Jeff Bezos lost $15 billion in a single day, triggering a massive $134 billion drop in the stocks of the world’s 500 richest people, including Mark Zuckerberg and Elon Musk.

Shares of Amazon.com Inc fell 8.8 percent on Friday as part of a broader market sell-off, according to a report by the Stock Exchange. BloombergThis reduced Bezos’ net worth to $191.5 billion, as his wealth is tied to his company.

Bezos has been selling Amazon stock repeatedly this year, selling $8.5 billion worth of shares in February and announcing plans to sell another $5 billion worth of stock, which would still leave him with 912 million shares, or 8.8 percent of the stock.

This is the third worst drop Bezos has ever experienced, after his wealth shrank by $36 billion following his divorce in April 2019 and when Amazon shares fell 14 percent in April 2022.

The tech-heavy Nasdaq 100 index fell 2.4 percent, also hitting billionaires such as Mark Zuckerberg and Elon Musk, who are among the world’s 500 richest people.

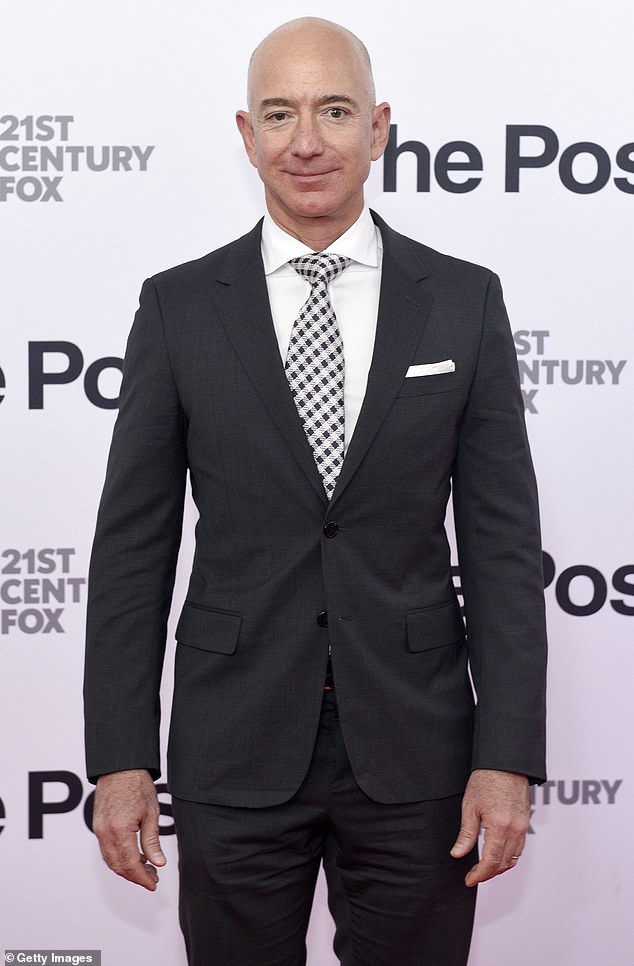

Amazon.com Inc shares fell 8.8 percent on Friday as part of a broader market selloff, according to Bloomberg. As Bezos (pictured) owns 912 million Amazon shares, or 8.8 percent of the stock, this reduced Bezos’ net worth to $191.5 billion.

Shares of Zuckerberg’s Meta Platforms Inc (left) fell 1.9 percent, losing more than $3 billion in value, while Musk’s (right) net worth also fell by $6.6 billion as his Tesla shares fell 4.2 percent.

Amazon’s recent stock plunge comes after the company said it would continue to invest heavily in AI, despite fears from investors across the industry that AI-driven gains this year are overblown.

Shares of Zuckerberg’s Meta Platforms Inc fell 1.9 percent, losing more than $3 billion in value, while Musk’s net worth also fell by $6.6 billion as his Tesla shares fell 4.2 percent.

Other Fortune 500 billionaires include Oracle Corp’s Larry Ellison, whose wealth fell by $4.4 billion, and tech billionaires Sergey Brin and Larry Page, who each lost more than $3 billion.

The fallout from Friday’s Nasdaq plunge was still being felt on Monday as stock markets around the world continued to fall amid fears the U.S. economy could be headed for a recession while Japan suffered its worst sell-off since Black Monday in 1987.

Experts at investment bank Goldman Sachs said they now believed there was a staggering 25 percent chance of a US recession, up ten percent from their previous estimate of 15 percent, while JP Morgan put the chances of a recession at 50 percent.

U.S. stock index futures fell on Monday, with those linked to the Nasdaq down nearly 4 percent, but traders are now increasing bets that the Federal Reserve will announce an emergency interest rate cut in response to the global stock market collapse and to prevent a major recession.

The sell-off followed the release of a disappointing unemployment report last week.

Employers added just 114,000 jobs last month, according to Labor Department data released Friday, well below the Dow Jones estimate of 185,000.

The figure was the weakest since December last year and the second weakest since the start of the Covid pandemic in March 2020.

This comes after the US Federal Reserve decided on Wednesday not to cut interest rates from the 5.25 percent to 5.5 percent range, which have been frozen since July last year.

Investors have shared concerns that the Federal Reserve may have waited too long to support the fragile US economy, warning that a recession there would wreak havoc on other economies around the world.

The Federal Reserve cuts, as well as several high-profile earnings disappointments, have helped sink the Nasdaq index into correction territory, according to Bloomberg.

This wiped out more than $2 trillion in value in the past three weeks.