- The cost of home insurance is constantly increasing, and rising claims are the reason

- Insurers say the increase is due to extreme weather conditions such as heat, flooding and frost.

Home insurance costs have risen 20 per cent in a year, with insurers blaming bad weather for the surge in claim payouts.

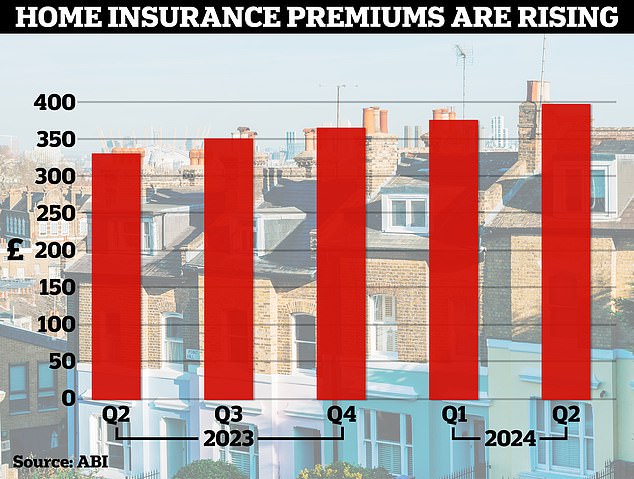

The average buildings and contents insurance premium was £396 in the second quarter of 2024, according to the Association of British Insurers.

This represents a 5 per cent increase in three months from the £375 paid in the first three months of 2024, and a 20 per cent increase from the £329 paid for a typical home in the second quarter of last year.

Rising: Home insurance costs are steadily increasing, and higher payouts are to blame

The average price of a building-only home insurance policy was £321 in Q2 2024, up 7% from the previous quarter. For contents-only cover, the average price paid was £137, up £5 (4%) from Q1 2024.

The ABI said unusually extreme weather was the reason for the steady rise in home insurance premiums, as it had led to an increase in the cost of claims.

The average home insurance claim payout rose 16 per cent from the previous quarter to £5,284.

Overall, claims for damage to homes caused by storms, heavy rain and frozen pipes hit 144 million pounds in the second quarter of this year, insurers said.

Home insurance claims subsidy payments also rose in the second quarter of the year, reaching £60m, the highest quarterly figure on record and 12 per cent higher than the £53m paid in the first quarter of 2024.

Last year was also expensive for climate-related claims, with £573m paid out during 2023.

The ABI said the increase in bad weather claims in 2023 was driven by a series of storms including Babet, Ciaran and Debi.

Landlords also received £153m in payments for burst pipes, most of which occurred in early 2023 due to the cold start to the year.

Consultants EY say home insurers lose money on underwriting (the work of balancing premiums collected and claims paid), while ideally they make a profit.

EY figures show that in 2022, for every £1 property insurers received in home insurance premiums, they paid out £1.22 in claims and expenses.

EY expects further losses in 2023, making it the fourth consecutive year that property insurers will pay out more in claims than they receive in premiums.4

Louise Clark, policy adviser at ABI, said: ‘Home insurance continues to play a vital role in supporting customers when the worst happens.

‘Despite increasing cost pressures, insurers remain committed to doing everything they can to offer competitively priced coverage and assist their customers during a claim.

“Our latest figures demonstrate the devastating impact that severe weather can have on people and their homes. That’s why it’s important that the Government seizes the opportunity to reform the planning system and focus on prevention and resilience measures to help reduce our nation’s vulnerability to the effects of climate change.

‘Urgent action by the Government to address surface water flooding and maintain investment and maintenance of flood control projects will also help reduce the future impact of flooding.’

Households are also paying huge amounts for car insurance premiums – the typical driver will pay £622 a year for motor cover in the second quarter of 2024.

This represents a 2 percent drop compared to the first quarter, but still a 24 percent increase in one year.

Car insurers say premiums have had to soar to pay for their inflated costs, such as more expensive engine repairs, claims costs and rising thefts.

The ABI’s home and motor insurance figures are the most accurate as they are based on actual premiums paid, whereas many other indices use premium quotes.