation likes to run. “It’s a similar model to Costco,” Brachle says, “in that all of their customers are members and pay an annual fee to shop at their stores. This results in a healthy, recurring revenue stream that provides them with very important financial stability.”

Another key holding is MSA, which supplies safety equipment to fire services and oil and gas producers. “It operates in an area where spending on its equipment is not discretionary,” Brachle says. “That supports its cash flow, which we like.”

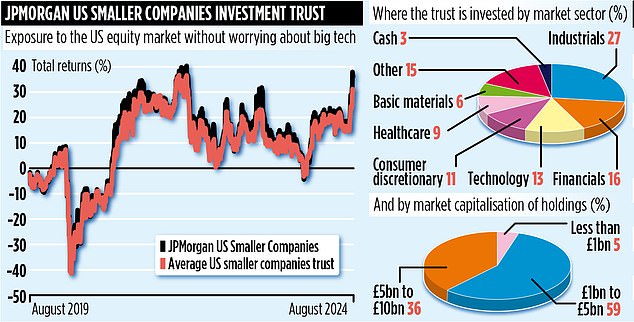

The trust has outperformed its peer group over the past five years (37 percent vs. 30 percent), but has slightly underperformed over the past 12 months (13 percent vs. 14 percent).

Over the past ten full calendar years, it has outperformed its Russell 2000 benchmark seven times.

The trust’s stock code is BJL5F34 and its ticker is JUSC. Annual charges add up to 0.93 per cent and it pays a small dividend – 3p a share last year, while shares are currently priced at just over £4.30.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.