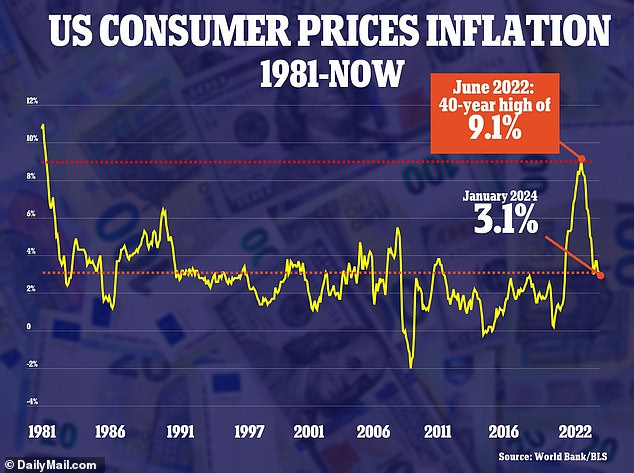

- US inflation slowed to 3.1 percent in January, a smaller drop than expected

Annual inflation was 3.1 percent in January, 0.2 percentage points higher than expected.

Higher-than-anticipated inflation may be an indication that the Federal Reserve is unlikely to lower record interest rates as soon as expected.

Markets on Tuesday seemed to rule out the possibility of a rate cut at the Federal Reserve’s next March meeting.

Prices rose 0.3 percent between December and January, up from 0.2 percent the previous month, according to the latest CPI data.

Rent was one of the main elements that drove inflation. The housing index rose 0.6 percent in January after rising 0.4 percent in December. And auto insurance rose 1.4 percent for the month.

Annual inflation was 3.1 percent in January, which was down from 3.4 percent in December but still 0.2 percentage points higher than expected.

The inflation figure plays a big role in whether the Federal Reserve will cut interest rates sooner rather than later. In the photo appears its president Jerome Powell.

The cost of food also rose again, with the CPI index for food at home increasing the most in a year.

Stock futures fell immediately after the news. The Dow Jones fell 300 points or nearly 1 percent and the S&P 500 fell 1.1 percent, falling below the 5,000-point milestone it surpassed on Friday.

Economists and markets previously expected consumer prices to rise 2.9 percent, which would have been the smallest year-on-year change in two years.

“The overall year-over-year increase was 3.1 percent, better than December’s 3.4 percent, while the core remained at 3.9 percent, in other words, not close to where the Fed wants be,” said Mark Hamrick, a senior economic official. Bankrate Analyst.

The core CPI excludes food and energy and is a figure the Federal Reserve pays close attention to when setting rates.

The CPI index for food at home is the one that increases the most in a year. Pictured are shoppers outside a Kroger in Dearborn, Michigan.

U.S. consumer expectations pointed to a fairly stable inflation outlook for the beginning of the year, a New York Federal Reserve survey showed.

Several Federal Reserve officials, including Chairman Jerome Powell, said last week that they want to see more evidence that inflation will continue to decline before cutting rates.

“The focus is on the upcoming meetings in May and June,” Hamrick said.

Thursday’s retail sales data and Friday’s producer price index (PPI) numbers are also on the radar, as markets await comments from a host of Federal Reserve officials this week.