Billie Eilish and actor Alex Wolff put on a very friendly display while stepping out in Los Angeles on Thursday.

In photos obtained exclusively by DailyMail.com, Billie, 22, and Wolff, 26, were cuddling during a relaxed lunch.

The duo were joined by Eilish’s longtime friend, photographer Zoe Donahoe, as they headed to Astro Burger after a trip to the climbing gym.

Billie donned a black top, biker shorts, and chunky sneakers paired with Nike socks. Her hair was contained within a black scarf while hoop earrings enhanced her look.

Alex was wearing an ‘A24’ sweater over a white t-shirt, black shorts and sneakers.

Billie Eilish and actor Alex Wolff put on a very friendly display as they stepped out hugging each other in Los Angeles on Thursday.

The actor, who starred on the Nickelodeon show The Naked Brothers Band with his brother Nat Wolff, completed the look with a backwards cap.

Billie beamed a big smile as she approached Astro Burger with her friends, Alex’s arm still resting on her shoulders.

As an actor, Alex has an impressive resume of film credits including roles in Jumani: Welcome to the Jungle, Stella’s Last Weekend, Old Man Hereditary and, most recently, Oppenheimer.

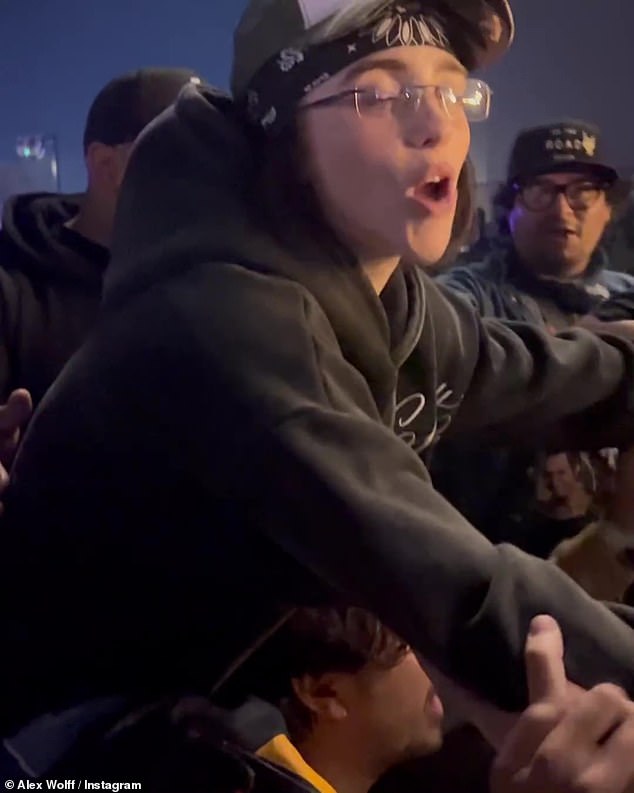

Last week, Alex posted snaps recapping her trip to Coachella, which included snaps of Billie and her friends having fun at the music festival.

The post began with a photo of Eilish turning off the camera while hanging out with the Nickelodeon star and her brother Nat.

The post included a video of Billie sitting on someone’s shoulders while watching the show, followed by a clip of the superstar on stage with lead star Lana Del Rey.

It comes after the publication of Billie’s very candid interview with Rolling Stone where he talked about his sexuality, attraction to women and masturbation.

When asked how she likes to relax, the singer, who previously dated The Neighborhood’s Jesse Rutherford and rapper Brandon Quention Adams, revealed that she relaxes with sex and self-pleasure.

“Sex,” he told the publication. ‘I basically talk about sex whenever I can. That’s literally my favorite topic. My experience as a woman has been that it looks very strange. People feel very uncomfortable talking about it and are surprised when women feel very comfortable with their sexuality and are communicative about it.’

Wolff’s arm remained on her shoulders as they entered the establishment.

The singer showed a bright smile.

She smiled playfully as her arm continued to hang over his shoulder.

The Bad Guy hitmaker continued: “I think it’s a very frowned upon topic and I think that should change.” Did you ask me what I do to decompress? That shit can really save you sometimes, just saying it. To be honest, I couldn’t recommend it more.’

