Fallen cryptocurrency prodigy Sam Bankman-Fried, currently serving a 25-year prison sentence following a wide-ranging fraud case, has agreed to cooperate in a class-action lawsuit against celebrities who promoted his cryptocurrency exchange.

By agreeing to cooperate with the investors, the victims will now withdraw their civil liability claims against the founding criminal.

Celebrities include some big-name sports stars such as Tom Brady, Shaquille O’Neal, Stephen Curry and Shohei Ohtani.

Brady’s ex-wife Gisele Bundchen and actor Larry David are also among the names accused of promoting unregistered securities for FTX and luring investors into a Ponzi scheme.

The lawsuit claims that crypto Bankman-Fried and the celebrities he recruited to endorse the company are responsible for around $11 billion in losses to American consumers.

Former FTX boss Sam Bankman-Fried, currently serving 25 years behind bars, has reached a deal with investors to resolve his civil claims.

Bankman-Fried will cooperate in a class action lawsuit targeting celebrities such as Tom Brady and Gisele Bundchen, who promoted FTX, with the goal of resolving current and future civil lawsuits.

Bankman-Fried is pictured with Bundchen at a Crypto Bahamas conference on April 22

Many of the stars were “ambassadors” for the commercial platform, while others appeared in prime-time commercials.

The plaintiffs hope to be able to recover some of their losses following the collapse of FTX in November 2022.

Bankman-Fried, 32, appealed her federal conviction earlier this month after U.S. District Court Judge Lewis Kaplan imposed the prison sentence and ordered her to pay $11 billion in forfeiture. .

In exchange for removing him from the civil suit, Bankman-Fried would hand over all non-privileged documents detailing his assets and investment in artificial intelligence startup Anthropc, an affidavit certifying his net worth as negative, and documents regarding other defendants. in the broad spectrum. wide-ranging civil litigation.

Bankman-Fried also agreed to disclose any information she can about the venture capital firms that invested in FTX along with a list of accountants and lawyers who worked with the exchange.

Tom Brady and now his ex-wife Gisele Bundchen appeared in an FTX commercial in 2022. They are named in a class-action lawsuit that alleges the company’s collapse has cost consumers $11 billion.

Brady was filmed at home calling his friends to register them on FTX. The company marketed the ad campaign with the tagline: “Tom Brady is in. You?”

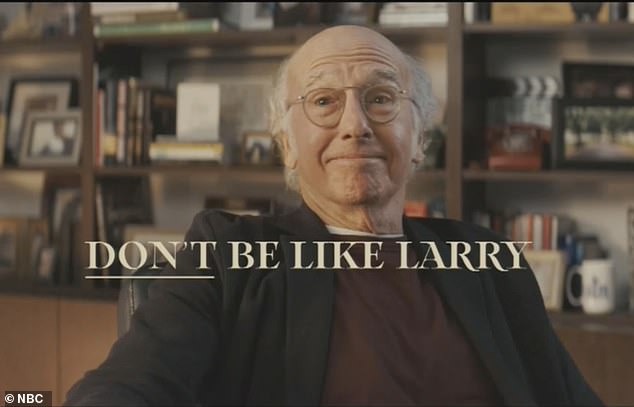

Larry David starred in a multimillion-dollar Super Bowl ad rejecting cryptocurrencies before viewers were told, “Don’t be like Larry.”

David plays a series of characters who reject inventions and ideas, such as the light bulb, the bathroom, and space travel. He then rejects FTX, before viewers are told: “Don’t be like Larry.”

It is unclear what liability any superstar endorsement might be responsible for, given that Bankman-Fried paid celebrities to boost the profile of his crypto empire.

Pro football quarterback Trevor Lawrence was paid $500,000 in September 2022, reports Bloomberg.

The celebrities are described in the 41-page document as “parties who controlled, promoted, assisted and actively participated in” FTX’s operations, allegedly in violation of Florida law.

The lawsuit adds: ‘The deceptive and failed FTX platform was based on false representations and deceptive conduct.

‘Although many incriminating emails and text messages from FTX have now been destroyed, we located them and evidence how FTX’s fraudulent scheme was designed to take advantage of unsophisticated investors across the country, who use mobile applications to make their investments.

“As a result, American consumers collectively suffered more than $11 billion in damages.”

Steph Curry’s ad showed him telling viewers: “I’m not an expert and I don’t need to be, with FTX I have everything I need to safely buy, sell and trade cryptocurrency.”

Shaq put on an FTX-branded sweater and said, “Hi, I’m Shaquille O’Neal and I’m excited to partner with FTX to help make cryptocurrency accessible to everyone.” I totally agree, what about you?

Tennis star Naomi Osaka said in her commercial, “I’m proud to partner with FTX.” Making cryptocurrencies accessible is a goal that FTX and I strive for.”

