The money-making Mayor of London’s ultra-low emissions zone (ULEZ) has sunk like a lead balloon among many motorists since it was expanded at the end of August last year.

There have been “honk if you hate ULEZ” demonstrations in London, while more than 1,000 ULEZ cameras have been damaged or stolen. However, Sadiq Khan has not been willing to back down.

The scheme, designed to limit harmful pollution (really?), means anyone with a non-compliant vehicle must pay a daily fee of £12.50 to drive within London. Failure to pay the charge promptly can result in a fine of up to £180. About 60,000 vehicle owners (of gasoline vehicles registered before 2006 and diesel vehicles registered before 2015) pay the daily rate.

Louise Matz, an accountant at Pinner in north-west London, has paid more than £300 in ULEZ charges since the scheme was launched. To ensure she never got fined, she set up an “autopay” account with Transport for London (TfL).

In January, he decided enough was enough and sold his non-ULEZ-compliant Kia for a ULEZ-compliant Nissan Micra. The Driver and Vehicle Licensing Agency duly notified her that she was no longer the owner of the Kia. Not sure if she had any outstanding charges from ULEZ, she kept her account open so he could pay it from her bank account.

Sign of the times: there have been “honk if you hate ULEZ” demonstrations in London, while more than 1,000 ULEZ cameras have been damaged or stolen.

Last Tuesday, Louise received her monthly ULEZ statement for February and was shocked to discover that she had incurred a £12.50 charge on February 5, ten days after getting rid of her Kia.

The backup camera image showed his car on a transporter truck in Enfield, north London, presumably on its way to be auctioned. Having successfully contested a previous charge because a ULEZ camera mistook the ‘C’ on someone else’s number plate for the ‘G’ on his, he assumed he would have no problem voiding the £12.50 note.

But interestingly, TfL said it was still responsible for paying the fine. This is because he had not removed the Kia from his automatic payment account at the time it was caught on camera.

In its letter to Louise, TfL said: “We are unable to make an adjustment/give you a refund as we have reviewed the image of the vehicle and believe the charge has been correctly raised.”

What nonsense. We already know that the ULEZ plan is unfair, very unpleasant and a tax on many working people.

What Louise’s experience highlights is that the scheme is run by people whose sole duty is to raise as much revenue as possible for TfL. Common sense simply doesn’t work. If you did the same as Louise and scrapped your non-compliant ULEZ car in favor of one that gets Mr Khan’s seal of approval, don’t forget to collect your old motor from TfL. automatic payment service.

I have taken Louise’s case to TfL and will let you know when I receive a response. Hopefully TfL will see the folly of her methods and refund Louise the money she had no right to take from her.

The shiny buildings you could trust…

Many thanks to all those lovely readers who have taken the trouble in recent days to nominate their most striking bank branch: still open, closed (forever) or repurposed.

This follows a trip earlier this month to Stratford-upon-Avon, Warwickshire, where I stumbled upon a magnificent HSBC branch whose roots date back to 1810, when it was the headquarters of Stratford Old Bank. An imposing Victorian Gothic building that still takes your breath away today.

Some of the photos he sent of local branches were stunning and confirmed how important they once were to the communities they served. Many were (and still are) grand buildings dominating the streets.

