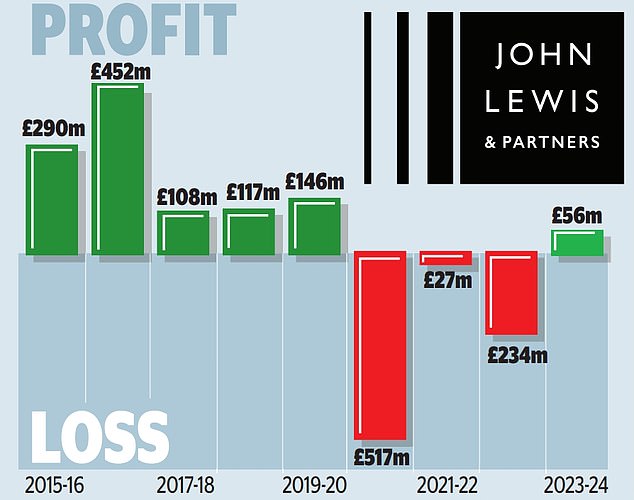

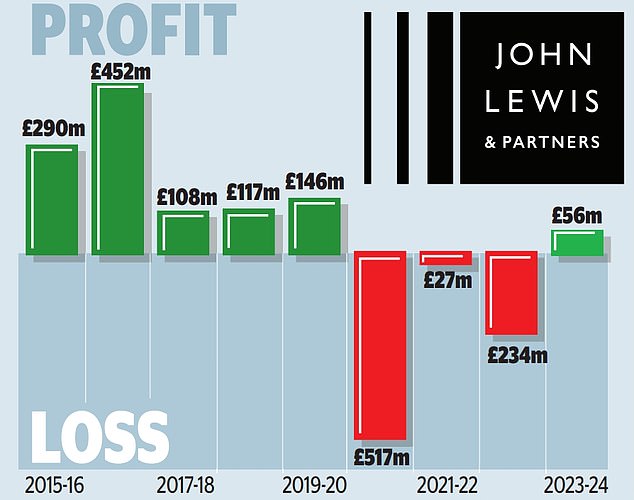

John Lewis Partnership is back in the black after three years of losses, but is struggling to keep up with the resurgence of rival Marks and Spencer.

The group behind Waitrose and department store John Lewis revealed profits of £56m for the 12 months to the end of January, after making a loss of £234m a year earlier.

It was the first gain since the pandemic struck, but was accompanied by a somewhat disappointing rise in revenue of 2 per cent to £10.8bn.

And the profits were still not enough for employers to recoup their annual staff bonus, as The Mail revealed last Sunday.

John Lewis is owned by its 70,000 employees, also known as “partners”. They usually receive an annual bonus on top of their base salary, but this year they were disappointed again.

Exit: John Lewis Partnership, headed by chair Dame Sharon White (pictured), revealed profits of £56m for the 12 months to the end of January.

The company, led by its chairman Dame Sharon White, who will step down next year, said it “would not be right” to provide a payout while the company cuts costs. It is the second year in a row that workers have been denied a bonus and the third time since 1953.

John Lewis’ problems put it at odds with M&S, which returned to the FTSE 100 last year as its recovery accelerated.

In its latest figures, M&S recorded its 11th consecutive quarter of growth, including a 7 per cent year-on-year sales rise over Christmas.

Food sales led the growth with 10 percent, while clothing and home goods increased 5 percent.

Analysts attribute this to M&S abandoning its scruffy clothing and attracting younger shoppers. Actress Sienna Miller was the face of its autumn collection and Ted Lasso star Hannah Waddingham appeared in its Christmas advert.

In January, M&S chief executive Stuart Machin said the company was entering 2024 with “a spring in our step”.

By contrast, John Lewis has struggled to reactivate its stores. Yesterday, it said department store sales fell 4 percent to £4.8 billion last year, largely weighed down by a weak performance in home and technology products as shoppers they cut back.

But Waitrose was a bright spot, with sales rising 5 per cent to £7.7 billion, despite raising its prices by 7 per cent on average for the year.

A million more customers shopped at the group last year, bringing the total to 22.6 million.

But the improvements were not enough to restart the annual bonus, which may prove controversial for workers concerned about job cuts.

And rather than giving them a bonus, bosses said it was their responsibility to “ensure the partnership is sustainable over the long term”, which has meant investing in stores and increasing base pay.

Pay could rise by a record £116m this year, he said.

It comes as the business moves forward with a turnaround which could mean 11,000 jobs will be lost over the next five years in a bid to save £900m, reports suggest. The group has already made cuts of £88m during the last financial year.

However, in September’s half-year results, John Lewis warned that it would take two more years to complete the cuts, changing the end date from 2025-26 to 2027-28.

White said it would “blatantly” focus on its retail by opening more Waitrose stores and renovating existing ones. John Lewis has also removed targets for its non-retail departments, including its financial services and homebuilding divisions.

This marks a significant setback from previous targets, which included building and leasing 10,000 homes as part of plans to generate 40 per cent of profits from off-site retail by 2030.

But change is already underway. In October, White said she would step down as president in February 2025, making her the shortest-serving chief in the society’s 94-year history.

The former Ofcom boss joined in early 2020 and has been criticized for her lack of retail experience. Rumors have circulated about who will be named her replacement.

Katie Bickerstaffe, the first woman to lead M&S when she was appointed co-chief executive two years ago, has been put forward as a candidate. She leaves M&S in July and has helped revive the High Street giant.

Garry White, of wealth manager Charles Stanley, said M&S’s resurgence meant John Lewis’ sustainability was “not guaranteed”.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.