Table of Contents

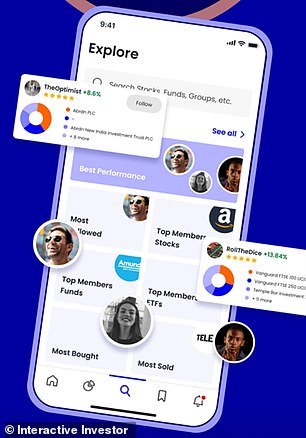

- Users will be able to discuss stock picks and compare portfolios in the new app.

ii Community will allow Interactive Investor clients to discuss investment ideas for free

Customers of investment platform DIY Interactive Investor will now be able to chat with each other online as the website launches its own social media app.

The app, ii Community, will allow users to discuss investment tips, stock picks and compare portfolios for free.

Interactive Investor, owned by Abrdn, said ii Community users will be able to use performance data to compare their portfolio to others, monitor growth and get weekly performance reviews.

“Users can chat with like-minded investors, exchange ideas and exchange strategies,” added head of equity strategy Lee Wild.

“The ii Community app allows ii clients to discuss market trends, investment ideas and winning trades, and share insights on important global events, policy changes and economic releases.”

Interactive Investor hopes to connect with the growing influence of social media on DIY investors by launching its own platform.

Research carried out by Opinium on behalf of Interactive Investor last year found that 30 per cent of working-age Brits see social media as a useful source of investment information.

It is most influential for younger investors: 16 percent of respondents under 40 identify social media as their biggest influence on learning about investing, retirement and pensions.

Similar efforts by investment firms to build social platforms for users include eToro’s Social Trading and Trading 212’s 212 Social.

Many active retail investors are also known to discuss trading on more generic social platforms, particularly Reddit, Youtube and X (formerly Twitter).

This has not gone unnoticed by regulators, with the Financial Conduct Authority becoming increasingly concerned about the influence of unqualified financial advice influencers – or ‘finfluencers’.

Interactive Investor’s research also found that investing is seen as “too complicated” by 58 per cent of Brits and “intimidating” by 56 per cent. Another 46 percent also believe the investment process takes too much time.

The firm said the standalone app, which will be separate from its investing platform, aims to “make investing less intimidating” by creating a forum for users to ask questions anonymously under a chosen name.

Wild added: ‘Social media is a medium that is not going away and, if used responsibly, can clearly be a valuable channel to reach people and educate them about investing. It’s something that Interactive Investor, as a platform, takes very seriously.

‘At ii Community, we already have a number of engaged users on the platform, who are eager to use this new social platform as a tool to have open and honest conversations about their investment journey, with the aim of helping themselves and others to learn. further.’

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.