Tim O’Brien, Executive Vice President and Chief Financial Officer of N-able Inc (New York Stock Exchange:NABL), sold 22,148 shares of the company on August 15, 2024. The transaction was reported in a recent SEC FilingFollowing this sale, the insider now owns 565,222 shares of N-able Inc.

N-able Inc specializes in providing cloud-based software solutions for managed service providers, enabling them to support digital transformation and IT service management for small and medium-sized businesses.

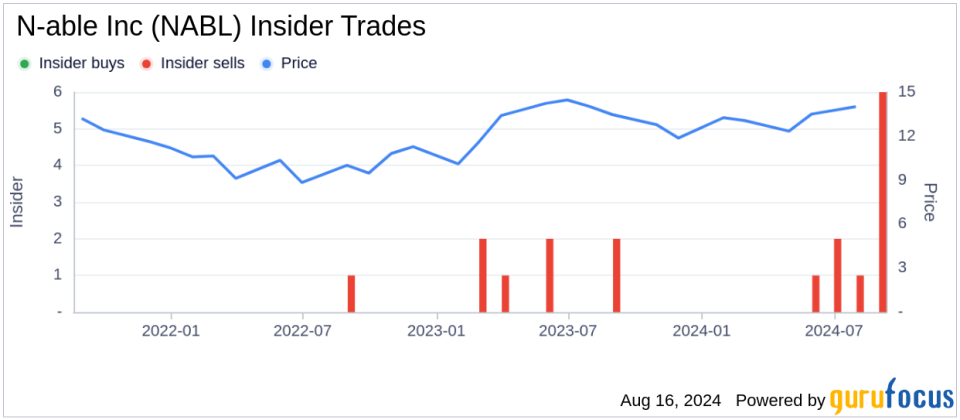

Over the past year, Tim O’Brien has sold a total of 100,205 shares of N-able Inc. stock and has made no purchases of shares. This recent sale is part of a broader trend within the company, where there have been 12 sales and no purchases of shares by insiders over the past year.

On the date of the sale, N-able Inc. shares were trading at $12.81, giving the company a market capitalization of approximately $2.37 billion. price-earnings ratio The company’s value stands at 75.24, above the sector median of 25.32.

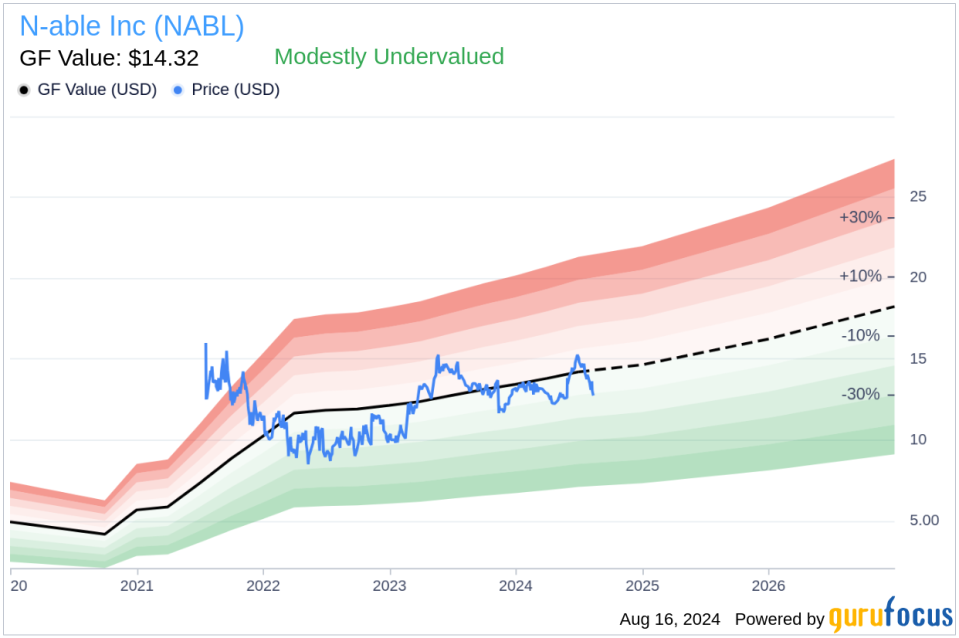

According to the GF ValueThe intrinsic value of N-able Inc is estimated at $14.32 per share, which suggests that the stock is modestly undervalued with a GF P/B ratio of 0.89.

The GF value is calculated based on historical trading multiples such as the price-to-earnings ratio, price-sale ratio, Price-to-book ratioand price to free cash flow ratioadjusted to the company’s past performance and expected future business results.

This insider selling could be of interest to investors who follow insider behavior as an indicator of future company performance and valuation adjustments.

This article, generated by GuruFocus, is designed to provide general information and is not personalized financial advice. Our commentary is based on historical data and analyst projections, using an unbiased methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to buy or divest from any stock and does not consider individual investment objectives or financial circumstances. Our goal is to provide long-term analysis based on fundamental data. Please note that our analysis may not incorporate the latest price-sensitive company announcements or qualitative information. GuruFocus does not have any positions in the stocks mentioned herein.

This article first appeared in Guru Focus.