A mother revealed her experience bringing her 14-month-old son to Coachella while showing videos of her son dancing alongside a host of performers.

maddie bannister and her husband, Brandon, are parents living in Mexico who have a great love for music and have been sharing their favorite songs with their daughter, Hannelore, since she was born.

Having previously taken Hannelore to concerts in their hometown, the couple decided to take their little one to Coachella, which takes place over two weekends in California and features performances from more than 160 artists.

When Maddie, who works at a company that helps with the production of music festivals, was asked to attend Coachella and work at the venue, she decided to make it a family affair and bring Brandon and Hannelore to the festival, and she documented the experience of his little girl. and music in a series of videos on his TikTok account.

Maddie Banister is a mother living in Mexico and shared her experience bringing her 14-month-old to Coachella while showing videos of the young man dancing.

After taking Hannelore to a series of concerts in her hometown, the couple decided to take the child to the long-awaited Coachella music festival.

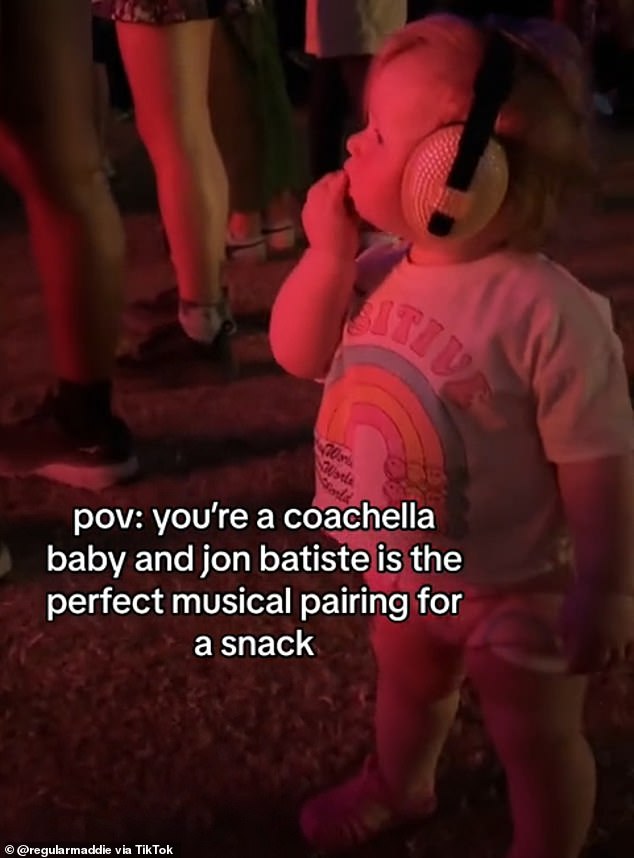

She shared footage of Hannelore putting on a pair of large noise-canceling headphones to block out loud sounds while she danced, slept, and ate snacks while watching the performers.

In one of the videos, the girl is seen sleeping in her stroller while her parents played music.

In another, Hannelore ate some snacks while watching the performers on stage. Meanwhile, Brandon incorporated her bottle into her dance moves and shook it well while she listened to the music.

speaking to PeopleMaddie talked about her decision to bring Hannelore to the festival.

She told the outlet that having her daughter accompany her was a no-brainer because she had been listening to music since she was born.

‘My husband and I met during the pandemic. We had a lot of love for music in common and I worked in that industry for a long time. As soon as we could start going back to festivals and concerts and things like that, we did,” Maddie said.

‘We’ve been taking Hani to shows since he was a couple of months old. She has always loved it.

‘So he saw Metallica, Guns N’ Roses and Tool when he was a few months old. We took her to see Phish and some one-day festivals in our hometown. It’s definitely had its fair share of concert days.

And despite being professional concert goers, Maddie and Brandon still wanted to make sure they gave their daughter the most comfortable experience and planned everything they would need for her.

He added: ‘We brought everything we thought we might need. The second day we were able to leave some extra things at home because we had the rhythm a little better. The things we always have are her diaper bag, her bottle, her headphones for all the music (she has to have them on every set), and snacks upon snacks upon snacks.

‘We had golf cart goggles and a hat as she is a redhead baby so she definitely couldn’t sit in the sun for too long. We made sure to bring layers and look at all the possibilities, like she could drop 40 degrees at night.’

Maddie noted that being a worker at the festival helped because they could use “golf carts.”

The mother admitted that she was not the only mother who took her son to the festival either and added that there was even a ‘kidchella’ area.

And Maddie revealed she was happily surprised to have received so much positive feedback when it came to bringing her daughter.

She told the outlet: “We got a lot of positive feedback, which isn’t always the case when you take your kids to a concert, but the people at Coachella definitely warmed to us and said, ‘You’re doing a good job.'” I want do this with my kids when I have kids.” That’s why it’s good to have that support. “It was very community-oriented.”

He also shared that those mothers and fathers who did not bring their children even asked them for advice.

And although Maddie confessed that it was a little “hard” having Hannelore at the festival while she worked, she would do it again because of how “fun” it was, adding that her “amazing” husband helped take care of their daughter while she worked .

However, the mom revealed that there were a few things she would change about her trip to Coachella.

‘Maybe we’ll come in a little later and look at some different sets. We were there for eight hours starting relatively early, between 2 and 3, so by the time the headliners started, we were struggling and too tired. This [weekend two]”I hope we can change our schedule a little bit and come in a little later so we can enjoy some of the later headlines,” he explained.

After sharing the clips of her daughter enjoying the music festival, the mother received a lot of comments from people, most of them positive.

After sharing the clips of her daughter enjoying the music festival, the mother received a lot of comments from people, most of them positive.

One person even called the mother “embarrassing” because she brought her daughter.

The comment read: ‘I guess anyone can be a parent these days…’ I’d be embarrassed to bring my baby.

However, other people online gushed about her daughter’s adorable behavior during the music festival.

One person wrote: “This is amazing.”

Someone else commented: “Okay icons.”

“Hands down the coolest girls ever,” one user wrote.