Table of Contents

- Analysts believe the BofE could cut the base rate more than currently expected

British bonds could prove a lucrative bargain as analysts forecast an imminent recovery after UK government debt sold off sharply ahead of the autumn budget.

Two-, five- and 10-year bond yields have fallen almost 40 basis points each over the past month as markets have digested the impact of £40 billion in tax rises, public spending increases and the possibility of smaller interest rate cuts from the Bank of England.

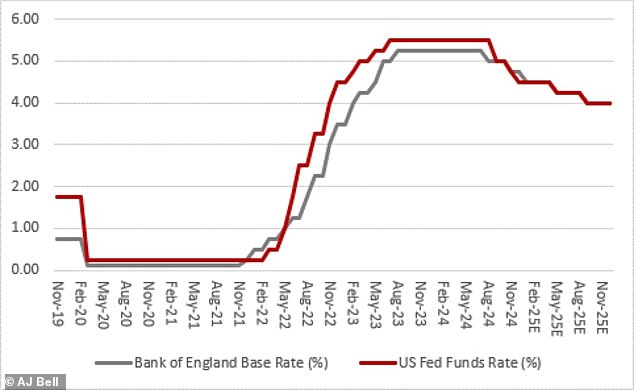

Market prices now suggest the BofE base rate will stabilize at 4 percent by the end of 2025, 75 basis points below its current level of 4.75 percent and 50 basis points ahead of terminal rate expectations. from 3.5 percent just a month ago.

Samuel Adams, an economist at UBS, blamed “divided minds over the outlook for interest rates appear to bear much of the responsibility” for the bond market swings, as opposed to “concerns about fiscally lax politicians.” .

And he added: “We believe that this is an opportunity that we must take advantage of.” After all, vibrations about the economy can change faster than we think.”

New data from the Office for National Statistics on Wednesday will shed light on the bank’s battle against inflation, with forecasters predicting the Consumer Price Index rate will rise from 1.7 to 2.2 per cent in October.

The Bank of England is no longer expected to cut the base rate again this calendar year.

Thomas Watts, senior investment analyst at Abrdn, said: “With many economists now expecting the Bank of England to pause any further rate cuts during 2024 and even reduce such moves over the next year following an inflation-inducing budget, The numbers will take added importance and could perhaps help set the tone for the rest of the year.

Markets now expect the bank to delay its next rate cut until March – or even June – next year, but significant progress on difficult services inflation this week could quickly change forecasts.

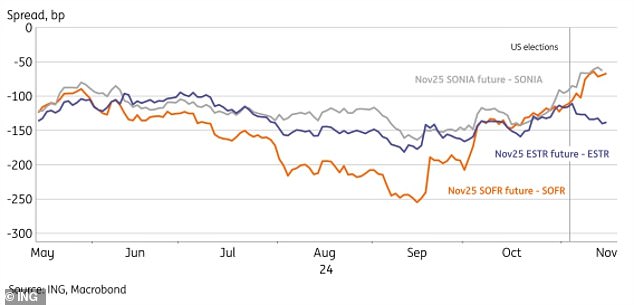

Analysts at ING said markets have “overreacted to the recent UK budget announcement” and “become too aggressive with BofE cuts”.

ING expects 10-year yields to fall back to 4 percent by mid-2025, “significantly below” their current level of 4.4 percent.

However, analysts warned that the market would need to see a “series of better services inflation figures” to convince traders “of the BofE’s ability to cut more than the meager two or three total cuts currently priced in.”

BlackRock is currently overweight government bonds, which it believes will benefit as the BofE prepares to “cut rates more than the market is pricing in given a weak economy.”

UK and US interest rates are now forecast to fall to just 4% by the end of next year.

The US elections marked a sharp divergence in European rate expectations compared to those of the US and UK.

And some groups of retail investors appear well positioned if yields – which move inversely to price – decline.

TN25, a bond maturing in January 2025 with a coupon of 0.25 percent, was the most held position among the 25-34, 35-44 and 45-54 age groups among Interactive Investor users in the third quarter.

Similarly, exchange-traded funds that track gilts saw inflows of $800 million in October, according to Invesco.

Kyle Caldwell, funds and investment education editor at Interactive Investor, said: ‘As interest rates rise, so do bond yields.

‘As a result, income seekers have more choice and can take on less risk, as the safest types of bonds, such as gilts, offer yields of around 4 per cent, compared with virtually nothing when interest rates were at minimum levels.

“Falling interest rates could act as a catalyst for a change in fortunes for alternative income strategies, as well as other investment funds that have fallen out of favor.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.