Table of Contents

Although the Indian stock market experienced a major shake-up last month, investment firms still believe the case for investing in the world’s most populous country remains as strong as ever.

The correction, which saw stock prices fall nearly six per cent on June 4, was triggered by the surprise result of India’s general election, which required Prime Minister Narendra Modi and his Bharatiya Janata Party (BJP) to form a coalition government.

Most political commentators had thought the BJP would easily win the election, securing its third term in office since 2014.

However, the situation has eased and Indian stock prices have resumed their upward trend, and most financial experts believe that Modi will continue with policies aimed at growing the economy.

Among them is Michael Langham, an economist at investment firm abrdn.

He says the Budget due later this month should “reaffirm” the Prime Minister’s focus on “manufacturing and infrastructure development”.

That’s a view shared by Ayush Abhijeet, chief investment officer at Singapore-based Whiteoak Capital Partners.

He says: ‘Most of the economic reform agenda that Modi has overseen over the past ten years will continue.

“That means better infrastructure, increased defense spending, better public services and the development of a competitive manufacturing base.”

Whiteoak specialises in managing investment portfolios in emerging markets and in particular in India.

In total, he controls assets worth £5.5bn.

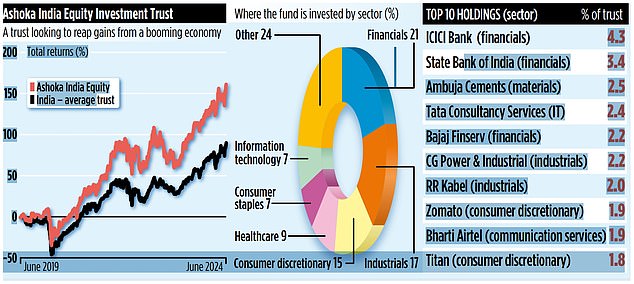

Among its range of funds is a UK-listed investment trust. Ashoka India SharesOver the past year, it has provided shareholders with a return of 40 percent.

Over the past five years, the £433m fund has returned 160 per cent. Other Indian investment trusts include Abrdn New India, India Capital Growth (run by asset manager AssetCo) and JPMorgan Indian.

The Ashoka fund has the best five-year track record. Abhijeet says Ashoka India’s equity managers try not to get distracted by politics.

“The main goal is always to find great businesses: companies that have scalability and are run by exceptional management teams,” he says.

“Once we have identified these companies, we like to buy them at attractive prices. If we manage to bring together the two key ingredients (quality and price), we have a potential recipe for investment success.”

Among the trust’s largest holdings are stakes in ICICI Bank and food delivery company Zomato.

“We first bought ICICI in March 2020,” says Abhijeet.

“It has been gaining market share from some public sector banks.” Food delivery company Zomato, he says, has benefited from its focus on fast commerce – getting products to customers’ doorsteps within 10-15 minutes.

Whiteoak’s focus on identifying great companies involves a huge commitment to research, with around 25 analysts looking for companies to invest in. “It’s not just about meeting managers,” says Abhijeet.

“It’s also about talking to suppliers, distributors and former employees. It’s what we call a 360-degree investigation.”

Ashoka India Equity’s stock ticker is BF50VS4. Its symbol is AIE.

Annual charges are 1.64 percent and the trust does not pay dividends to shareholders.

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

eToro

eToro

Stock Investing: Community of Over 30 Million

Trade 212

Trade 212

Free and commission-free stock trading per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.

Compare the best investment account for you