Table of Contents

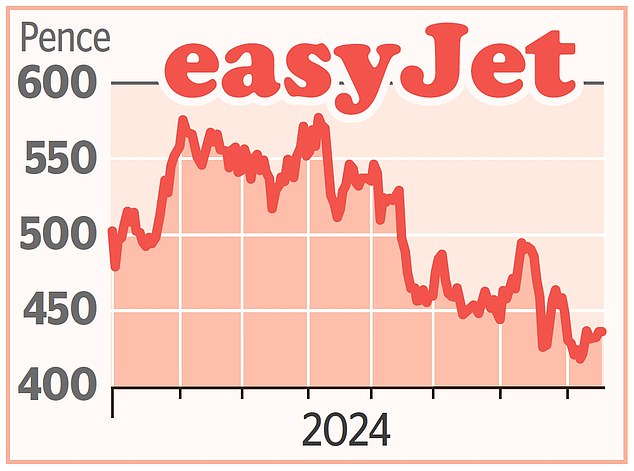

Shares in the £3.3bn FTSE 100 member have fallen 13 per cent to 436 pence since the start of the year, and are almost 70 per cent lower than they were a decade ago.

During the pandemic’s travel bans and other issues, the airline was forced to raise additional capital twice to ensure its survival. This cast a shadow over the stock and has yet to dissipate.

Rival Ryanair’s problems have also been a negative factor, with EasyJet believed to be affected by some of the same issues.

Is that justified?

No. EasyJet is faring much better than Ryanair, which last month announced a 46% drop in profits for the first three months of June and a fall in passenger demand. By contrast, EasyJet chief executive Johan Lundgren revealed a 16% rise in profits and said his airline was “on track to deliver another record summer”.

Why is EasyJet doing better than Ryanair?

EasyJet appeals to what Barclays analysts call “a more upmarket customer demographic” that has been less affected by cost-of-living pressures.

Unlike Ryanair, EasyJet is not dependent on the troubled aircraft manufacturer Boeing.

Another reason for EasyJet’s resilience is its package holiday division, which offers beach holidays and city breaks.

The initiative is considered one of Lundgren’s greatest achievements.

The operation not only has low overhead costs, but also allows the airline to fill seats on its planes with higher profit margins.

What are Lundgren’s greatest achievements in his top role?

The two requests for funding during the pandemic may have been a forced move as EasyJet faced an existential crisis, but they had a useful side effect. The move diluted the stake of EasyJet founder Sir Stelios Haji-Ioannou, who had been a critic of bosses. Although Haji-Ioannou still owns 15 per cent, he had less ability to interfere with decisions Lundgren made. Indeed, he has praised Lundgren this year for saving the company.

What’s Lundgren’s next move?

He will step down in 2025 and be replaced by chief financial officer Kenton Jarvis, who is tasked with delivering annual profits of £1bn by 2028-29 at the latest.

The company’s profits for the year to September 2023 amounted to £455m, of which £122m came from its package holiday division. The company had made a loss of £178m in the previous year.

Is EasyJet stock a buy at this depressed level?

Analysts believe that EasyJet’s virtues will be recognised. This week, UBS set a target price for the shares of 785 pence. The average target price is 652 pence. Haji-Ioannou, meanwhile, wants EasyJet to list on the Nasdaq in the United States for a second time.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.