The heartbroken family of a murdered art student have shared the last known photograph of the main suspect, who attempted to fake his own death and fled Ireland after her murder.

The mutilated and charred body of Emer O’Loughlin was discovered in John Griffin’s burned mobile home on April 8, 2005.

O’Loughlin, 23, had been living in a neighboring caravan with her boyfriend Shane Bowe in Ballybornagh, Co. Clare. It is believed she visited Mr Griffin’s home to charge his mobile phone following an electrical problem at his own residence.

Initially, forensic experts could not determine whether her remains were male or female because they were so damaged, and a post-mortem examination at the time did not indicate the cause of death.

But following pressure from Mrs O’Loughlin’s family, in 2010 her remains were exhumed and a re-examination found she had died violently before the fire; X-rays of her bones showed marks that suggested she had been attacked with a machete-type knife. A similar weapon was found among the remains of the mobile home.

Griffin, 56, from Galway city, was placed on Interpol’s most wanted list in connection with the murder. But the main suspect tried to fake his suicide before fleeing Ireland. Despite extensive searches, gardaí never found him.

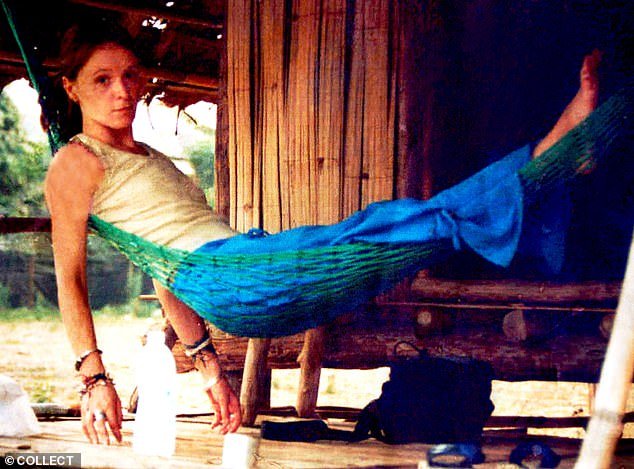

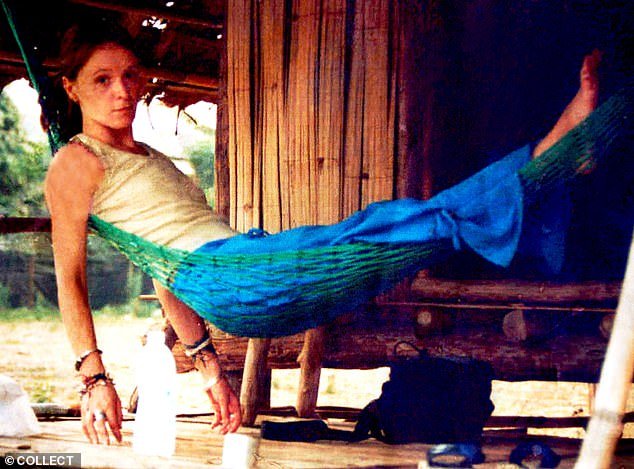

The mutilated and charred body of Emer O’Loughlin was discovered in John Griffin’s burned-out mobile home on April 8, 2005. Pictured, Emer O’Loughlin

speaking to The Irish Independent For his podcast The Indo Daily, O’Loughlin’s distraught father, Johnny O’Loughlin, insisted that Griffin must have had help to escape.

‘Someone must have helped him. How could he leave the country without anyone knowing? the father asked before the 19th anniversary of his daughter’s death.

Gardaí were already aware of Mr Griffin, who is said to have a history of drug addiction. He had previously used the alias John McDermott and lived in Scotland.

Gardaí interviewed him in the days after O’Loughlin’s death, but he said he had stayed with a relative the night before the fire and knew nothing about the fire.

But three days after the art student’s murder, the suspect reportedly began acting strangely. The Irish Independent.

He traveled to the historic Dún Aonghasa ring fort on the island of Inis Mór, Aran, where he threatened to throw himself off a cliff and threw stones at anyone who tried to approach him.

Gardaí flew in from the mainland and lifeboats were lined up in the water in case the suspect carried out his threat.

He was taken to a psychiatric hospital in Ballinasloe, Co. Galway, after the nine-hour standoff, when he was finally subdued.

