- Chalerm Yoovidhya allegedly sent a family member to spy on Red Bull headquarters

- He and his family step up their involvement in team management

- There are fears changes are coming with Horner under immense pressure

<!–

<!–

<!–

<!–

<!–

<!–

Red Bull’s majority owner has reportedly sent a family member – dubbed the ‘Thai Spy’ – to keep tabs on the Christian Horner scandal and the company as a whole.

The spy examined each department in detail after visiting the company’s headquarters in Salzburg.according to PICTURE.

There are fears that Thai owners are on the verge of sweeping changes, as the ruling family has generally been hands-off so far.

Horner and the direct F1 team work from a base in Milton Keynes.

He was mired in scandal following accusations of “inappropriate behavior” by a female employee ahead of the 2024 season, although an internal investigation cleared him.

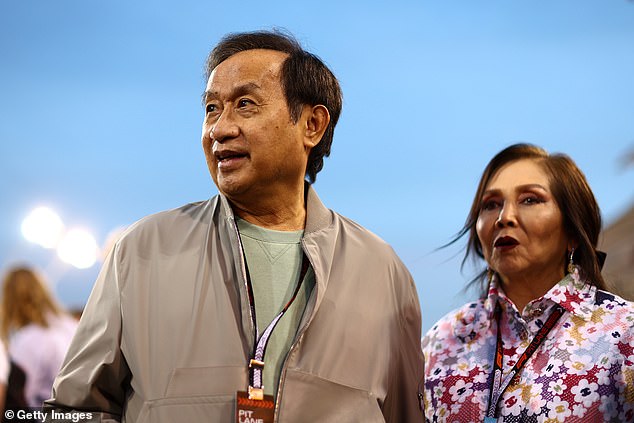

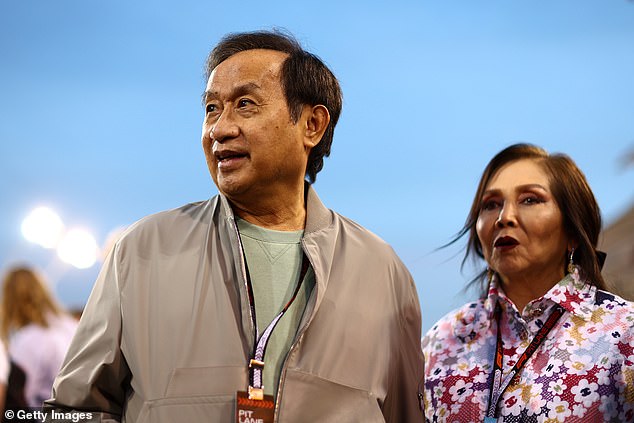

Red Bull majority owner Chalerm Yoovidhya (right) ‘sent a spy to Red Bull headquarters in Austria’.

Yoovidhya’s family member’s spy reportedly examined every department in detail

Hundreds of messages allegedly from Horner – some of a sexual nature – were leaked to the media and F1’s major powers, but Red Bull insisted he would not be sacked and his accuser was suspended.

Chalerm Yoovidhya owns 51% of Red Bull and has a staggering personal fortune of around £26.3 billion, as reported Forbes Last year.

His family is considered the second richest in Thailand.

According to BILD, they are ready to assert more dominance over how Red Bull’s F1 operations are run.

The company’s founder, Dietrich Mateschitz, an Austrian billionaire who died in 2022, previously had enormous influence on the team.

On his passing, Horner said: “He was an incredible man and he loved Formula 1. We owe him a lot as a team.

With Mateschitz no longer there, the Yoovidhyas would be interested in intensifying their involvement, hence this whirlwind visit.

Previously, they made do with occasional visits to the races.

The scandal surrounding Horner has been a public relations disaster for F1 and many high-ranking figures have spoken of the need to resolve the situation quickly.

Horner, husband of former Spice Girl Geri Halliwell, faces huge pressure at Red Bull amid ‘sex texting’ scandal after employee accuses him of ‘inappropriate behaviour’

The 50-year-old team principal was exonerated after a Red Bull investigation and her accuser was suspended, but she has since launched an appeal.

The woman at the center of Red Bull’s text message scandal last week launched an appeal against the company’s findings exonerating Horner.

An internal investigation involving KC cleared him of any wrongdoing last month and he remained in charge of the first two races of the season.

Horner, husband of former Spice Girl Geri Halliwell, is also expected to be on duty for Sunday’s Australian Grand Prix in Melbourne.

But he faces added pressure with the announcement of the appeal, which was lodged with parent company Red Bull GmbH in Salzburg, rather than the Milton Keynes-based racing team.

The woman, who was suspended on full pay, recently changed lawyers – a precursor to her latest legal move.

MailOnline has contacted Red Bull for comment.