Adam Peaty has revealed he endured “three years of hell” after suffering from depression and alcoholism and splitting from his girlfriend – but has now rediscovered his passion for swimming.

He admitted he “never wanted to see a swimming pool again” after being “devastated” by the sport and turning to drinking and partying as an escape.

In 2022 her three-year relationship with Eirianedd Munro ended, as did her eight-year unbeaten streak in the pool, and she took a mental health break after the Commonwealth Games.

Add in a broken foot and a facial cut after a fight with a teammate and the last few years don’t make for the most rosy reading for a three-time Olympic champion.

But now Peaty has qualified for the 2024 Paris Olympics after winning the British men’s 100m breaststroke title with his fastest time since 2021.

Adam Peaty endured ‘three years of hell’ after suffering from depression and alcoholism following a difficult split from his long-term girlfriend.

In 2022, Peaty split from his girlfriend Eirianedd Munro (L) after three years together and has been dating Holly Ramsay (R), daughter of TV chef Gordon, since mid-2023.

However, Peaty has rediscovered his passion for swimming and is now focused on being “a better person” and “being a better father to George.”

When asked if he was back to his best, he said: “I think so.” A 57.9 is very good, it’s still not where I want to be, but it’s the first solid result where I think, “Oh, not many people can do this.”

‘I felt so light in the water.

‘This is a real victory for my team, my family and me. We’ve made it through the last three years of hell. I never wanted to see a swimming pool again. The sport had broken me.

‘I didn’t know which path to take and many things got in my way, but now I wake up every day and enjoy my work.

‘Who knows what the ending will be, but I’m having fun along the way. It may not end up like a fairy tale, but it could be.

His time of 57.94 seconds was his fastest since retaining his Olympic title in 2021.

The 29-year-old won three Olympic gold medals and two silver medals and was undefeated for eight years, from 2014 to 2022.

However, he broke his foot in May 2022 and ran back to the Commonwealth Games, where he could only finish fourth. He later quit swimming to focus on his mental health.

In August 2022, he battled the breakdown of his relationship with Eirianedd Munro, the mother of his then two-year-old son George.

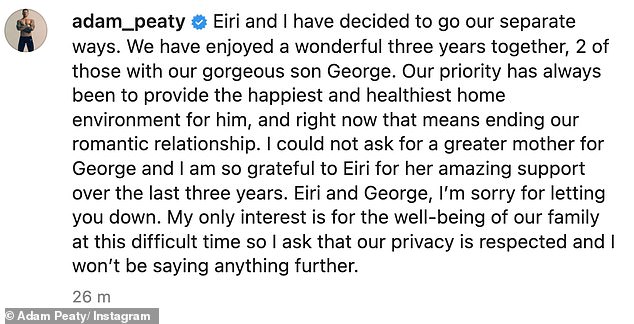

Announcing the news via social media, Adam wrote: ‘Eiri and George, I’m sorry I let you down. My only interest is the well-being of our family at this difficult time.’

The Olympic swimmer and former Strictly contestant took to Instagram to share the sad news with his followers, back in August 2022.

Peaty has become incredibly close to Ramsay and professed online that he loves her ‘so much’

Eirianedd took to her own social media to announce the split, predicting she would face an “incredibly difficult” future.

The split marked another example of the doomed ‘Strictly Curse’ hitting once again, after Adam attracted attention for his chemistry with pro partner Katya Jones on the dance floor in 2021.

However, Peaty is now dating Holly Ramsay, 24, daughter of TV chef Gordon Ramsay, who he met during his time on the show.

In 2020, Peaty told Mail Sport that he had found himself turning to alcohol after triumphing at the Commonwealth Games two years earlier.

‘After the Commonwealths, towards the end of the year, I didn’t have any races. And when it comes to partying and off-season drinking, that’s a depressant in itself, so I did it a lot.

‘In a way I didn’t go off the rails, but I didn’t really have that overwhelming motivation to act on something. And I’m an artist, so if I don’t have something to act on, I completely lose track.

‘Couple that with all that partying and stuff, it wasn’t so good to have all that at once.

“Then you’re at this low point where you can’t really enjoy anything, you don’t really see the point in buying nice things or doing nice things, because you’re not getting any effect from it anymore.”

In a Valentine’s Day social media post in February, Peaty labeled Ramsay his “best friend.”

In 2020, he told Mail Sport he turned to alcohol and partying and “went off the rails”.

He turned up at an event with a nasty cut above his eye after allegedly getting into a fight with a teammate from Team GB.

‘It took me a long time to recognize what was important to me and what wasn’t. Fortunately I have found it now. I know exactly how to treat my body, how to treat my mind, and it’s not by forcing alcohol consumption as much as possible.’

He said The times: ‘It has been an incredibly lonely journey. The devil on my shoulder (says): “You’re missing out on life. You’re not good enough. You need a drink. You can’t have what you want. You can’t be happy.”

‘I’ve been on a self-destructive spiral, which I don’t mind saying because I’m human. By saying it, I can begin to find the answers.’

Last year, he appeared with a nasty cut above his eye after allegedly getting into a fight with Team GB teammate Luke Greenbank after apparently slapping him on the bum and making an ‘arrogant joke’ about his girlfriend. , Anna Hopkin. .

Since the summer of last year, Peaty has been dating Holly Ramsay, 24, daughter of famous TV chef Gordon Ramsay.

The couple met on Strictly Come Dancing and in 2023 revealed matching tattoos in a tribute to each other.

They went public with their relationship in June, after which they sparked engagement speculation four months later when she was seen wearing a ring. On social media, she professed: ‘I love you so much.’

However, the three-time Olympic champion says his Christian faith has helped him on the road to recovery and he has opened up about his newfound faith and how it helped him overcome alcoholism.

In 2023, he told Mail Sport that his Christian faith had improved his mental health.

He said: ‘I go to church every Sunday. It’s been the last few months and it’s definitely helped.

‘It’s about being a better person. Not only to be a better athlete and fulfill my gift, but also to be a better father to George. There are many other reasons. It gets pretty deep. But it’s great to be a part of it.’