Tesla investors are bracing for what are expected to be their worst quarterly earnings results since early 2017, as sales decline and major new projects are scrapped.

CEO Elon Musk will host the automaker’s earnings conference call on Tuesday and try to calm investor concerns that the company is headed for catastrophe.

As of Monday, it was the second-worst performer in the S&P 500 this year. Its share price fell 43 percent to $141, well below its all-time high of $410 in 2021.

“The Street wants and NEEDS answers next week on Tesla’s first-quarter conference call next Tuesday,” Wedbush analyst Dan Ives said in a research note last week.

Ives described how “the string of bad news over the past few months has been a horror show for investors” and suggested that many could soon “be heading for the elevators during this perfect Category 5 storm.”

Tesla investors on Tuesday will wait for CEO Elon Musk to address a series of crises that have sent its stock price down more than 40 percent so far this year.

Tesla’s Cybertruck was launched earlier this year, but was plagued with problems. Last week all models were recalled for a defect that caused the accelerator pedals to get stuck.

The analyst noted that Musk has behaved erratically during recent quarterly earnings calls, failing to inspire confidence in investors.

“If Musk goes back to being flippant and there are no adults in the room on this conference call without answers, then darker days lie ahead,” he said.

Fueling the crisis at Tesla is declining demand for electric vehicles in the U.S., a price war with increasingly capable Chinese electric car makers and a wave of problems surrounding its just-launched Cybertruck.

Last week, the automaker recalled nearly 4,000 Cybertrucks to fix an accelerator pedal fault that could cause the electric vehicle to accelerate to full speed.

Just this month, Tesla also announced it would lay off 10 percent of its staff and reported that its global vehicle deliveries in the first quarter fell for the first time in nearly four years.

It was also reported that the company had abandoned plans to make the so-called ‘Model 2’, a $27,000 economy car that it hoped would capture the mass market.

Musk said the company would instead focus on developing autonomous robot taxis.

But Ives also warned that this strategy is also fraught with problems, as he said a fully autonomous robo-taxi might not be ready for five or six years.

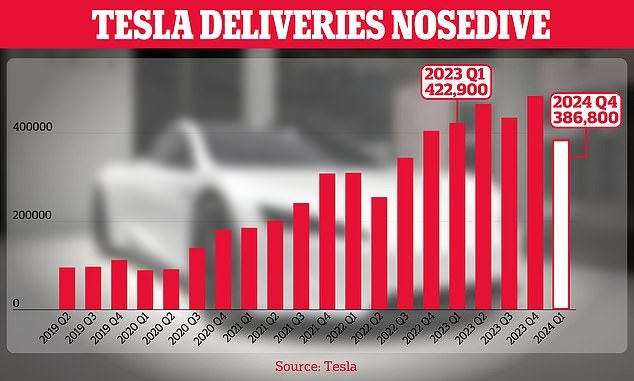

Tesla’s deliveries were significantly lower than Wall Street projected as the company faced increased competition in China and declining demand for electric vehicles in the US.

Meanwhile, companies like BYD, Li Auto and Nio are some of China’s largest electric vehicle manufacturers, producing cars for as little as $10,000, about a third of the price of the cheapest electric car available in the United States.

Although Chinese cars are not directly affecting Tesla’s sales in the United States, they are in other parts of the world. Chinese electric vehicles had only 0.5 percent of the European market in 2019, but around 9.3 percent in the fourth quarter of 2023.

In a bid to boost sales amid declining demand, Tesla this weekend began cutting the price of its cars around the world.

Tesla reduced the starting price of the Model 3 in China by 14,000 yuan, or $1,900, to 231,900 yuan, or $32,000, its official website showed on Sunday.

Chinese electric vehicle maker BYD recently launched the Seagull, which costs $9,700 in China. Tesla recently scrapped its plans to make a cheap ‘Model 2’ car for the mass market

Tesla posted its first year-over-year drop in sales since 2020 earlier this month. It delivered 386,810 vehicles in the first three months of the year, 20 percent less than the previous quarter and 9 percent less than in the same period in 2023.

In Germany, the price of the rear-wheel drive Model 3 was reduced by 2,000 euros, to 40,990 euros, or about $43,600. There were also price cuts in many other countries in Europe, the Middle East and Africa, a Tesla spokesperson told Reuters.

Musk took to X, formerly Twitter, to defend criticism of the price changes.

“Tesla prices must change frequently to adapt production to demand,” he wrote. ‘Other cars change prices constantly and often by wide margins through dealer markups and manufacturer/dealer incentives. “Only a fool thinks ‘MSRP’ is the real price,” he added.

Another blow to Tesla came earlier this year when rental companies Hertz and Sixt announced they were taking steps to remove electric vehicles from their fleets due to a lack of demand and their tank value.

At the center of many of Tesla’s recent issuances is the Cybertruck, which Musk’s critics have called a vanity project that generated little value for shareholders.

While most electric vehicle manufacturers have been working hard in recent years to build affordable electric vehicles that could bring electrification to the masses, Tesla was busy developing the Cybertruck.

This unconventional vehicle has little in common with typical cars and features many expensive tricks, according to its critics.

The choice to make the vehicle’s body out of stainless steel has been a source of countless problems for Tesla.

This month, Elon Musk sent an internal memo stating that the company would lay off about 10 percent of its total workforce.

Truck doors are bulletproof, but the use of this material resulted in the production of vehicles with huge and inconsistent panel gaps.

The fiasco even led Musk in the months before the truck’s launch to send an internal memo to employees urging them to prioritize quality.

Then, after the truck was shipped, owners began complaining about cosmetic issues with the stainless steel body panels, with small spots of rust-like corrosion appearing on them.

Another controversy erupted around the ‘frunk’ of the truck. Some owners have noticed that when closed, its sharp edges act almost like a guillotine, cutting through anything that gets in its way.

But perhaps the biggest blow came last week when it was revealed that the company would be recalling nearly 4,000 Cybertrucks that had been shipped with accelerator pedals that could stick.

Unlike most “over-the-air update” recalls, owners were instructed to bring their vehicles. Tesla’s solution involved drilling a hole in the bottom of the pedal and installing a rivet to hold the cover down.

Musk is expected to answer investor questions during the company’s earnings conference call, which will be broadcast live at 4:30 pm CT on X.