Table of Contents

Family inheritance disputes are on the rise and more challenges arise in the first step, obtaining probate, which unlocks an estate so it can be distributed.

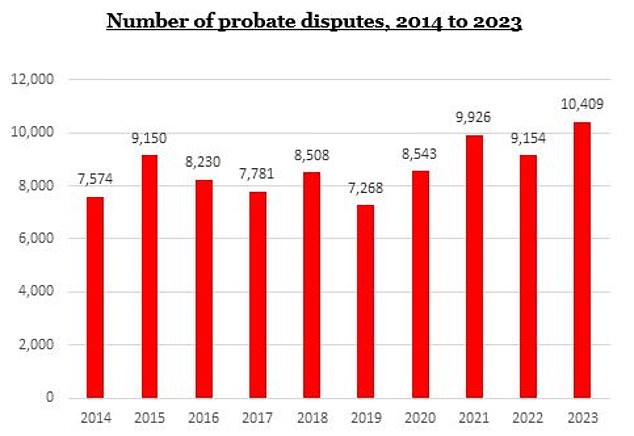

More than 10,000 applications to stop the granting of probate were submitted last year, 14 percent more than in 2022 and 43 percent more than the year before the pandemic, according to new figures.

Probate disputes can involve family disagreements over who should be in charge, but they can also be the precursor to a full-blown legal battle over a will.

Inheritance disputes: High house prices and DIY wills during Covid lockdowns may have led to increased family disputes at the succession stage

The number of applications to introduce a “caveat” against succession (which initially lasts six months but can be extended) has fluctuated over the years but is at its highest level in at least a decade.

Not all inheritance disputes involve a waiver, so there may be more cases underway than recent figures reveal, says law firm Nockolds, which obtained the data through a Freedom of Information request to the Ministry of Justice.

Nockolds suggests that high house prices and DIY wills during Covid lockdowns may have led to increased family disputes at the probate stage when dealing with inheritances.

Succession disputes have increased over the past year. Source: Nockolds and Ministry of Justice

Rising house prices increase the risk of inheritance disputes

High property values, particularly in London and the South East, are making property disputes increasingly “high stakes” if successful, says Michael Henry, senior associate at Nockolds.

“As living standards have declined, there is a growing desire by family members to challenge the validity of wills that leave property to different beneficiaries,” he says.

“People are increasingly reliant on inheritance to access property or to live on in retirement. If someone is not named in a will or inherits less than they expected, this can give rise to a claim.”

He adds that the increasing complexity of modern family structures is contributing to disputes over inheritance.

Many people have been married before and have children and stepchildren, so families are potentially more divided and the likelihood of someone feeling wronged is significantly higher.

Henry adds: “The rules on intestate succession, which govern the distribution of an estate when someone dies without a will, do not address the situation of a surviving cohabitant, which is often the basis of a claim.”

DIY Wills, COVID-19 Lockdowns, and Inexperienced Executors

Nockolds also identifies the trend towards do-it-yourself wills, accelerated during Covid lockdowns, as a contributing factor to probate disputes.

Michael Henry, Senior Associate at Nockolds: People are increasingly relying on inheritance to access property or to cover their needs during retirement

He says wills can contain omissions and errors and be open to interpretation, and this can be exacerbated when a family member takes charge of the succession themselves.

Nockolds explains that during the pandemic many wills were made under restrictions and in unfavourable circumstances.

Because of lockdown and social distancing, the usual measures to ensure people were able and free from undue influence may not have been able to be taken, he said.

According to Nockolds, there were also greater opportunities for fraud and undue influence because people were isolated from those who might normally intervene.

“Anyone who has made an emergency will on their own during lockdown should consider reviewing it now with the benefit of legal advice,” says Henry.

Meanwhile, family members or friends are often appointed as executors of wills. They can do this on their own or have the option of obtaining legal advice, in which case the fees are disbursed from the estate.

