Its sunny climate, expansive state parks and relative affordability attracted an influx of buyers during the pandemic.

But after two years of rapid price growth, Austin’s housing bubble finally appears to be bursting.

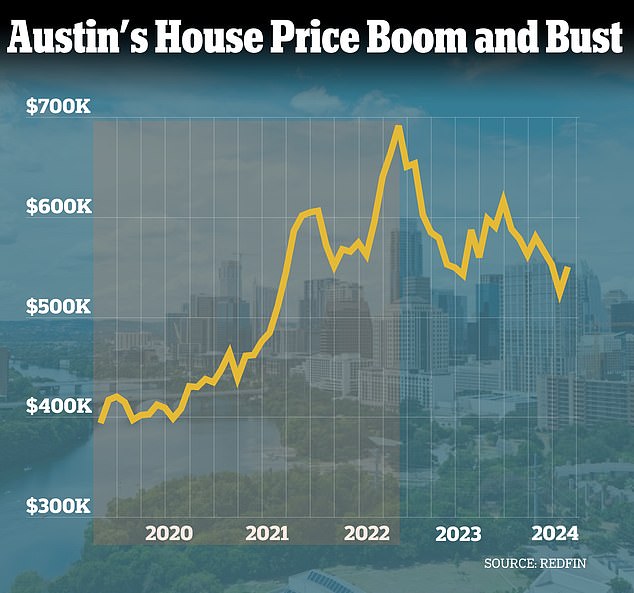

Properties in the Texan city typically sell for $525,750 after falling nearly $150,000 from their peak in May 2022, according to figures from Redfin.

It marks a stunning U-turn in demand for Austin, which was seen as the epitome of the Sunbelt’s real estate boom during the pandemic. The region proved particularly popular among well-paid tech workers who were left unshackled from their San Francisco offices by the lockdown.

But a sudden slowdown in jobs and population growth – ahead of a period of overbuilding – has caused both prices and rents to plummet.

Properties in the Texan city typically sell for $525,750 now, after falling nearly $150,000 from their peak in May 2022, according to figures from Redfin

Austin’s sunny climate, expansive state parks and relative affordability attracted an influx of buyers during the pandemic

Data from Zillow shows that the average rent price in Austin is now $2,112, down from a high of $2,395 in June 2023.

The problem is so extensive that Moody’s Analytics estimates that homes in Austin are 35 percent overvalued.

To calculate how ‘overvalued’ a market is, experts look at the long-term relationship between house prices and the factors that drive demand. Demand includes average incomes, household formations and the cost of building properties.

Moody’s Analytics economist Matthew Walsh told DailyMail.com: ‘Austin saw strong increases in net migration during the pandemic.

“Back then, housing was very affordable and many people moved from areas with very high costs on the coast. They moved with a lot of cash and pushed the prices up.

‘But these kinds of rapid price increases are unsustainable. Prices still have a way of falling.’

Between March 2020 and May 2022, the median sales price for a home in Austin increased from $420,000 to $669,000.

However, rising mortgage rates – pushed up by the Federal Reserve’s aggressive tightening cycle – have since poured cold water on the real estate market as a whole.

The average interest rate on a 30-year fixed-rate home loan is now 6.74 percent, according to government-backed lender Freddie Mac.

That’s almost double where they were in March 2022, when they hovered at 3.76 percent.

This means that a buyer today buying a $400,000 home faces paying about $700 more per month on their mortgage than they would have two years ago. This analysis assumes a payout of 5 percent.

Between March 2020 and May 2022, the median sales price for a home in Austin increased from $420,000 to $669,000

Moody’s Analytics estimates that homes in Austin are 35 percent overvalued. Pictured: a home in Austin, Texas, for sale for $639,000 on Zillow

Data from Zillow shows that the median rent in Austin is now $2,112, down from a high of $2,395 in June 2023. Pictured: an Austin, Texas home for sale for $525,000

Rising prices have created a ‘lock-in effect’ where buyers do not want to give up their cheap deals.

America’s real estate market has been nearly frozen as a result. In the first week of March, applications for home purchases were 11 percent lower than in the same period a year ago, according to the Mortgage Credit Board.

Austin is among the worst-hit areas, in part because prices rose so unsustainably quickly there in the first place.

Americans flocked to America’s Sunbelt during the pandemic, as a widespread shift to working from home shacked workers from big cities like New York and San Francisco.

At the time, properties were priced so low that buyers ran to get them up. And Austin’s picturesque landscapes also gave stranded workers much-needed respite from the interior of their homes.

However, new research shows that the Sunbelt no longer provides the same savings for those moving from major cities as it once did.

Recent analysis by Smart Asset found that someone moving from New York City to Austin in 2019 would have saved $154,564. Last year, that savings dropped to $116,195 — about $38,000 less.

Walsh said: ‘At its peak, Austin’s housing market was over 60 per cent overvalued.

“In general, in Texas, a lot of housing has been built in the last few years at a time when demand is stagnating because of affordability.”

A recent report by Texas Realtors found that home sales in the Lone Star State were down 11 percent by 2023. Its findings showed that Austin-Round Rock saw the largest drop in prices of any other metropolitan area in the state as it fell with 10.4 percent.