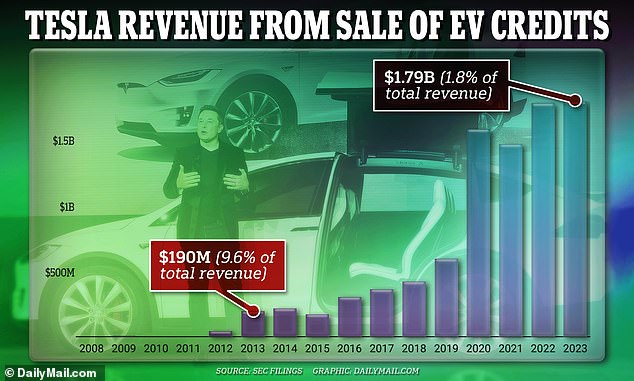

- Tesla made $1.79 billion selling regulatory credits last year, its latest filings show

- This brings its total earnings to almost $9 billion over the past 15 years.

- The percentage of income generated through the sale of credits falls

Tesla made nearly $1.8 billion last year by taking advantage of rival automakers that failed to comply with emissions regulations.

Because it makes only electric cars, the company gets surplus regulatory credits in the United States, Europe and China that it can sell to other automakers that would otherwise be penalized for not making enough low-emission cars.

Last year, the sale of these credits amounted to 1.79 billion dollars, according to Company presentations published last week.. This is more than in any other year since its incorporation.

Over the past decade and a half, the company has earned a total of nearly $9 billion selling credits.

The good news for Tesla investors is that the percentage of its revenue generated by selling regulatory credits is falling.

Last year, the sale of regulatory credits earned Tesla $1.79 billion, according to company filings.

In many regions, automakers must produce a certain number of zero-emission vehicles (ZEVs). How many they have to make depends on how many non-compliant gas-burning cars they sell in that region.

Because Tesla only makes battery electric vehicles, it accumulates excess credits that it sells for profit to other automakers that don’t make enough zero-emission vehicles to meet regulations.

California was one of the first regions to introduce a zero-emission vehicle policy back in 1990, according to the Pembina Institute.

Tesla’s reliance on selling credits to generate revenue is often seen as a flaw in its business model and is seen by investors as a red flag.

Famed investor Michael Burry, who appeared on the Big Short, claimed in 2021 that he made a $534 million bet that Tesla’s stock price would fall, citing its reliance on regulatory credits.

As other companies start making more and more compliant cars, demand for credits is expected to fall. There is no fixed price for a loan, but its value is determined by supply and demand.

The good news for Tesla investors is that their reliance on credit sales appears to be decreasing.

Ten years ago, in 2013, he relied on them for nearly 10 percent of his total income, old documents show.

But in 2023, its sale only accounted for about 1.8 percent of its total revenue of $98 billion. This is the lowest percentage in more than a decade.

Ford has revealed that it was losing almost $50,000 on average for every electric car it sold last quarter.

Last week, Ford revealed that it was losing $47,000 on average for every electric car it sold in the final three months of last year.

However, its executives assured investors that the sale of electric vehicles was still important because it allowed them to sell more profitable internal combustion engine cars.

“We can sell up to a dozen ICE F-150s or other profitable ICE vehicles for every Lightning we sell,” Chief Financial Officer John Lawley told investors.

Therefore, establishing how much you can afford to lose on the sale of an electric vehicle is the “mother of all optimization models,” Lawler said.

As long as regions like the EU impose unachievably strict emissions regulations on major automakers, the sale of regulatory credits will likely remain a lucrative source of revenue for Tesla.