Australian home borrowers could face huge rate cuts before Christmas after fears of a US recession wiped more than $150 billion off the local stock market in just two days.

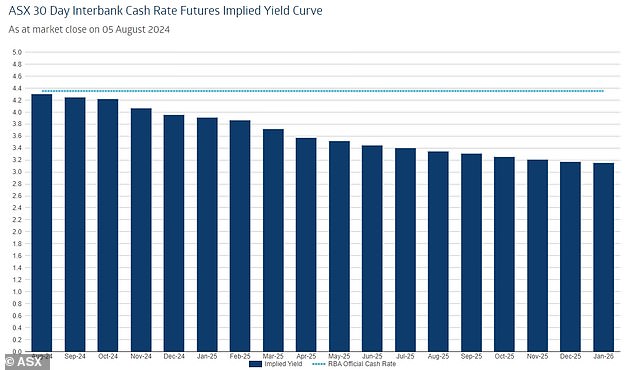

The 30-day interbank futures market now forecasts rate cuts in November and December, marking the first consecutive rate cuts since the pandemic hit in early 2020.

The benchmark S&P/ASX200 index fell 293.6 points, or 3.7 per cent, to 7,649.6 on Monday, its biggest daily drop since May 2020.

That represented a loss of 5.8 percent – or $160 billion – for the local bourse in the past two trading days, after it closed 2.1 percent weaker on Friday.

The broader All Ordinaries index fell 311 points, or 3.81 percent, to 7,859.4.

Not since March 2020, when markets were spooked by the outbreak of the COVID-19 pandemic, has the ASX experienced such a brutal two-day sell-off.

Financial markets have been thrown into turmoil amid fears that the US Federal Reserve may have to start cutting interest rates to avoid a recession in the world’s largest economy.

CommSec market analyst Steven Daghlian said a jump in the US unemployment rate to 4.3 per cent, the highest level since October 2021, was spooking financial markets and dragging down the Australian stock market.

Australian home borrowers could be in need of massive rate cuts before Christmas after fears of a US recession wiped $90 billion off the local stock market in just two days

The US unemployment rate is half a percentage point higher than in March, reminding traders Sahm’s rule theory holds that a recession is likely to occur if unemployment increases by 0.5 percentage points in a year.

“Concerns about the US economy: For most of last week there was data highlighting a slowdown in the economy, from employment to manufacturing,” he told Daily Mail Australia.

Japan’s first interest rate hike in 17 years also hit traders who had borrowed yen to buy U.S. technology stocks, sending payments app Block Inc, formerly known as Square, down 5.3 percent on the New York Stock Exchange.

“There has been attention on the carry trade in Japan with rising interest rates,” Daghlian said.

But amid the turmoil, Daghlian said the Reserve Bank was unlikely to cut interest rates on Tuesday, despite financial market concerns that central banks around the world were too slow to ease monetary policy.

“They are unlikely to do so because it would probably send the wrong signal and would certainly worry the markets,” Daghlian said.

“I don’t think the Reserve Bank is going to make any hasty decisions today that would surprise markets in any significant way.”

Australia’s stock market plunged 3.7 percent on Monday, losing more than $50 billion in one day – the worst day in more than four years.

The 30-day interbank futures market now forecasts rate cuts in November and December, marking the first consecutive rate cuts since the pandemic hit in 2020.

‘This is also the first RBA meeting in seven weeks; they don’t happen that often anymore.’

The Commonwealth Bank, Australia’s largest home lender, is expecting a rate cut in November but not December (the RBA meets in both months and now only has eight meetings a year).

Two rate cuts in 2024, as predicted by the futures market, would take the Reserve Bank’s cash rate back to 3.85 percent for the first time since June 2023.

Monthly payments on an average $600,000 mortgage would fall by $197 to $3,671 as the Commonwealth Bank variable rate fell to 6.2 per cent.

The futures market has also priced in five rate cuts through the end of 2025, which would take the spot rate back to 3.1 percent for the first time since February 2023.

Scott Solomon, a portfolio manager at T. Rowe Price, said it was almost certain the Reserve Bank’s board would not raise the cash rate from the current 12-year high of 4.35 percent at its two-day meeting in August.

“Markets saw a near 50 per cent chance of a rate hike by the RBA before the end of the year completely reversed, and now markets are pricing in a near 100 per cent chance of a cut before the end of the year,” he said.

The Australian stock market opened lower again on Tuesday, but the All Ordinaries index was down just 0.2 percent in early trading.

But in the first hour it rose 0.1 percent, a sign that bargain hunters have returned to the market.