- Sens. Joni Ernst, R-Iowa, and Gary Peters, D-Mich., introduced the bill.

- Its goal is to provide greater transparency about federal teleworker policies.

- The move comes after Ernst previously revealed that no agency has office utilization greater than 50 percent.

<!–

<!–

<!– <!–

<!–

<!–

<!–

Senators plan to hold President Biden accountable for his administration’s federal telework policies after scathing reports showed most government agency headquarters are virtually empty.

The bipartisan bill will require federal agencies to publicly share their telework policies and better track employees working from home. It will also require audits and performance reviews of remote workers.

Senators say the bill will also crack down on local pay (compensation based on a worker’s location within the US) to ensure it is not abused.

The bill comes after a bombshell report from the Government Accountability Office (GAO) found that no federal agency had more than 50 percent occupancy between January and March 2023.

That’s a staggering statistic when you consider how federal agencies spend about $2 billion a year to operate and maintain federal office buildings, and more than $5 billion a year on leases.

Senators Joni Ernst, R-Iowa, and Gary Peters, D-Mich., introduced the ‘Telework Transparency Act of 2024’ on Wednesday.

“For too long, Americans have been on hold while bureaucrats call on the phone,” Ernst said in a statement to DailyMail.com announcing the bill.

Sens. Joni Ernst, R-Iowa, and Gary Peters, D-Mich., introduced the telework transparency bill to better track federal data on remote workers and better inform decisions about how they spend taxpayer money.

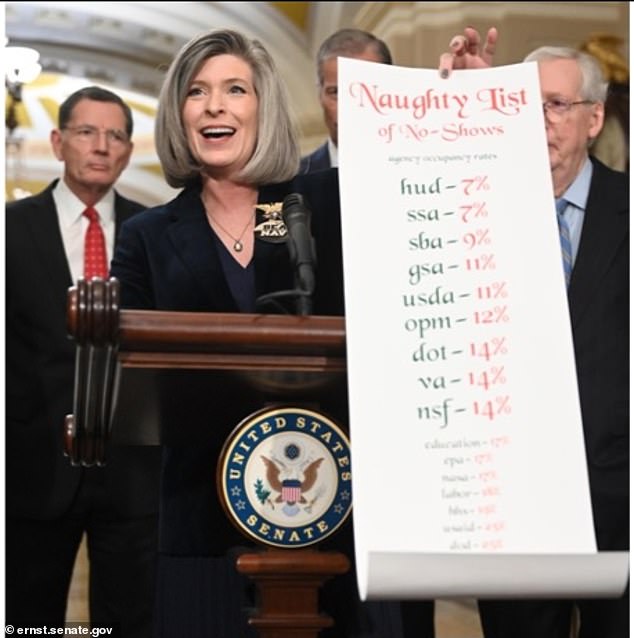

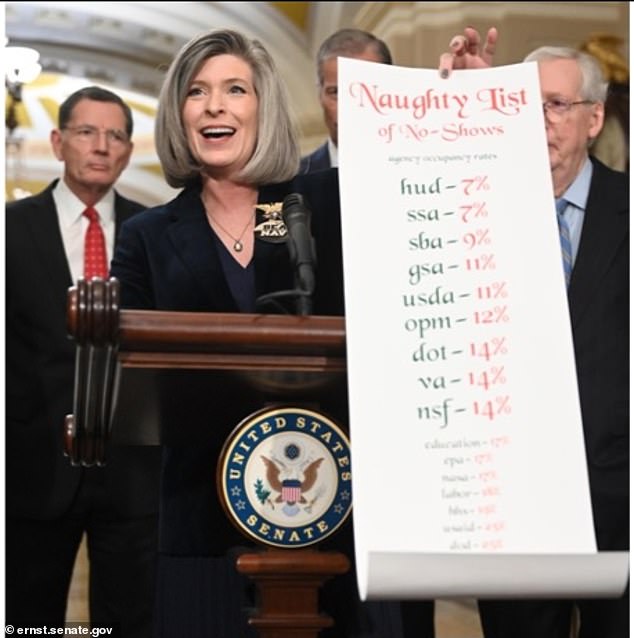

Ernst previously revealed on Decemver that not a single federal agency had more than 50 percent utilization of office space between January and March 2023.

“Since ‘temporary’ telework policies went into effect more than four years ago, the remote lifestyle has come at the expense of the people federal agencies are meant to serve.”

“My bipartisan bill will provide full transparency about the inefficiencies of teleworking, so taxpayers no longer have to pay for costly wasted space at federal headquarters and wasted local salaries.”

Lawmakers say the bill will create greater accountability for federal agencies and could end up saving taxpayers billions.

If approved, it would require periodic audits for federal agencies to understand whether employees are working from the location where they are supposed to.

Salaries can often differ greatly depending on locality. For example, people who work in St. Louis would get a much lower local allowance than those who live in the San Francisco Bay Area, where costs are generally higher.

It would also create new standards to monitor the effectiveness of teleworkers, “including customer service, delays and wait times, cost of operations, security, property management, technology investments, and hiring and retention,” according to the statement.

However, some agencies are worse than others when it comes to working from home.

Housing and Urban Development (HUD), the Social Security Administration and the Small Business Administration (SBA) all had utilization of 10 percent or less.

And more and more legislators are realizing it.

Small Business Committee Chairman Roger Williams, R-Texas, recently wrote a letter to SBA Administrator Isabella Guzmán, demanding answers about why the office “is operating at only 10 percent of its capacity.”

The Small Business Administration headquarters is operating at 10 percent capacity as many federal workers enjoy lavish telework policies.

“The SBA has one purpose: to help Main Street,” Williams said.

“It’s hard to do that effectively when you’re working from home and you’re more focused on making sure laundry is washed and folded rather than ensuring our business owners’ needs are met.”

The Republican expressed concern about the agency’s request for a $42 million allocation for rent even though the headquarters has no employees.