O’Loughlin, 23, had been living in a neighboring caravan with her boyfriend Shane Bowe in Ballybornagh, Co. Clare. She is believed to have visited Mr Griffin’s home (pictured) to charge his mobile phone following an electrical problem at her own residence.

The autopsy performed at that time did not indicate the cause of death. But after pressure from O’Loughlin’s family, in 2010 his remains were exhumed and a new examination found that he had died violently before the fire. Pictured, Mrs O’Loughlin

But after five days, he realized it and on April 18, after shaving his head and beard, he allegedly boarded a ferry to Inis Mór.

According to the publication, he had left clothes on the edge of the island’s cliff in an attempt to fake an apparent suicide. However, O’Loughlin’s family never believed Griffin was dead.

Despite extensive searches, Gardaí have been unable to find him since and detectives reportedly believe he fled Ireland.

In 2014, The Irish WhatsNew2Day revealed how Griffin was believed to have moved to Scotland, after leaving a “paper trail” in Edinburgh.

Then, in 2022, the Sunday Independent revealed that the suspect was located at a drug rehabilitation center in Scotland following coordination between Gardaí, Police Scotland and Interpol.

But surprisingly, he was discharged before investigators realized his whereabouts, according to a source.

“His identification at the Scottish rehab center occurred some time ago,” the source said. ‘It is terribly unfortunate that he was not identified while he was there as a patient.

‘When it was established, he had already been released. He is the main suspect in connection with the murder of Emer O’Loughlin and remains at large.

Griffin, 56, from Galway city, was placed on Interpol’s most wanted list in connection with the murder. But the main suspect tried to fake his suicide before fleeing Ireland. Despite extensive searches, gardaí never found him. Pictured, Mrs O’Loughlin

Ms O’Loughlin’s father, Johnny, admitted he had a number of problems with Gardaí’s initial investigation into his daughter’s murder.

“We have a number of questions and issues about the original garda investigation,” he said. ‘How did that man get out of Ireland? Why didn’t they talk to him after he left the mental hospital? We need answers.

‘I have faith that Gardaí are doing everything they can now, but I don’t know how that man got off the island and how they still haven’t found him.

‘All we can do is keep going until we get answers. Emer’s mother, Josephine, is gone, but we will move on. Mrs O’Loughlin died peacefully after a long illness in 2015.

Speaking on The Indo Daily podcast, Catherine Fegan, special correspondent for the Irish Independent, claimed that Griffin’s whereabouts had been linked to Spain, the Netherlands and “most recently, Morocco”.

Last month O’Loughlin’s family was informed that alleged sightings of the main suspect in Morocco had been ruled out.

The country’s authorities have reported that Griffin is not in the country, according to the Sunday Independent. Pam O’Loughlin, Emer’s older sister, said the news was “heartbreaking.”

“He could have changed his appearance by now, he could be anywhere in the world right now,” Catherine warned.

The suspect had a tattoo on his throat area, described as an Egyptian “eye of Horus,” pictured.

He explained that in April 2005, the “brilliant and talented” Mrs O’Loughlin was studying art in Galway. She had traveled all over the world and had just returned home with her boyfriend.

They were building a house and meanwhile lived in a mobile home in a remote location. She was described as a “carefree person, really artistic, interested in photography, kind and gentle.”

On April 8 of that year, her boyfriend had gone to work while she was preparing for college. She believes she needed to charge her phone, but she had an electrical problem in her own home.

Her boyfriend Shane, who is now deceased, according to Catherine, allegedly suggested she use the electricity at a neighboring mobile home owned by Mr. Griffin.

Shane, who was at work, received a phone call informing him that there was a fire at the location. The remains of Mrs O’Loughlin’s body were discovered inside the burnt-out caravan.

