- Rangers’ Fabio Silva had a golden opportunity to score but fell comically

- Fans accuse him of taking a cheeky shot despite the easy scoring opportunity.

- Man City exhausted?! We are all tired, but it is dangerous to spread that message. What it’s all about are the great games: Listen to the podcast Everything is Beginning

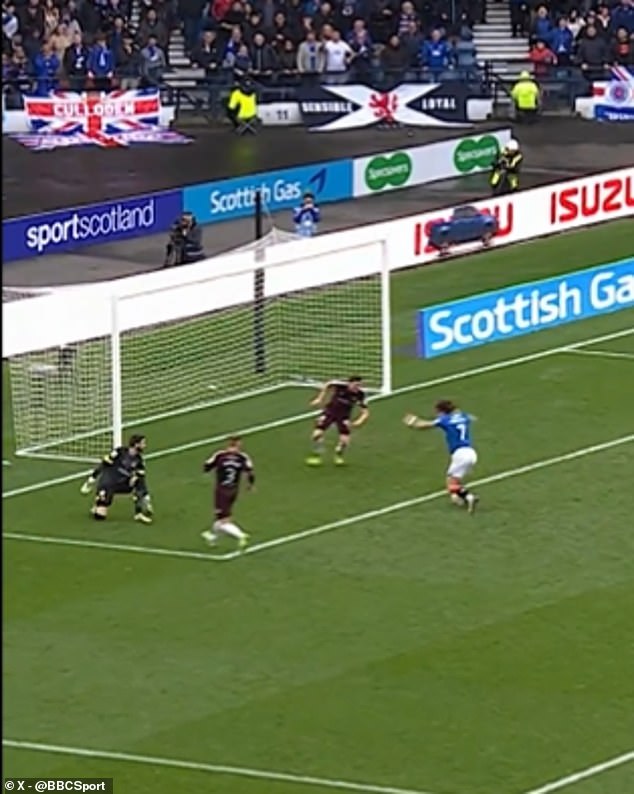

Fans have mercilessly mocked Rangers striker Fabio Silva after he theatrically fell into the box without any challenge in the Scottish Cup semi-final.

The striker, on loan from Wolves, had the chance to make it 3-0 in added time when Cyriel Dessers gave him a selfless goal a few meters from goal, instead of trying to score a hat-trick.

But Silva raised his arms in the air and took a rare tumble despite not being under pressure and having an easy chance to finish, with only one defender on the line.

Ally McCoist offered the possibility of him falling because the ball was played behind him and he got trapped, but fans were quick to label him a jumper.

“He’s diving, anticipating contact, but there was no one near him.” A shame,” wrote a viewer on X, formerly Twitter.

Fabio Silva was mocked by fans after he suffered a theatrical fall in a Scottish Cup semi-final.

Silva, on loan from Wolves, was a few meters from the goal and fell without problems

He’s been called “shameful” about the fall, but Ally McCoist believes he simply lost his balance.

“You have to wonder what the mentality is of a guy who would rather dive in and cheat than put the ball in an open goal,” said another cynic.

The same thing he did in the derby two weeks ago! ‘We all know what he was doing!’ wrote one.

However, there were some light-hearted spectators who preferred to take a funnier perspective on the fall.

Mail Sport’s Chris Sutton, star of the podcast It’s All Kicking Off with Ian Ladyman, was one of them.

“People who say Silva took a dive here are biased… that’s a penalty,” he joked.

‘Stone wall penalty. It should have been red. “The ball was lucky to stay in the field,” one comedian joked.

“Stonewall penalty,” said another.

In the end, Silva’s mishap didn’t really matter as Rangers reached the Scottish Cup final with a 2-0 victory.

It’s unclear if Silva was lunging, somehow thought he had been tagged, or just got confused.

While Silva accepted the criticism, many commentators, including Mail Sport’s Chris Sutton, saw the funny side.

Even if they fail to win the Scottish Premiership title (a fate that looks increasingly likely as they are in poor form and three points behind Celtic with five games remaining), they will have the chance to have one last laugh at their Glasgow rivals. in May. 25.

In fact, Celtic beat Aberdeen 6-5 on penalties after a 3-3 draw to book their place in the final.

Silva’s form in Scotland could be a cause for concern.

He joined Wolves from Porto for £35m in 2020 but failed to make an impression and received several loans.

He was loaned to Rangers in January, where he scored four goals in 19 games.

However, he’s still only 21, so he has plenty of time to be more clinical.