NFL star Brady and Bundchen, his former supermodel wife, are named FTX ambassadors who “joined the company’s $20 million ad campaign in 2021” and starred in a commercial “that shows them telling people they know to join the FTX platform”.

Basketball player Curry is notable for appearing in an advertising campaign in which he said that he did not need to be a cryptocurrency expert because “with FTX I have everything I need to buy, sell and exchange cryptocurrencies safely.”

David appeared in a Super Bowl commercial for FTX that showed him playing a series of clueless characters who reject bright ideas throughout history, including the toilet and the light bulb.

The ad then showed David rejecting FTX, before a message appeared: “Don’t be like Larry.”

Shaquille O’Neal also appeared in an FTX commercial, as did Steph Curry. Osaka was an ‘ambassador’ for the company.

The lawsuit states: ‘The deceptive FTX platform maintained by the FTX Entities was truly a house of cards, a Ponzi scheme in which the FTX Entities shuffled client funds among their opaque affiliated entities, using new investor funds obtained through investments. in the YBAs. [yield-bearing accounts] and loans to pay interest to the old and try to maintain the appearance of liquidity.

‘Part of the plan employed by the FTX Entities involved using some of the biggest names in sports and entertainment, like these Defendants, to raise funds and encourage American consumers to invest in the [yield-bearing accounts]which were offered and sold largely from the FTX Entities’ national base of operations here in Miami, Florida, investing billions of dollars into the deceptive FTX platform to keep the entire scheme afloat.

The lawsuit was filed in the Southern District of Florida of the United States District Court.

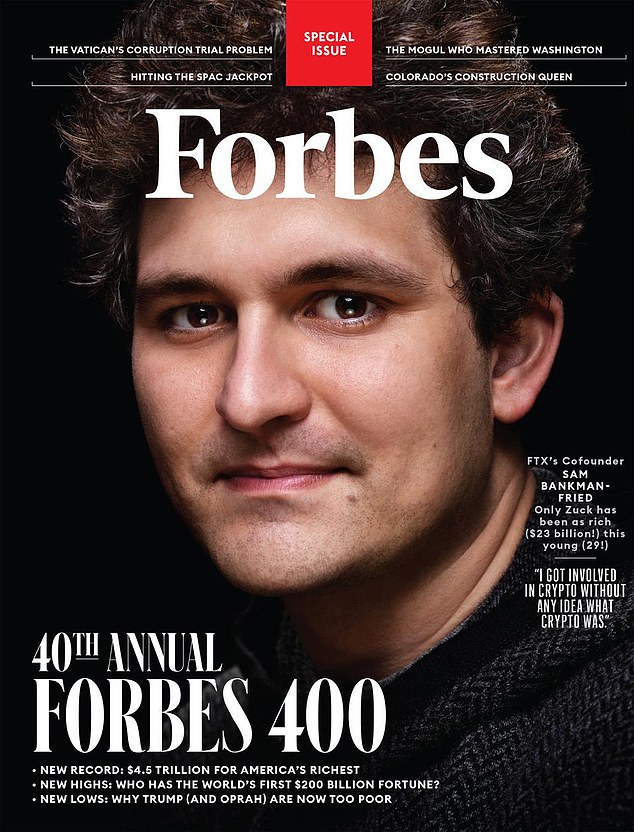

Bankman-Fried had skyrocketed to the top of the cryptocurrency world, becoming a billionaire before the age of 30 and turning FTX, a small startup he co-founded in 2019, into the world’s second-largest exchange.

But in November 2022, Bankman-Fried’s dizzying rise collapsed, with a flood of client withdrawals and revelations that billions of dollars had been illegally moved from FTX to Bankman-Fried’s personal hedge fund, Alameda Research. .

He was convicted by a federal jury in New York in November 2023 on seven counts of fraud, embezzlement and criminal conspiracy.

Sam Bankman-Fried appeared in federal court last month, where he was sentenced to 25 years in prison for defrauding people out of billions of dollars.

Bankman-Fried was the example of cryptocurrencies quickly becoming the face of the coin and its rapid rise.

During last month’s sentencing hearing, Bankman-Fried lamented the company’s demise, which also affected many colleagues.

“It haunts me every day,” he said. “I made a series of bad decisions.”

But the judge said Bankman-Fried had not fully accepted responsibility.

Bankman-Fried said “mistakes were made, but never a word of remorse for the commission of a terrible crime,” said Kaplan, who called the violations “brazen” and criticized SBF for its “exceptional flexibility” toward the truth.

“Since the collapse of FTX, Mr. Bankman-Fried has been particularly focused on returning estate assets to clients, which could and should be recovered at current prices,” said Bankman-Fried spokesman Mark Botnick.