Eilish also praised how masturbating in front of a mirror has helped her form a “deep, raw connection” with herself and her body that she never had in the past.

“I have to say that looking in the mirror and thinking ‘I look great now’ is very helpful,” she explained. ‘You can make up the situation you find yourself in to make sure you look good. “You can make the lighting very dim, you can be in a specific outfit or in a specific position that is more flattering.”

The Oscar winner noted that she has learned that looking at herself and observing herself “feel pleasure has been a great help in loving” and accepting herself, as well as in “feeling empowered and comfortable.”

‘People should be shaking it, man. “I can’t emphasize it enough, as someone with extreme body issues and dysmorphia I’ve had my entire life,” he told readers. ‘I should have a Ph.D. in masturbation.’

While discussing her sexuality and feeling forced to come out as queer during a red carpet interview last year, the artist revealed that she has “been in love with girls” her entire “life.”

‘I just didn’t understand it, until last year I realized I wanted my face in a vagina. I never planned on talking about my sexuality in a million years. It’s really frustrating to me that it came up,” she admitted.

What was I made for? The singer was wearing a Chicago Bulls jersey and biker shorts.

The duo was joined by photographer Zoe Donahoe, Billie’s lifelong friend.

Alex sported an ‘A24’ sweater and black shorts.

The trio had just finished a session at the climbing wall.

While talking about her upcoming track Lunch, inspired by her queer identity, Eilish explained that she “wrote part of it before I even did something with a girl” and “the rest after.”

The chorus of the sassy song goes: “I could eat that girl for lunch / Yeah, she dances on my tongue / She tastes like she’s the one / And I can never get enough / I could buy you so many things / It’s a longing, no a crush.’

In December, the musician said she thought her queer identity was “obvious” during Variety’s Hitmakers event.

‘I thought, wasn’t that obvious? I didn’t realize that people didn’t know,” he said at the time. ‘I just don’t believe in it. I wonder: why can’t we just exist? I’ve been doing this for a long time and I just didn’t talk about it.

When asked how she felt about other women’s opinions, she stated, ‘I’m still scared of them, but I think they’re pretty!’

Billie appeared in photos from Alex’s recent post at the Coachella festival.

Wolff starred in The Naked Brothers Band with his brother Nat on Nickelodeon

The trio was clearly in good spirits for the outing.

During her previous interview with Variety, Eilish talked about having a long-standing issue where she couldn’t connect with other women.

“I never felt like I could relate to girls very well. Love you very much. I love them as people. I am attracted to them as people. I’m really attracted to them,” she said.

The What Was I Made For singer elaborated on her previous statement, expressing: ‘I have deep connections with the women in my life, the friends in my life, the family in my life. I feel physically attracted to them.

However, she added: “I also feel very intimidated by them, their beauty and their presence.”

Eilish has been romantically connected to several people over the years, including rapper Brandon Adams, who performs under the name 7:AMP.

The couple’s relationship was covered in the documentary Billie Eilish: The World’s a Little Blurry, which was released on Apple TV+ in February 2021.

Wolff accessorized his relaxed look with a backwards cap.

The revelation comes after Billie’s candid interview with Rolling Stone about her sexuality, attraction to women and masturbation.

Eilish was seen sitting on someone’s shoulders at Coachella in a post shared by Alex

He also captured a clip of his performance with lead star Lana Del Rey.

Wolf’s extensive resume includes a role in the 2021 film Old

The performer also spoke about the end of her romance with the rapper during the documentary, in which she revealed that she “just wasn’t happy” during their time together.

She stated through People: ‘I didn’t want the same things he wanted and I don’t think that’s fair to him. I don’t think that in a relationship you should be very excited about things that the other person doesn’t care about at all.’

Eilish began a relationship with Rutherford, best known for his work as the singer of The Neighborhood.

The couple, who were separated by an 11-year age difference, began seeing each other in October last year and split in May.

In October, she set the record straight that she was single after rumors surfaced that she was dating famous tattoo artist David Enth.

“I literally couldn’t be more single right now,” she declared after reading a report that alleged she and Enth had been “on quite a few dates” and “really hit it off.”