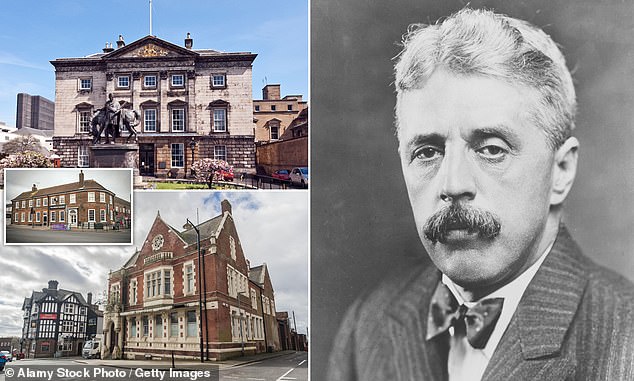

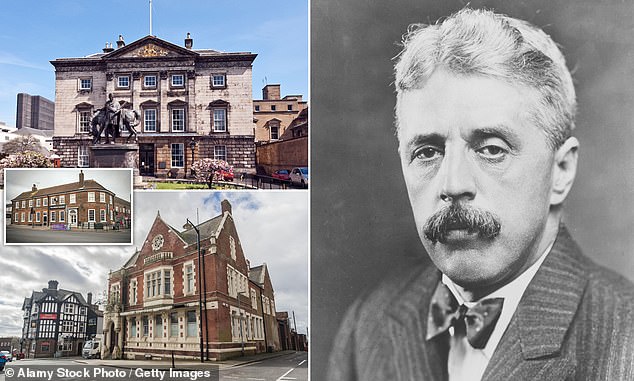

Although space prevents me from showing all of these splendid examples of banking architectural excellence, three caught my attention. The first is Royal Bank of Scotland’s flagship branch in St Andrew Square, Edinburgh, proposed by Perth-based actuary Kirsten Watt, 49.

Kirsten used to work for RBS’s insurance division, in a building close to the branch. “I loved walking in there at lunchtime,” she recalls, “and marveling at the size of the bank room, its vaulted ceiling, and its ornate design. I was never bored.

High life: (top left to bottom) RBS HQ in Edinburgh, The Greedy Banker in Rainham, NatWest in Burslem and right, Arnold Bennett.

Although Kirsten lost her job under the mad reign of RBS boss Fred ‘The Shred’ Goodwin, she soon found employment at a rival financial services firm. And she adds: ‘A few Christmases ago, I returned to the branch with one of my two daughters and I was impressed again. It’s a fantastic building, inside and out.’

The building, the former home of merchant Sir Lawrence Dundas, was acquired by RBS just under 200 years ago. Its beauty makes it an integral part of walking tours of the new city. Only time will tell whether it remains an integral part of RBS’s shrinking branch network.

The second is the imposing NatWest branch in Burslem, Stoke-on-Trent, a listed building that has been empty since 2017.

Resident Carol Gorton says the Gothic-style branch, which began life as the District Bank in 1870, often appears in the novels of local writer Arnold Bennett, who wrote prolifically between the 1890s and 1930s. Carol, secretary of the 200-member Arnold Bennett Society says that Burslem (Bursley in Bennett’s novels) has lost all its major banks. “He’s suffering on so many levels,” says Carol, who is busy organizing the society’s annual Arnold Bennett Day in June. ‘Empty stores dominate. The NatWest building and the former Lloyds branch recall a past when the area was prosperous.’

Finally, retired charity worker Jill Sidders, who lives just outside Sittingbourne in Kent, tells me that the former Barclays bank in nearby Rainham is now a pub called The Greedy Banker. “The bank had no architectural merit,” she admits, “but the name change was meritorious.” I’ve never been inside the pub, but I laugh quietly every time I pass by.

Thanks for all your photos and emails.

‘Debt Awareness Week’ Aims to Help Those With Money Worries

Nobody likes to talk about personal debts. Most people ignore it, hoping it will miraculously disappear. Of course it’s not like that. Unfortunately, problems paying off debt are increasing as many households’ finances are stretched to the limit.

Credit card debt – and interest rates – continue to rise, while mortgage arrears are now at their highest level in seven years.

It is therefore fitting that charity StepChange (stepchange.org) launches its 10th ‘Debt Awareness Week’ tomorrow.

The overriding message the charity wants to convey is that those struggling with debt should not bury their heads in the sand. They should seek advice.

If you find yourself in that situation, PLEASE pay attention to his important message.

Some links in this article may be affiliate links. If you click on them, we may earn a small commission. That helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.