Table of Contents

Avant Homes has entered the battle to control struggling housebuilder Crest Nicholson after proposing a £770m merger.

Details of the approach from Avant, which is backed by US investment firm Elliott, come three weeks after Crest Nicholson rejected a £650m offer from rival Bellway.

Avant, led by former Persimmon boss Jeff Fairburn, is proposing an all-stock merger that would see it take a 30 percent stake in the combined company, with the remaining 70 percent held by Crest owners.

The company would retain the Crest Nicholson name and remain listed on the London Stock Exchange.

It could mark the return of Fairburn, 58, to the helm of the listed builder six years after he was ousted as chief executive of Persimmon amid outrage over his £75m pay package. Sources suggested a merger between Chesterfield-based Avant and Surrey-based Crest Nicholson would provide greater job security for Crest employees than a takeover by Bellway.

Bellway has not yet said whether it will cut jobs in the event of any takeover.

Avant is an affordable homebuilder focused on the Midlands, the north of England and Scotland, while Crest Nicholson operates mainly in the south. Avant’s proposal comes six days before the “do or shut up” deadline for Bellway to submit a bid after details of its interest emerged.

Crest confirmed it had received “preliminary, indicative and unsolicited proposals from Avant Homes”.

He said he had discussed the approach with his financial advisers but was “currently not prepared to enter into discussions regarding a potential transaction with Avant while it is in an offer period in relation to a potential Bellway share offer”.

The company warned last month that its annual profit would be much lower than previously expected amid “volatility” in mortgage rates and uncertainty caused by the general election.

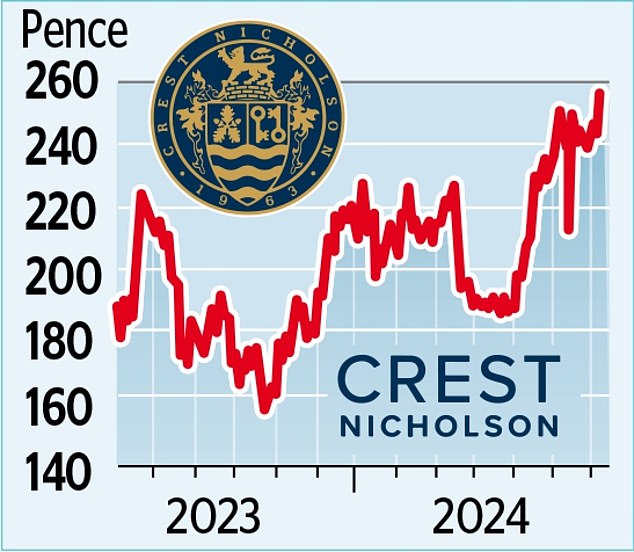

Shares in Crest Nicholson closed up 2.2 per cent, or 5.4 pence, at 250 pence yesterday. Avant and Bellway, whose shares gained 1.5 per cent, or 40 pence, to 2,700 pence, declined to comment.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

eToro

eToro

Stock Investing: Community of Over 30 Million

Trade 212

Trade 212

Free and commission-free stock trading per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Compare the best investment account for you