Table of Contents

- Analysts Say Changes to Inheritance Tax on Small Business Stocks Could Lose Revenue

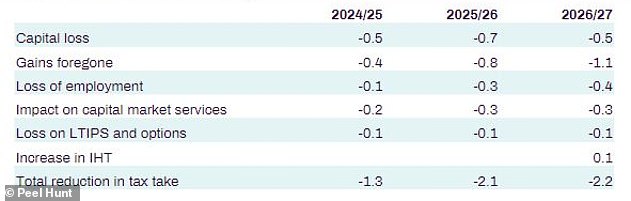

Analysts have warned that autumn budget changes to inheritance tax on investments in UK small businesses could lead to a £2.2bn-a-year reduction in Treasury revenue.

Chancellor Rachel Reeves last month revealed a restructuring of IHT, which will see a freeze on the nil rate band at £325,000 until 2030 and taxable pensions from 2027, as well as changes to agricultural property relief and business.

Investments in AIM shares were fully exempt from the 40 per cent IHT, but from April 2026 this will change to 50 per cent BPR relief, which equates to a 20 per cent IHT charge, up from zero previously.

HMRC says this will see the tax cost to the Treasury fall from £185 million a year to £92.5 million.

But research by broker Peel Hunt suggests an imbalance between the IHT charged on private assets versus shares in Britain’s junior stock market could hit the Treasury’s tax take.

Peel Hunt said: ‘The problem is that AIM shares will be excluded from the £1m allocation being provided to farms, family businesses and private companies.

The City Council continues to reflect on the possible impact of the Autumn Budget

‘The result is that qualifying private investments are included in the £1 million allocation, while AIM companies are not.

“The consequence will be that private companies will be prioritized for new investments, and owners of existing AIM investments will have an incentive to move into the private sector in order to save up to £200,000 in IHT.”

Consequently, the broker believes that an exodus of AIM shares in favor of private investments, as well as a lack of incentives for new allocations, will cost the Treasury £2.2bn by the 2026/2027 financial year.

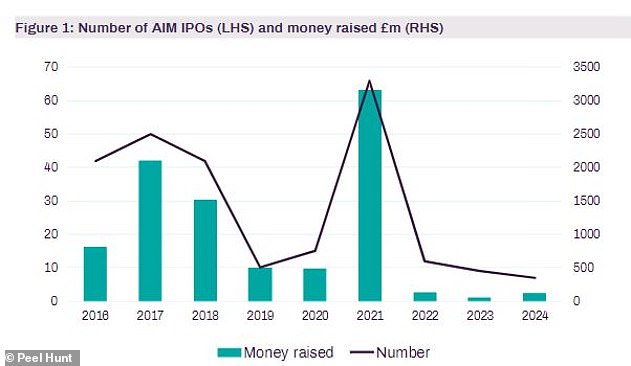

London’s AIM market has been depressed for some time, with investors and managers frustrated by the lack of share price momentum, poor liquidity and weak trading volumes.

New listings have become increasingly rare, while several companies have left the stock market.

There was some relief for AIM investors when the Chancellor stopped short of removing IHT relief entirely.

Bearish: AIM market has struggled to raise cash in recent years

But Peel Hunt said even Reeves’ more limited changes to IHT relief will have unintended consequences for the rate and Treasury tax collections.

The analysts said: “We expect the budget changes to result in an increase in funding for private vehicles, particularly given the changes to pension tax.

‘These vehicles generally aim to deliver a steady return (around 3 per cent) and focus on capital preservation, providing additional appeal now that tax relief has been reduced.

“This is very likely to create future problems given the lack of liquidity in most of these vehicles, which already have approximately £10bn (in assets under management).”

Peel Hunt added that the Government should review the exclusion of the AIM investment from the £1m BPR allocation, confirm that the 50 per cent BPR allocation will remain indefinitely and provide guidance on whether AIM shares held in pensions they can receive 50 percent. relief’.

Peel Hunt believes IHT changes could cost the Treasury £2.2bn by 2026/27

The broker also believes the Government should reduce the level of capital gains tax on AIM to “stimulate investment in AIM and increase tax revenue”, while looking for ways to accelerate investment in AIM through the British Business Bank and the Business Growth Fund.

Peel Hunt said: ‘If we want AIM to survive and prosper it is essential that capital is attracted and the market functions well.

‘The good news is that there are many high-quality growth companies listed on AIM, so the problem is the demand side.

‘We urge the government to review the £1 million allocation to consider the inclusion of AIM businesses. This should ensure that capital remains in AIM rather than flowing into private assets. “We believe the unintended consequences will be substantial if this is not addressed.”

DIY INVESTMENT PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-to-use portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free Fund Trading and Investment Ideas

interactive inverter

interactive inverter

Fixed fee investing from £4.99 per month

sax

sax

Get £200 back in trading fees

Trade 212

Trade 212

Free trading and no account commission

Affiliate links: If you purchase a This is Money product you may earn a commission. These offers are chosen by our editorial team as we think they are worth highlighting. This does not affect our editorial independence.