“If the person administering the estate is a family member with no experience as an executor, mistakes are more likely to be made, which can lead to legal action,” Henry says.

‘Wills are often complex and contain legal terminology that can be difficult for a layman to understand.

‘A mistake can result in assets or money being distributed to the wrong person. Worse still, if a family member acting as executor is also a beneficiary, that can lead to outright fraud.

‘Lack of mental capacity can also be a trigger for claims as people live longer and make changes to their wills at an older age, which could later be challenged.’

How do “warnings” work in inheritance grants?

A successful probate application gives someone the legal right to distribute an estate.

If you object to a person having such responsibility, for example because you think it is unsuitable, or if you question whether the will is legal, you can ‘enter a caveat’ to prevent probate being granted.

A caveat lasts for six months and can be extended for another six months, but the person who applied for probate can fight back by giving a formal “caveat” against you, and the whole process can end up being costly and lengthy.

Nockolds says there has been an increase in cases where a beneficiary of a will feels that the person seeking probate is unfit to administer the estate.

Reasons may include an executor behaving prejudicially toward one or more beneficiaries, causing unnecessary delays, being irresponsible with money, or having a conflict of interest.

Nockolds notes the following about the warnings:

– More than one person can apply for a caveat, if for example several family members dispute the validity of a will, although in these cases they can work together and give joint instructions to the lawyers.

– Legal reasons why caveats can be used to stop probate include lack of testamentary capacity to make a valid will; undue influence; fraudulent slander – ‘poisoning the mind’ of a testator against a legitimate beneficiary; falsification or failure to properly witness the will; and unsuitability of the appointed executor due to serious misconduct or a conflict of interest.

– The approximate cost of hiring a solicitor to obtain a caveat is £250 plus VAT, but further work is likely to be needed to explore the inheritance dispute, and this varies from case to case.

– The first step in preventing a contested will from moving forward to probate is the relatively low cost when you consider the financial implications if a contested will does go to probate and assets are distributed according to its terms.

– You can try to remove a warning by using a formal document known as a caveat, but the person objecting can file an “appearance” document within 14 days, at which point the warning becomes permanent and can only be removed by consent or a court order.

The Gov.uk website explains how Stopping a succession request by requesting a warningand how Responding to a challenge against your probate application.

It only provides basic information and it is best to seek legal advice if you are determined to introduce a warning or remove one, as the process is likely to become increasingly complicated and expensive.

Kevin Modiri, Partner at Nelsons: The fairer your will is to all the parties that need to be included, the less likely it is to be challenged

How to avoid family disputes over inheritances

There is no foolproof way, but there are some practical steps you can take to avoid a family feud after your death, according to Kevin Modiri, a partner at Nelsons who deals with inheritance disputes.

If any problems arise, contentious disputes over successions and inheritances are a highly specialised area, he adds.

‘It is important to consult with an attorney who is a member of the Trust and Estate Litigation Attorneys Association to ensure that the dispute is resolved as efficiently as possible.’

Kevin Modiri offers the following advice.

1. Make sure you have a will in place. Consult a will and estate attorney to help you draft your will. he writes.

The attorney should keep a detailed note of his discussions regarding each item set forth in the will.

This will help resolve any disputes about your wishes and provide valuable evidence in support of your last will and testament.

2. Talk to your family about the content of your will so that no one is surprised after your death.

Often, it is the surprise and heightened emotions of the moment that can lead to hasty decisions in matters such as disputes.

3. Do not take extreme positions in your will, such as excluding one of your children.

The fairer your will is to all parties who need to be included, the less likely it is to be challenged.

4. If you are preparing a will for an elderly person or someone whose mental capacity may be compromised later, you may want to seek advice from an appropriate medical professional who has access to the person’s medical records.

If they wish, they can draw up a report certifying the testator’s capacity at that time and act as a witness to the will.

However, this approach is not always possible, so the earlier in a person’s life a will is created, the better.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. This helps us fund This Is Money and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationships to affect our editorial independence.