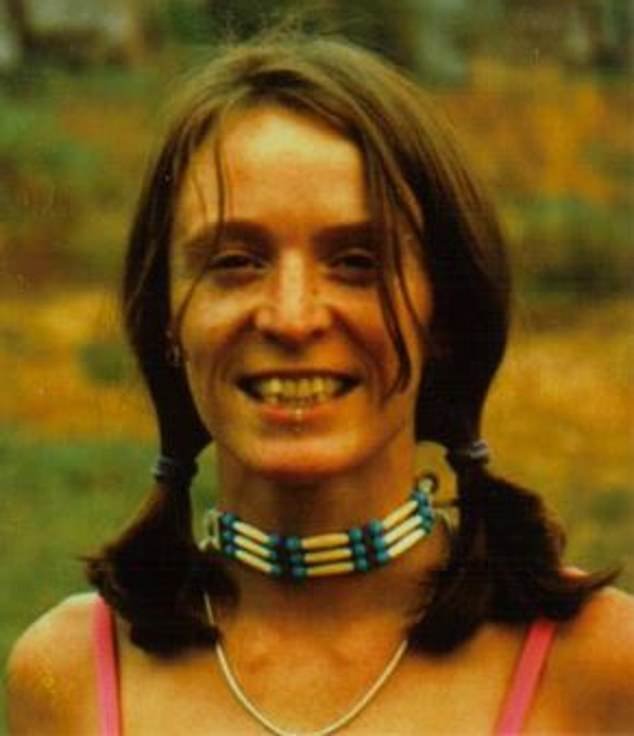

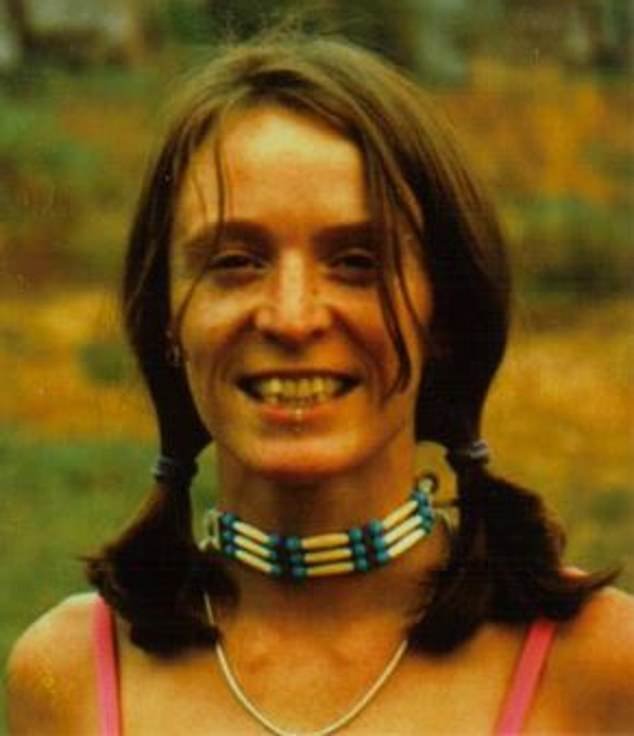

His family is still seeking justice and last month shared a photograph of Mr Griffin on the Justice for Emer O’Loughlin Facebook page.

“This is the last photo taken of John Griffin, the prime suspect in Emer’s murder,” the caption read. ‘It was taken several days after the event. “It took 19 years for this photo to become public.”

Gardaí also shared the photograph, along with a description of Mr Griffin which read: ‘Bald on top of head. He often sported a beard, which he sometimes shaved. Known by many by his nickname “Fozzie”.

He also noted that the suspect had a tattoo in his throat area, described as an Egyptian “eye of Horus.”

Sharing a statement alongside the photo, it read: “Gardaí at Gort Station are investigating the full circumstances surrounding the death of Emer O’Loughlin (aged 23) in Ballybornagh, Tubber, Co. Clare.

‘On April 8, 2005, human remains were discovered in a mobile home near where Emer lived with her boyfriend.

‘The mobile home belonging to a man named John Griffin had been completely destroyed by fire; The human remains discovered inside were later identified as those of Emer O’Loughlin.

‘On 19 May 2010, Gardaí investigation exhumed Emer’s remains, which were then taken to Galway University Hospital, where forensic anthropology tests were carried out.

‘Evidence indicated that Emer had died violently and as a result the investigation was upgraded to murder.

‘Gardaí investigators are hopeful that the public can assist in efforts to track down John Griffin, formerly of the Mervue area of Galway city. Gardaí believe John Griffin may have information that will help them and are keen to interview him as part of the investigation.

On the 19th anniversary of her murder, Ms O’Loughlin’s father Johnny and sister Pam appealed for information on RTE’s Crimecall.

Gardaí said they “believe that John Griffin is still alive and at the time of his disappearance he was assisted by an unknown person or persons to leave the island of Inis Mór.”

They added: ‘AGS has never received a missing person report regarding John Griffin. Extensive searches were carried out along the coast following the discovery of his clothing, but he has never been seen nor has his body been recovered.