Table of Contents

It’s been just over two and a half years since investment fund JP Morgan European embarked on a major revamp.

Having previously offered investors a choice between growth or income shares, the board decided to consolidate the two share classes into one, change the name to JP Morgan European Growth & Income and reduce ongoing charges.

The result is a confidence that now pursues the best of both worlds. That is, it seeks to increase the value of its assets by investing in quality companies – large and small – that are listed on European stock markets (excludes the United Kingdom).

It is also committed to providing shareholders with attractive income, paid quarterly, even if part of that income must be paid out of the trust’s capital.

Simply put, if the trust’s net assets (assets less loans) grow, the dividend in cash terms should increase, because it is paid at a rate equal to 4 percent of the net asset value.

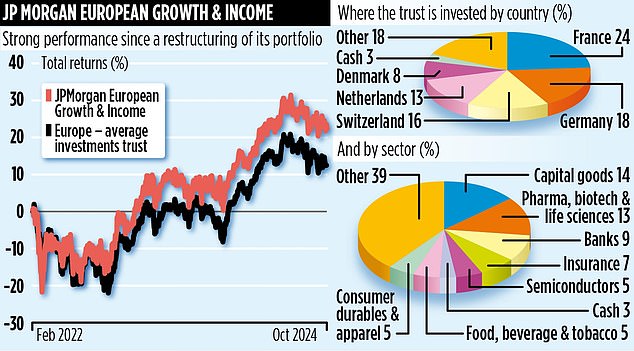

Although its shares – like those of many investment funds – do not reflect the value of its underlying assets, the performance figures indicate that the renewal has been successful. Since February 2022, it has delivered shareholders a total return of 23 percent, more than double the peer group average.

In terms of dividends, earnings have increased from 4p per share over the year to the end of March 2023 to 4.2p over the last full financial year.

In the current year to the end of March 2025, the first two dividends total 2.4p, indicating a full annual payout of 4.8p. Shares currently cost around £1.

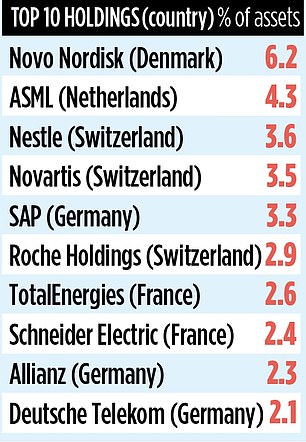

The trust’s portfolio comprises 95 stocks, including stakes in some of Europe’s most successful companies: Danish pharmaceutical giant Novo Nordisk and Dutch semiconductor specialist ASML.

It is assembled through a combination of in-house quantitative research that the trust’s three managers use to help identify stocks that are potential buys and sells (if already in the portfolio).

The trust managers then perform additional qualitative analysis on stocks they like or might need to sell. “The result is a very defined investment process,” says Timothy Lewis, who manages the trust’s portfolio with Alexander Fitzalan Howard and Zenah Shuhaiber.

And he adds: ‘Quantitative research is a generator of ideas, which then allows us to do a little research on the actions we like. We want to maintain companies that generate a lot of cash and are backed by good management.’

Lewis says this approach means the trust will buy shares that are often off the radar of most other investors, including companies such as lifting equipment specialist Konecranes (listed in Finland); the French company Spie (which is heavily involved in the energy transition and digital transformation); and Cairn Homes, a dominant Irish housebuilder.

Although Lewis suggests that a volatile Middle East and ongoing conflict in Eastern Europe are obvious causes for concern, he says it is key that he and his fellow managers don’t get sidetracked in their search for quality companies and long-term investment returns.

As for the trust’s shares being at a discount of more than 12 percent to their underlying assets, he says it’s frustrating but an “opportunity” for investors to buy a European fund on the cheap.

The trust’s ongoing charges are reasonable at 0.66 per cent and the annual dividend yield is 4.2 per cent. Its stock identification code is BPR9Y24 and its ticker JEGI.

Other European investment trusts include Baillie Gifford European Growth, BlackRock Greater Europe, Fidelity European and Henderson European.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.