Table of Contents

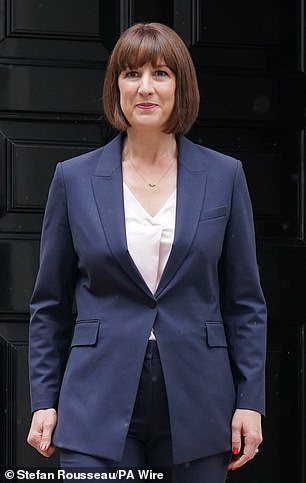

‘Black hole’: Chancellor Rachel Reeves

Rachel Reeves is expected to sign off on a raft of inflation-fighting public sector pay deals that could see the Bank of England keep interest rates at a 16-year high this week.

The Chancellor of the Exchequer is expected to lay the groundwork for tax rises in her autumn budget when she reveals the outcome of a Treasury audit of the government’s finances tomorrow. It is expected to reveal a £20bn-a-year “black hole” in the public accounts, which Reeves will try to blame on the “shocking legacy” left by the previous Conservative government.

But experts say half of the shortfall is due to the cost of funding higher-than-expected pay for millions of NHS workers, teachers and other public sector employees that Reeves herself is expected to sign off on.

Independent reviewers have recommended 5.5 per cent increases for nurses and school staff, well above the 3 per cent predicted by the Treasury.

The Institute for Fiscal Studies think tank estimates that if such a rise were extended to the rest of the public sector, the bill would rise to an additional £10bn a year.

That figure includes the cost of generous taxpayer-funded pension contributions, which for civil servants account for 29% of wages. These pay rises alone would wipe out the slim £8.9bn of headroom left by Conservative Chancellor of the Exchequer Jeremy Hunt in his March budget over the government’s borrowing rules.

Reeves’ announcement to parliament tomorrow comes days before the Bank’s rate-setting Monetary Policy Committee meets.

It has kept borrowing costs at 5.25 percent to control inflation, although price increases have slowed to within the bank’s 2 percent target.

The committee is closely monitoring the public sector pay round amid concerns that high revenue growth could lead the economy into a wage-price inflationary spiral, where high wage growth fuels price increases, which feed back into demands for higher wages, and so on.

Private sector wage growth slowed to 5.6 percent in May, in line with Bank forecasts, but a stronger-than-expected public sector wage agreement may delay interest rate cuts.

Traders expect the bank to cut rates in September, but Swiss bank UBS believes a rate cut could come as early as Thursday.

The committee split 7-2 in favor of keeping borrowing costs unchanged last month, he notes. Both Gov. Andrew Bailey and a vice chairwoman, Sarah Breeden, are seen as swing voters, having judged the latest decision to hold rates as “finely balanced.”

The unpredictable card is former Treasury official Clare Lombardelli, who joined as deputy governor last month. Anna Titareva, an economist at UBS, said: “Little is known about her voting intentions.”

Mortgage rates are already falling in anticipation of rate cuts.

Last week, Nationwide became the first lender to offer a five-year home loan with a fixed rate below 4 percent since April.

Reeves has so far refused to say how he will plug the hole in the public finances. He has ruled out increases in major revenue-generating taxes such as income tax, but experts say he could instead raise capital gains and inheritance taxes.

Another option is to allocate a tax break to pension contributions. Taxpayers on the basic rate of tax pay 80p for every pound they put into a private pension fund, while those paying 45 per cent income tax contribute just 55p, with the state making up the difference.

A flat-rate tax cut of 30 per cent would raise an extra £2.7bn a year, the IFS says.

A government spokesman said: “We value the vital contribution that nearly six million public sector workers make to the country.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investment and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free investment ideas and fund trading

interactive investor

interactive investor

Flat rate investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading commissions

Trade 212

Trade 212

Free treatment and no commissions per account

Affiliate links: If you purchase a product This is Money may earn a commission. These offers are chosen by our editorial team as we believe they are worth highlighting. This does not affect our editorial independence.