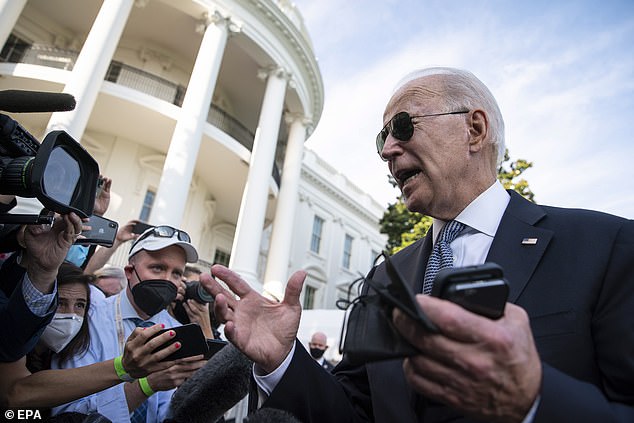

In 2019, presidential candidate Joe Biden smugly promised to “reverse Trump’s harmful border policies.”

Now, in 2024, he declares that he will restore Trump’s border policies.

He takes us all for fools.

On Tuesday, the president said he is considering a new executive action, reportedly to be unveiled in the coming weeks, to institute a Trumpian shutdown of immigrants who arrive by the tens of thousands each month.

This is, apparently, a presidential power that has been hidden in plain sight for years: an existing authority that allows US authorities to expel any individual caught crossing illegally into the country.

That would fix things quickly.

And it would already be very late.

But interestingly, just three months ago, our 81-year-old Commander in Chief, who promises to single-handedly restore American democracy, complained that he was absolutely powerless on immigration.

“I’ve done everything I can,” he complained, as he pleaded with Congress in February to pass a massive new immigration reform bill.

‘Just give me the power… Give me the people who can stop this…’

In 2019, presidential candidate Joe Biden smugly promised to “reverse Trump’s harmful border policies.” Now, in 2024, he declares that he will restore Trump’s border policies. He takes us all for fools.

On Tuesday, the president said he is considering a new executive action, reportedly to be unveiled in the coming weeks, to institute a Trumpian shutdown of immigrants who arrive by the tens of thousands each month.

Curiously, just three months ago, our 81-year-old Commander in Chief, who promises to single-handedly restore American democracy, complained that he was absolutely powerless on immigration.

So it was: Can no one help an old man?

Now it is: Dark Brandon, every migrant’s worst nightmare.

Biden’s evolution – from naïve “open borders” altruist to Trumpian realist – is complete.

But unfortunately for Joe and the country, the consequences of the historic humanitarian disaster he unleashed cannot be swept under the rug so easily.

On the Democratic primary debate stage in August 2019, Biden preached: “The idea that a country of 330 million people cannot absorb people who are in desperate need and justifiably fleeing oppression is absolutely bizarre.”

A month later, he declared: “We are a nation that says, ‘If you want to run away and you’re running away from oppression, you should come.'”

That sure sounded like an invitation. And, in fact, that’s what millions of would-be immigrants heard.

Then, Biden rolled out the red carpet.

On his first day in office, he halted construction of Trump’s border wall and halted nearly all deportations.

It later exempted unaccompanied immigrant children from rules blocking illegal immigration during the COVID pandemic.

Almost immediately, human smugglers began throwing children (as young as three years old) over 15-foot border walls to be rescued by Border Patrol.

This was Biden’s idea of a humane policy, while everything his predecessor had done was “dangerous” and “against everything we stand for as a nation of immigrants.” In other words, racist.

In April 2023, a record number of illegal immigrants – heeding Biden’s call – showed up at the southern border to be processed and released into the interior of the United States. But still, Homeland Security Secretary Alejandro Mayorkas assured Americans: “The border is secure.”

In Biden’s State of the Union address, he was challenged to “say [Laken Riley’s] name,” from Congresswoman Marjorie Taylor Greene, who interrupted him from the audience.

In April 2023, a record number of illegal immigrants – heeding Biden’s call – showed up at the southern border to be processed and released into the interior of the United States. But still, Homeland Security Secretary Alejandro Mayorkas assured Americans: “The border is secure.”

The crisis began to suffocate the northern cities.

The Bidenvilles (immigrant camps) emerged on the outskirts of New York.

High schools in Brooklyn and community centers in Boston and Chicago became shelters.

The president blamed Republican governors for busing immigrants to northern cities.

We now know that it was Biden, not Texas Governor Greg Abbott, who surreptitiously allowed tens of thousands of migrants to fly across the border to airports across the country.

One of Biden’s passengers was Haitian Cory Alvarez. He has now been accused of raping a developmentally disabled teenager.

And then, there was the Laken Riley tragedy. She was a 22-year-old nursing student at the University of Georgia out for a run when she was attacked and killed by an illegal immigrant.

At Biden’s State of the Union address, he was challenged to “say his name” by Congresswoman Marjorie Taylor Greene, who interrupted him from the audience.

“Lincoln…Lincoln Riley, an innocent young woman who was murdered by an illegal,” Biden said, botching the victim’s name.

He later apologized for badmouthing, though not for Laken’s name… for calling his killer “illegal”: a resounding victory for the woke police.

The Bidenvilles (immigrant camps) emerged on the outskirts of New York. High schools in Brooklyn (above) and community centers in Boston and Chicago became shelters.

There was the Laken Riley tragedy (above). She was a 22-year-old nursing student at the University of Georgia out for a run when she was attacked and killed by an illegal immigrant.

Biden is the portrait of moral weakness. A man pushed and dragged from one place to another by the political winds.

And now that his failure to secure the southern border has become an anchor sinking his re-election, he has veered again.

In January, desperate and greedy, Biden declared that he was willing to “close the border until it can be brought back under control,” as long as those nasty Republicans would approve everything and absolve him of these cynical sins.

Too little too late, Joe.

Today, nearly 7 in 10 Americans disapprove of Biden’s handling of immigration.

In one of the most notable demographic shifts to date, about 30 percent of black men now say they will definitely or probably vote for Trump in November. In 2020, Trump won the support of just 12 percent of black men.

Among the main issues that move these Americans are the economy and immigration.

We are witnessing the complete failure of Biden’s immigration policies: from sanctuary cities groaning under the crushing weight of immigrants they invited to their communities to a White House that steps on the accelerator.

Biden’s sudden policy change exposes him as a faithless and completely unprincipled executive.

His blatant political pandering to the open-borders activist left has finally (and rightly) blown up in his face.

But while he may talk a lot about executive orders this week, who knows what his border policy will be if he’s re-elected?

You can’t trust this president