Adelaide United teenager Musa Toure is “very sorry” for a social media post that said he did not support the A-League pride round.

Club officials told Touré to eliminate the position despite the Reds claiming to “respect individual beliefs.”

This weekend’s round of A-League matches are the competition’s official Pride Celebration, with the Pride Cup offered at Coopers Stadium this weekend when Adelaide and Melbourne Victory meet in the men’s and women’s competitions .

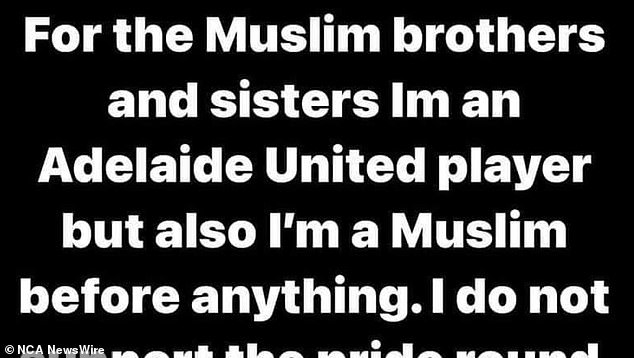

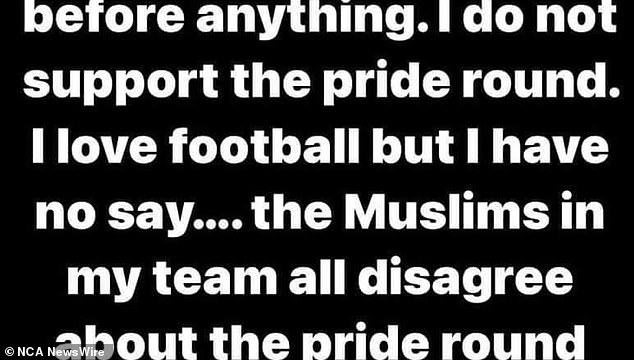

Earlier this week, Touré announced on Instagram that he and other Muslim players at the club “do not agree” with the pride round.

“For Muslim brothers and sisters I am an Adelaide United player, but I am also Muslim first and foremost,” Touré said in his post.

Adelaide United player Musa Toure (pictured) says he “made a mistake” by posting his thoughts on the A-League pride round.

Musa Toure says he and the club’s other Muslim players did not agree with the pride round in a now-deleted Instagram post.

‘I don’t support the pride round. I love football, but I don’t have a say… All the Muslims on my team don’t agree with the pride round, but we don’t have any problems with LGBTQ PEOPLE either!! It’s his life.’

Shortly after, however, Reds officials told Touré to delete the post.

“Adelaide United acknowledges a social media statement made by one of our players regarding the pride round,” the Reds said in a statement.

‘We respect individual beliefs and will continue to embrace diversity and welcome people from all backgrounds.

‘Our club is committed to inclusivity and respect for all and, through the pride round, we want to celebrate everyone, no matter who you are, who you love or what faith you have.

“We will continue to educate players and staff on the importance of respecting diversity and promoting inclusion, while fostering an environment where everyone feels valued, welcome and accepted.”

Adelaide’s men’s team includes Josh Cavallo, who came out as the world’s first gay professional footballer in 2021, while the club’s women’s team goalkeeper Grace Wilson is non-binary.

Musa Touré said he is “an Adelaide United player but also a Muslim first and foremost”

Touré was later told by Reds officials to delete the controversial post.

Touré has now apologized again via social media.

“I want to apologize for my comments on social media regarding this weekend’s Pride celebration,” he said on Instagram.

“Having spoken to my teammates and my club, I understand that my comments were hurtful and insensitive and I am extremely sorry.

“At my club a lot has been done to ensure that all players and fans feel included and can be themselves.

‘My comments did not reflect this. “I will continue to grow and learn and I look forward to this weekend’s games.”

Touré’s agent, Fahid Ben Khalfallah, said Touré would also apologize to Cavallo.

“Musa made a mistake because he didn’t mean it that way,” Ben Khalfallah said.

‘It’s a complicated issue. He didn’t want to hurt anyone. He is very sorry about it.

Touré plays for the same club as Josh Cavallo (pictured), who declared himself the world’s first gay professional footballer in 2021.

A spokesperson for the Australian professional leagues said the A-League men’s and women’s competitions were “proud of the rich diversity our players and fans bring” to the competitions.

“Football should be a safe and welcoming sport for everyone, especially members of communities where traditionally it has not always been that way,” he said.

Beau Busch, co-chief executive of Professional Footballers Australia, said: “We recognize and respect that people may have different views.” This is a long-term commitment and we will continue to provide guidance and support to all our members.

“Our goal is to reduce discrimination, increase education and improve everyone’s experience when playing football so they feel safe, included and welcome.”

Toure has not played since injuring his quadriceps in December, but is available for selection on Saturday night.