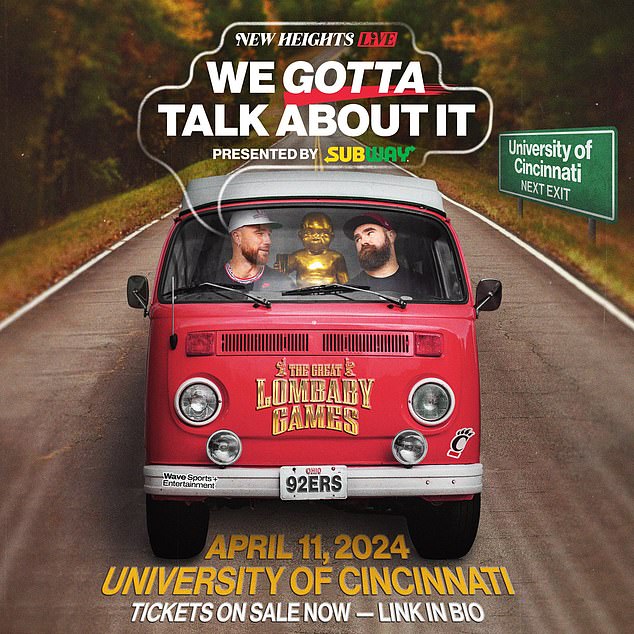

- The brothers will perform at the University of Cincinnati in a few weeks

- Tickets are free for students, but those who want VIP seats will pay more than $1,000.

- DailyMail.com provides all the latest international sports news

<!–

<!–

<!–

<!–

<!–

<!–

Tickets for Travis and Jason Kelce’s New Heights show sold Wednesday for a record amount of more than $1,000.

The Kelce brothers announced earlier this month that they would take their podcast on tour, starting with an April 11 show at Nippert Stadium at the University of Cincinnati, where they played college football.

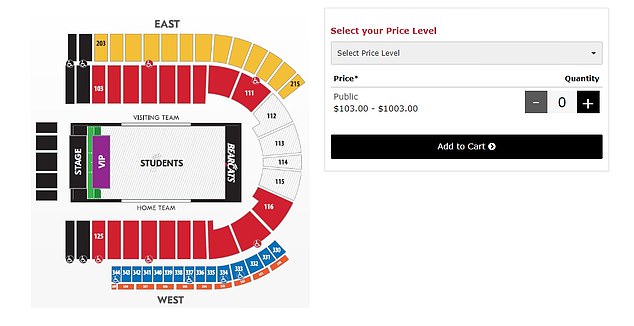

Tickets for the show went on sale Wednesday at noon ET and started at a surprising $100 for a seat in the stadium’s lower bowl.

Club and loge seats include hospitality, free food and two drink tickets – with a cash bar for additional drinks – but cost $253.

But that’s nothing in the VIP area – a standing-room-only section on the field in front of the stage, accompanied by an open bar, but costing more than $1,000.

Travis and Jason Kelce bring their podcast New Heights to a live show at their old university

Ticket prices started at $103 and VIP packages would run you over a thousand dollars.

Jason (left) and Travis (right) are both enjoying the success of their podcast this year

Students at the school will not have to pay anything for tickets; instead, they will have to try to obtain them through a lottery system.

When tickets were released, some fans were initially disappointed because the event seemed to sell out in minutes.

But eventually the University of Cincinnati was able to solve the problem and people were able to get them.

While the show is something of a homecoming for the Kelce brothers, it’s also a way for them to cash in on the hype of their popular podcast.

They saw a big increase in listeners during the last NFL season – thanks in part to Travis’ relationship with Taylor Swift.